It’s round two. President Trump may be on the verge of a second impeachment a mere nine days before he’s set to leave office. But investors aren’t phased.

“Long story short, I don’t think it means anything for stocks. I don’t really think investors care about it simply because Trump’s term is over in nine days,” Lindsey Bell, chief investment strategist at Ally Invest, tells Fortune. “They’re really thinking forward to, what does a Biden administration mean for what sectors and industries?”

Stocks did fall early on Monday with the S&P 500 down over 0.7%, while the Dow fell roughly 0.5% in early trading, before recovering somewhat in midday trading. The market moves preceded the introduction of an article of impeachment by the House on Monday as Republicans blocked a House resolution calling on Vice President Mike Pence to invoke the 25th Amendment to quickly remove Trump from office. But for one, Wells Fargo Investment Institute’s senior global market strategist Sameer Samana argues Monday’s moves are likely due to other factors (he points to raging COVID-19 cases, a sluggish vaccine rollout, and rates starting to rise once more).

Some strategists argue that, like the last time Trump was impeached in 2019 (when markets largely didn’t bat an eye), the stock reaction would be muted, if not nonexistent: “Not to take anything away from the political importance of it. It’s a slim chance, but unless it keeps Democrats from passing another stimulus bill, that’s the only implication we can think of,” Wells Fargo’s Samana tells Fortune.

“Beyond that, impeachment in President Trump’s final days isn’t going to impact markets one way or the other,” Samana adds.

All that said, some on the Street do point to a few longer-term implications that may have investors keeping an eye on impeachment proceedings.

Stimulus continues to be top of mind, and Wells Fargo’s Samana notes investors may care more about the impeachment “if it takes Congress’s eyes off the ball, so to speak, in terms of stimulus.” (Samana and Bell both still believe more stimulus will get done soon.)

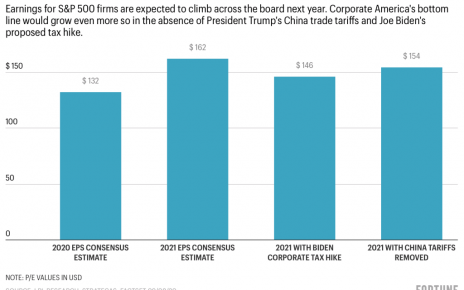

Meanwhile, UBS’s chief economist Paul Donovan notes a “successful impeachment could bar US President Trump from office in the future, [and] if investors think US President Trump has a political future that might matter,” he wrote in a Monday note, though Bell considers that to be “just too far out for investors to be thinking about.” Additionally Wells Fargo’s Samana, UBS’s Donovan, and Ally’s Bell note that impeachment might sharpen the already big divide between Republicans and Democrats—”making legislation more difficult to pass,” Donovan notes. That may actually benefit markets, Bell suggests, as a split Congress is historically favored by the Street.

And though he argues the impeachment proceedings probably won’t have any real impact on markets this week, Samana notes there may be longer-term implications for midterm elections in 2022. “To the extent that impeachment proceedings are viewed as, let’s say, overly partisan, it could turn off some voters,” he suggests.

Ultimately, adds Samana: “We would view it as just short term noise alongside everything COVID-related.”

More must-read finance coverage from Fortune:

- It’s officially a blue wave. What that historically means for stocks

- Democrats plan to use Senate win to pass $2,000 stimulus checks

- This calculator shows the “grim math” of how much leaving the workforce during COVID will cost you

- The fundamental flaw in cap-weighted index funds

- 2 U-turns in 2 days: Why the NYSE finally decided to delist 3 Chinese companies