A disputed election which could devolve to a full-scale constitutional catastrophe. A COVID third tide. A stimulation rescue package which bogs down in Washington.

Since the calendar turned to October, the beginning of the end quarter of 2020, those clouds suspended black and thick over the niches. Experienced investors might be excused for trying to accept the fourth quarter away, a frequent strategy at a presidential election season.

However, something unusual occurred. In keeping with this totally unpredictable calendar year, the markets plummeted, with the Nasdaq and S&P 500 both rising 2.2percent from the first week of October, sufficient to nearly recoup all September’s declines.

What’s?

You’ll be able to call it an October surprise which arrived , and one which might have a enduring effect for the subsequent four decades, and past.

President Trump’s optimistic COVID-19 investigation could have thrown his re-election bidding into chaos, but it’s had the reverse impact on the economies. From there on, Joe Biden’s lead in the elections and polls chances solidified, along with also Wall Street and investors began to come to grips with the way their portfolios could work , spanned , a Democrat from the White House, along with a grim sweep overtaking Congress. “And when the current bid for risk resources isn’t any guide, this kind of eventuality could establish a {} event for national equities.”

Usually, Wall Street hates one-party control. And, if anything else, it typically favors a low-tax, then regulation-busting Republican from the Oval Office. That stress works deep, even when the historic information doesn’t {} up the paranoia.

However, this season, the script has reversed. Wall Street isn’t simply unperturbed by the possibility of Washington piled in blue include January, it sees a potential upside.

Spending and taxation

Yes, even a Biden presidency would probably indicate a tax increase at any stage after 2021, however, all in all, the pros outweigh the drawbacks, an increasing chorus of all Wall Street analysts state.

“The main reason is the fact that it could sharply increase the likelihood of a financial stimulus package of {} trillion soon following the presidential inauguration on January 20, followed by longer-term spending gains in infrastructure, climate, healthcare and schooling that could at least fit the probable longer-term tax gains corporations and also upper-income earners. ”

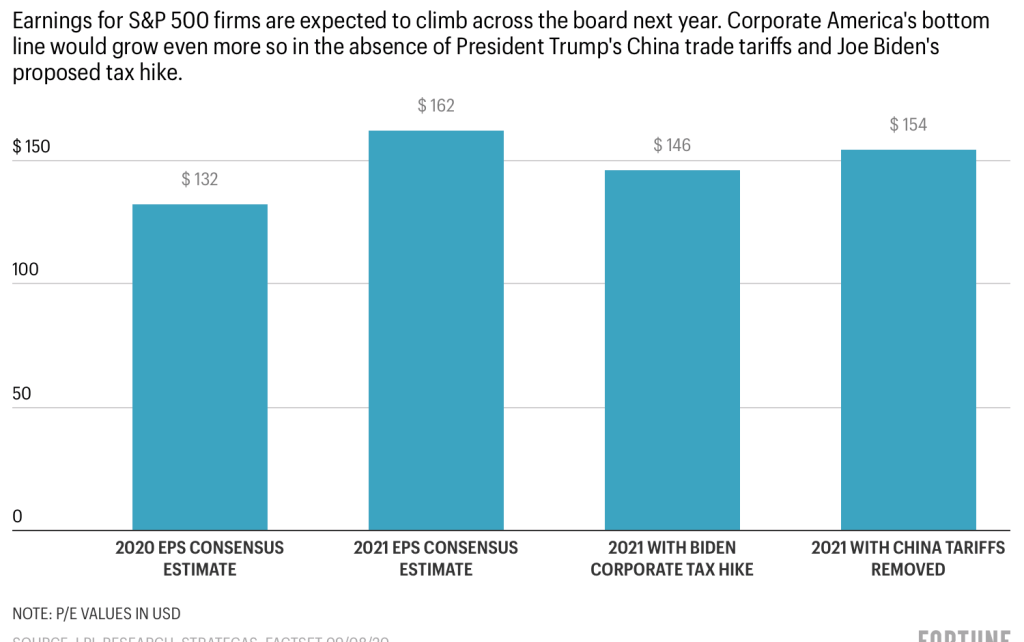

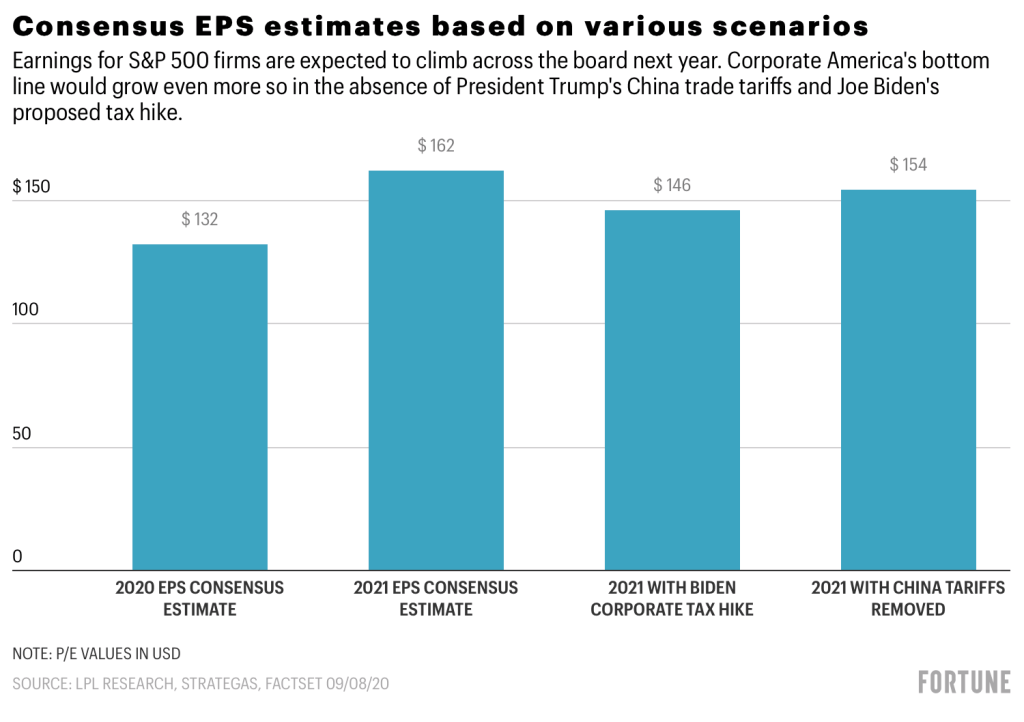

Jeff Buchbinder echoes which fear-not message. Buchbinder, vice president and market strategist in LPL Financial Research, finds the accession of a enormous fat stimulation spending bundle in the Biden-led White House and the elimination of this Trump era commerce wars as two tailwinds for Business America which may just about counter the adverse hit caused by a Democrat-led tax fee increase. The ideal situation for corporate earnings will be a return to free trade without any fresh taxes, because LPL’s calculation this reveals.

However, Buchbinder amounts that the 10% reach (Goldman computes it in an 9% strike ) to company earnings which you simply ’d see out of a Biden tax increase matches with the EPS increase you’d gain from eliminating tariffs in America’s leading trading partners from China and Europe.

And, it ought to be said that the consensus is that a Biden tax increase could be watered down until it has signed into lawenforcement. “Not just one President in American history has experienced a tax strategy in their effort that subsequently got photocopied and turned into a tax legislation. Ever,” David Bahnsen, founder and managing partner of this Bahnsen Group, informs Fortune.

Even stillit’s time to check at which industries are {} to Biden’s tax proposition. As is {} with any new taxation program, there’ll be losers and winners.

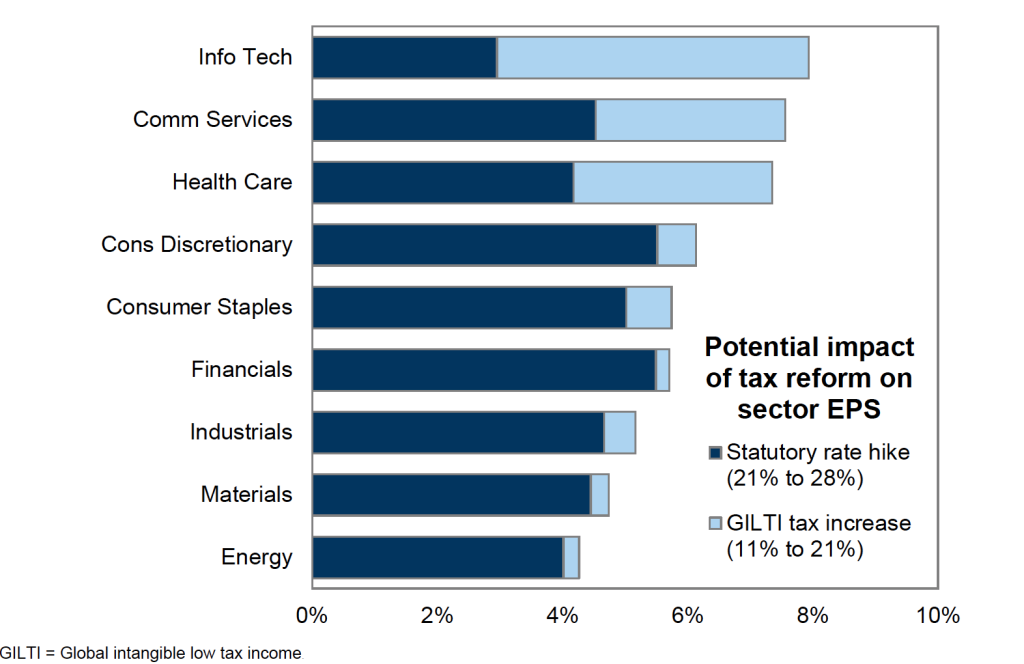

According to Goldman Sachs, the next industries –information technologies, healthcare, communications providers and consumer optional –might observe the largest EPS strikes out of a tax rate increase over the years ahead. Energy and financials are {} , as the next Goldman chart reveals:

The almighty dollar

There’therefore a third component that may add rocket fuel into some shares rally: the buck. Even the FX markets are exceptionally sensitive to changes in foreign exchange, and also to changes on very top.

{“A ‘grim wave’ situation –in which former Vice President Biden wins the presidency and Democrats {} the Senate–ought to quicken US Dollar weakness, in our opinion,” Goldman Sachs FX analysts wrote on its newest “Election Playbook” account to investors. |} They see greater government spendinghigher corporate taxation and a yield to freer international trade as three variables that may take to the greenback.

And also a weak dollar is a major stimulus for corporate earnings since it makes exports more affordable and provides Western multinationals a competitive advantage in {} trade.

“we’re holding off on advocating new Dollar perspectives for today as we expect more info about the way the President’s health problem will impact the race,” ” that the Goldman analysts wrote. “However we see current amounts as comparatively appealing to state our favorable cyclical views–particularly when polling proceeds to signal a big cause for Biden. ”

Surprise!

After the markets closed daily, my in-box stuffed with all sorts of historical investigations the way, every four decades, Wall Street generally performs badly in both months before a presidential elections. The message was obvious: background claims to move to money and wait it out before America elects a president.

As it stands today, that could have been a very poor move.

Butdear reader, that remains October. There’so no excuse stating just one October surprise each election cycle.

“We need to currently run ‘what-if’ situations supporting the U.S. presidential race,” James McDonald will be currently CEO of Hercules Investments, advised Fortune. “My largest ‘what-if’ is in case Joe Biden contracts COVID-19, also. ”

Research Fortune‘s Q4 investment manual :

- The largest economic threat confronting another government

- All these 6 economical graphs tell the narrative of Trump’s presidency

- What Wall Street’s preferred election signs say about who’ll win the White House at 2020

- 10 shares to buy today : All these titles must perform well regardless of who wins the White House

- ESG investing is much larger than everbefore. This ’s the way you’re able to conserve the Earth, along with your own portfolio

- Last season ’s ‘October surprise’ can affect your portfolio for many years to come

- The following President will hold a whole great deal of influence within Tesla’s largest profit centre

- Q&A: Former Commerce Secretary Penny Pritzker talks America’s R&D issue, taxation, along with the nation ’s economic standpoint