Even the Covid-19 pandemic was a catastrophe for most, a catastrophe for a lot more. It’s surpassed age-old inequities and also taken a significant toll on economic development.

Its long-term impact in our lives remains uncertain, but that doubt should not induce migraines. This is sometimes a time for change, an opportunity to reset priorities.

Climate change is one of the most pressing problems facing humankind; governments and businesses have a vital to act. Reaching the aims of the Paris Agreement, that intends to limit a increase in the planet’s average temperatures, could allow us to have an initial step towards a safer, more economical and sustainable future.

Meeting those targets will require amazing reservations of human power and creativity. Meaning fossil resources like gas and oil, which now provide 80 percent of the planet’s energy, can continue to play a major part in fulfilling future energy demands –from inducing factories to heating our houses.

While current private industry responsibilities have concentrated on accounting steps to measure banks’ donations to the climate problem, there is an urgent necessity to enhance the access to verifiable and accurate emissions information reported by firms. More information will make it less difficult to quantify outcomes, monitor progress and induce liability in a concerted manner, allowing financial markets to create more informed decisions regarding climate threat.

Our firm, JPMorgan Chase, declared this month which we’ll begin aligning our funding portfolio to satisfy the Paris aims. We’ll concentrate on three sectors specifically: petroleum and gas, electrical power and electrical production, since they jointly create a substantial share of emissions. As an international financial services company we do business with the majority of Fortune 500 firms, such as several in the energy industry, thus we think our capability to generate an impact is substantial.

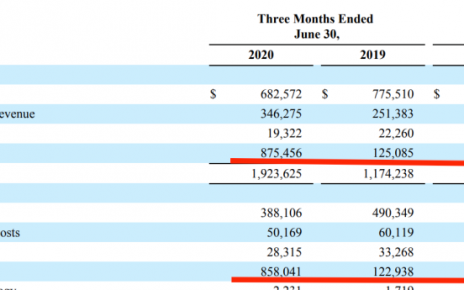

Working to conquer the problem of getting accurate information, the strategy we’re developing will incorporate the dimension of carbon dioxide, which monitors emissions relative to an component of output. In the energy business, as an instance, the calculation could appraise metric tons of carbon dioxide each megawatt hour of power generated.

Measured more than together with other signs, carbon monoxide provides insights about efficacy and company plan, identifying manufacturers that are enhancing their operation, and people that are not. As dimensions evolve and improve, we’ll adopt best practices. Meanwhile, we’re setting sector-by-sector intermediate emission goals for 2030 for all these three businesses that can go in effect during 2021.

In addition, our company is currently committing to becoming carbon neutral within our operations starting this season, moving beyond our initial promise to supply renewable energy to our whole firm.

There’ll be skeptics, we all know, and people who opt to delay. But now’s your time to act, to invent a market which has efficiency and sustainability in its heart and reduces strain on the world’s resources.

We would like to be a part of this solution. Our workers together with our many stakeholders wish to help drive shift. The huge majority of our customers do also, as most have declared actions strategies in their own. We think it is our duty to assist them, along with also the market, transition from conventional energy resources and produce cleaner alternatives. It is not just great for the world, it is great for company and much more appealing to key components such as shareholders, clients and potential workers.

Reaching the aims of the Paris Agreement will not be simple. It is a gigantic undertaking and requires a sustained work. Along with daring, cross-border authorities policies which eliminate obstacles to your low-carbon world, employers need to continue to progress sustainability through invention.

The clock is still now ticking. The planet isn’t available to restrict ordinary temperatures from rising over 1.5 ̊C – 2.0 ̊C over pre-industrial amounts, which can be the aim of the Paris accords, and we’re running out of time to stop long-term devastation into our world and our communities.

It’s taken a worldwide pandemic to prompt remarkable changes to how we work, live and eat. We are optimistic that governments and industry will exploit the momentum and grow to this challenge. Our lender plans our shared future is dependent upon it.

Ashley Bacon is your main risk officer of JPMorgan Chase.

Much Greater view out of Fortune:

- Exactly why a very conservative Supreme Court would probably be poor for company

- The way the Biden government could undo the four-decade decrease of America’s working class

- America’s backward privacy legislation leave women vulnerable

- American citizenship wants equal-pay legislation. Canada is showing us the way to make it function

- Are faculty diploma prerequisites holding Black job seekers rear ?