Our assignment that will assist you browse the new ordinary is fueled by readers. To enjoy unlimited access to the journalism, subscribe now .

Even the fintech giant Square declared on Thursday morning which it purchased 4,709 Bitcoins to the cost of $50 million, also noting that the cost equates to 1 percent of their firm ’s overall assets.

The statement provided few specifics about how it bought the Bitcoins or its purpose for doing this, beyond saying which cryptocurrency is a type of both “economic empowerment and gives a means for the entire world to take part in a international financial system. ”

This language is constant with all Square CEO Jack Dorsey’therefore current advocacy for electronic currencies such as Bitcoin, that can be controlled with no central power, and which make a tamper-proof listing of trades.

Further hints to Square’so motivation, though, can be discerned in a white newspaper the firm printed quietly this season. At a section of this white paper titled “Accounting,” Square notes the $50 million in Bitcoin will probably be categorized as “Additional non-current assets. ”

The upshot of the classification is that Square won’t use the Bitcoin as a part of its operations (the firm has a dynamic trade allowing clients purchase Bitcoin via its Money App) but also treating it as a long-term investment.

Square is the next publicly traded firm to create such a wager, after a $250 million Bitcoin buy from MicroStrategy, a Virginia-based software intellect company. In both circumstances, the buys amount to some long-term bullish wager on Bitcoin.

The Square white newspaper also has other fascinating bits of information concerning the way in which the firm obtained the Bitcoin and at which it will save it. The newspaper notes it purchased the 4,709 Bitcoins more than a 24 hour period with a so-called “over-the-counter” (OTC) agent, which concentrate in big, discreet trades. Square doesn’t define which OTC support it utilized, but points into a listing of agents it’s utilized previously that amuses Circle, ItBit, Genesis and Cumberland.

In terms of preserving the Bitcoin, the white paper notes Square utilizes “cold storage”–a means to safeguard digital money from hackers by keeping it offline. Square states it is relying upon its very own cold storage technologies, rather than third party part custody suppliers such as Coinbase or Anchorage.

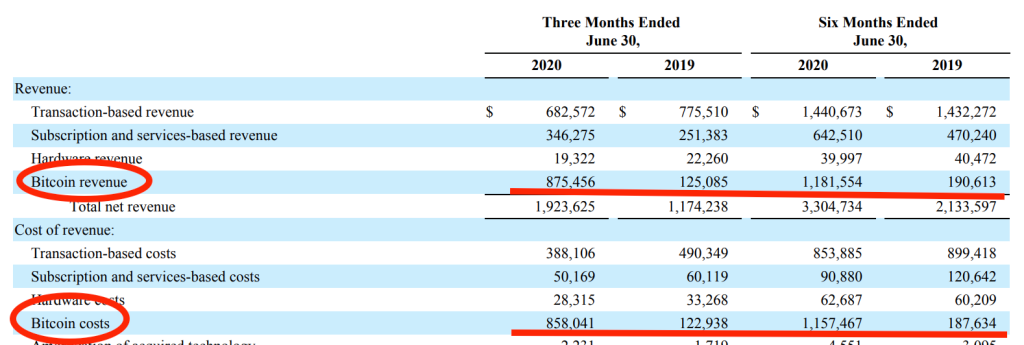

Square’s $50 million long term investment stems as its daily Bitcoin company has been flourishing. When it offered Bitcoin into Cash App clients in 2018, the ceremony was little and money-losing. However, as its Q2 fiscal reports reveal, Square’s Bitcoin surgeries –that demand sourcing Bitcoin from third party suppliers –are currently growing and profitable quickly:

Square didn’t immediately respond to your petition for additional specifics regarding the Bitcoin buy statement.

Much more must-read fund coverage out of Fortune:

- Everything Wall Street wants in the 2020 election

- Why it seems like we are in a downturn –although we are not

- Firms with more happy employees outperform their peers

- Biden”blue wave” would increase economy, states Goldman Sachs main economist

- Boris Johnson needs young Brits to purchase houses –even if this means banks need to lend just like it is 2006