That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

International stocks and U.S. stocks are going in opposite directions with the latter pointing to your weak open. COVID and labour economy jitters are weighing heavily on investor sentiment since the stimulation speaks down. Earnings defeats, up to now, are neglecting to raise risk appetite.

Permit ’s check out on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators were mainly higher in day trading using all the Hong Kong Hang Seng bouncing straight back up 0.9percent .

- Chinese market giant Minoso started trading having a bang to the NYSE yesterday. It’s ’s losing cash, but its vision is to go worldwide.

- From the EM planet, Indian stocks happen to be outperforming the bunch as April. Morgan Stanley is still bullish on Indian , also it’s obese some unexpected sectors, such as electricity.

- Can won or he ’t he? Now is Boris Johnson’s self-imposed deadline {} he walks off from post-Brexit commerce discussions . Among Johnson’s couple regions of leverage is really a fishy one. Very literally.

- Daimler stocks were up over two% in the start following the carmaker reported that a massive bottom line conquer, submitting a preliminary operational gain of $3.07 billion ($3.6 billion), a signal Europe’s automobile industry might be turning into a corner (aided by subsidies).

U.S.

- U.S. stocks have been at the red. This ’s following the three big indicators pared their losses overdue in ’s session about the majority of hopesstop me if you’ve noticed that this one–that the stimulation talks may not be lifeless . Alright they’re likely dead. But maybe not buried.

- Meanwhile, the U.S. labour economy is looking bleaker each Thursday. {The jobless claims amount came in {} an worse-than-expected 898,000. |} Caution: the stock exchange is starting to listen to the amount.

- Gamble of Boeing were upward 2.6percent from pre-market trading after that a Bloomberg report a European ruler has named the 737 Max “secure ” to soar.

Elsewhere

- Gold is ticking up, investing about $1,915/oz .

- The buck is down marginally.

- Crude is downward. Brent proceeds to trade at a variety only below $43/barrel.

***

From the amounts

898,000

New weekly programs for unemployment benefits are all moving in the wrong way. For the 2nd consecutive week, the more maintains number came from above analyst expectations in 898,000. “The worsening of this rate of UI maintains this week strengthens the message in the hottest September jobs report which the market’s rate of recovery will be slowing amid the continuing pandemic,” states Glassdoor Chief Economist Andrew Chamberlain. “America is not likely to find a complete recovery and a return on reduced unemployment before the speed of weekly UI asserts dials back appreciably. Since the virus stays in the driver’s chair, now’s raised claims throw a shadow within the destiny of the U.S. labour market within the next half a year. ”

Even the Dow Jones Industrial Average closed yesterday in 28494.20–which ’s a profit of a mere 69 points (+0.2percent ) within the previous five trading days. After shutting down three consecutive stages, the blue chip indicator seems to be losing momentum since COVID instances rise, and labour market amounts deteriorate. The significant lettuce –a stimulation deal–will be seeming less likely by the afternoon.

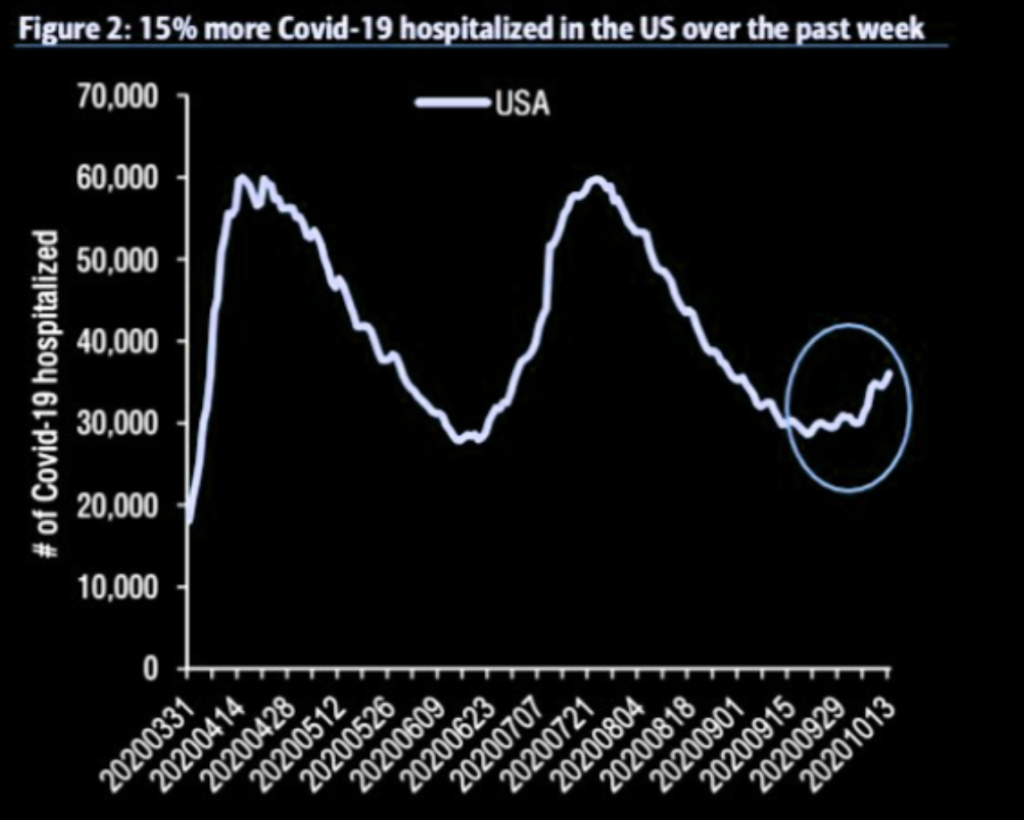

15 percent

COVID is climbing over each side of the Atlantic. And the economies have seen. The disease numbers are poor, however, the large metric to see would be hospitalizations and deaths, and just two menacing lagging indicators which possess the capacity to induce economic recovery, especially since curfews along with regional lockdown steps are enacted. Along with also the hospitalization amounts from the U.S. are flashing red right now. They’re up 15% within the previous two weeks. Ironically, the epidemic is surging in a number of America’s most populous countries.

***

Have a great weekend, everybody. I’ll visit you on Monday.

Bernhard Warner

@BernhardWarner

[email protected]