This article is part of Fortune‘s quarterly investment guide for Q1 2021. Even the casual market observer could recognize that 2020 was all about the tech trade. So-called work-from-home stocks, those enabling consumers and businesses to operate socially distanced, skyrocketed last year—with the tech sector’s rally outpacing the overall S&P 500 by more than double. But now […]

Tag: Quarterly Investment Guide

Tesla is the proxy for a stock market gone mad

This article is part of Fortune‘s quarterly investment guide for Q1 2021. According to many of the best minds in investing, including Jeremy Grantham and the experts at Research Affiliates, the investor mindset that’s driving Tesla’s stock ever higher mirrors the reckless thinking that has pushed the S&P 500 to an unsustainable speculative fever that’s soon bound […]

The next President will hold a Whole Lot of Influence on Tesla’s Largest profit Centre

For many years it’s turned into a little-talked about key hiding in plain sight: Tesla does not make a lot of its money selling automobiles. Rather, the business has shrewdly capitalized on sparking a intricate marketplace for selling international emissions credits. Since Fortune formerly analyzed in detail, Tesla’s credit earnings started off small, averaging $3.4 […]

ESG investing is larger than ever before. Here is how you can conserve the Earth, along with your portfolio

This guide is part of why Fortune‘s annual investment manual for Q4 2020. In case 2020 has been the year which upended lives, workplaces, and also the way we see health and security, it might also be that the year we’ve reached yet another tipping point: at the way we spend. Between April and June, […]

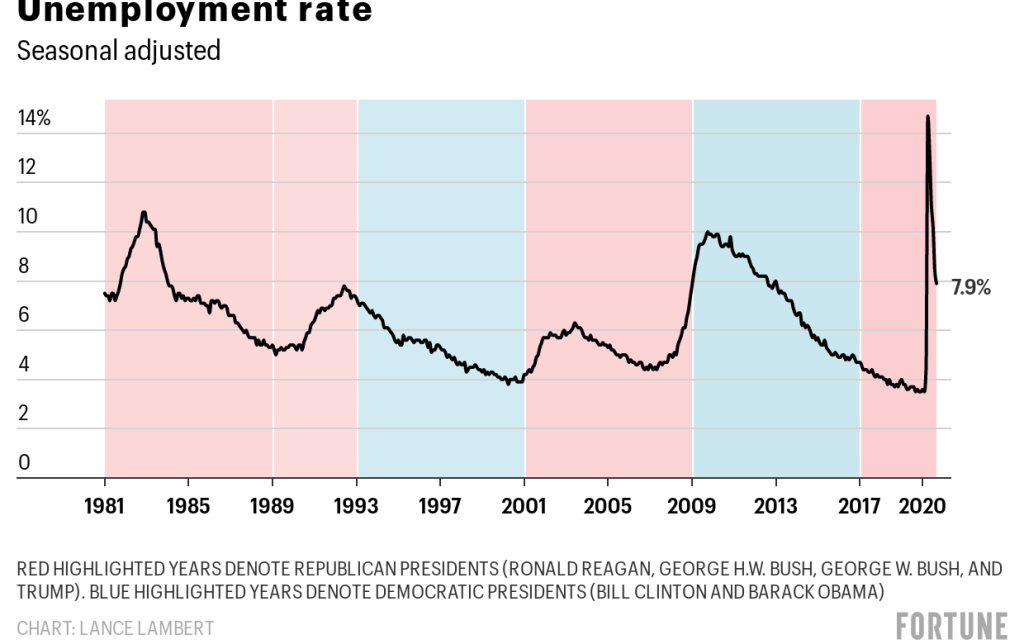

These 6 Economical Graphs tell the story of Trump’s presidency

This report is part of why Fortune‘s annual investment manual for Q4 2020. Whilst on the campaign trail in 2016, Donald Trump guaranteed to make an economic boom. However, did he? Before the start of the outbreak –that generated the toughest economic jolt in U.S. history–that he had been at the helm of a {} […]

This Season’s’October surprise’ Can impact your portfolio for Decades Ahead

A disputed election which could devolve to a full-scale constitutional catastrophe. A COVID third tide. A stimulation rescue package which bogs down in Washington. Since the calendar turned to October, the beginning of the end quarter of 2020, those clouds suspended black and thick over the niches. Experienced investors might be excused for trying to […]

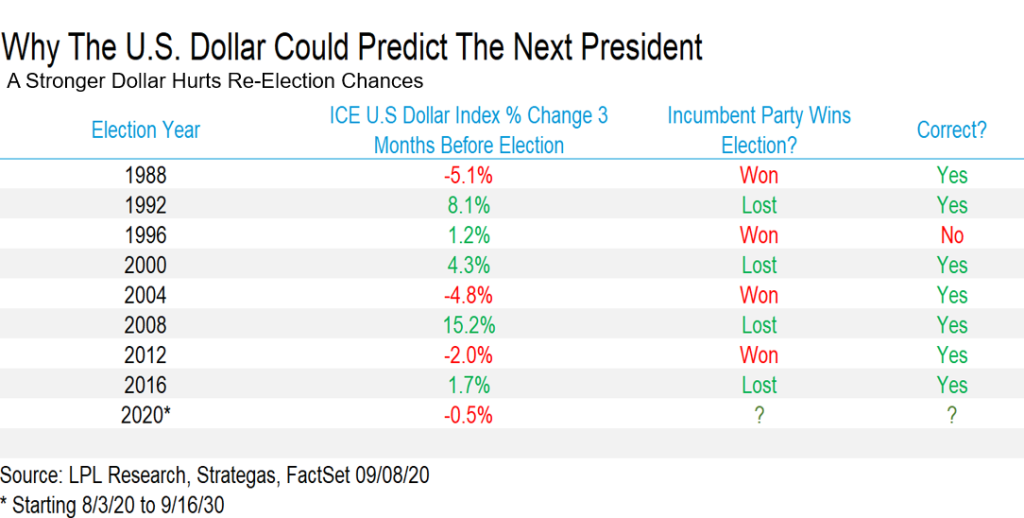

What Wall Street’s Treasured election Signs say about who’ll win the White House at 2020

It is a time-honored convention on Wall Street each four decades: proclamations from analysts and observers who assert that this or economic metric could correctly predict who is going to be the next President of the USA. After the identity of those that will inhabit the White House is really a significant, market-moving factor –one […]

10 Shares to Purchase Today: All These Titles Must perform well Regardless of who wins the White House

This guide is part of why Fortune‘s annual investment manual for Q4 2020. First arrived the book coronavirus that drove a lot of lien to get a loop. Then came a stressful summer where the worldwide market proceeded in fits and starts, petering out of a fast recovery into a lesser rebound. But using less […]

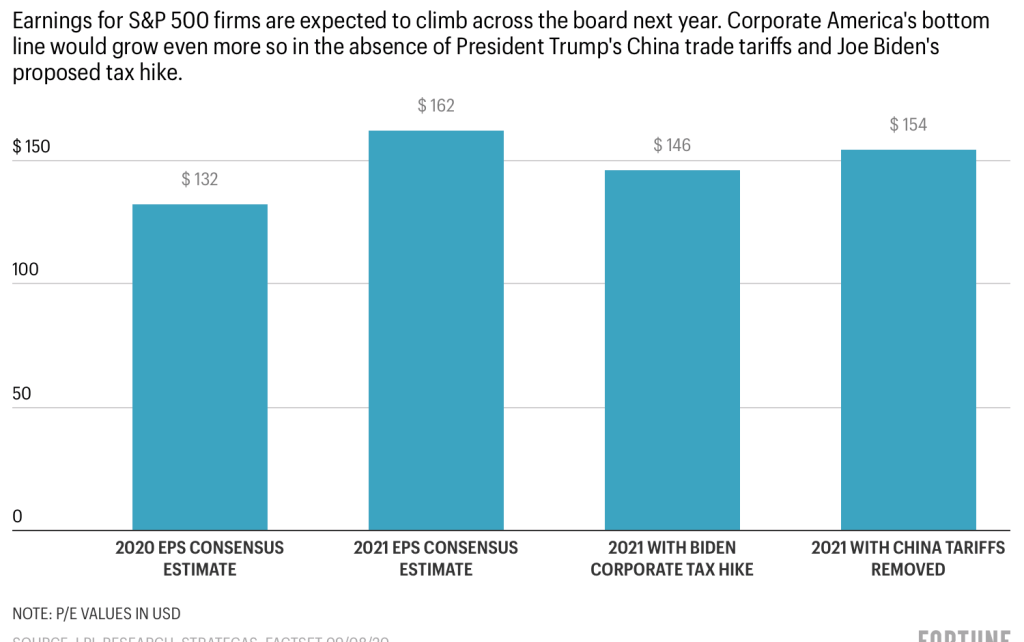

The Greatest economic threat facing the next Government: A Poor dollar

The next President will inherit a market characterized by states we harbor ’t {} in our lifetimes. Permit ’s take inventory. Even the Fed’s {} centers around holding short-term interest levels , and maybe a very long stretch of the return curve, beneath the amount of inflation. Supercheap borrowing, the Fed reckons, can lure businesses […]