It is a time-honored convention on Wall Street each four decades: proclamations from analysts and observers who assert that this or economic metric could correctly predict who is going to be the next President of the USA.

After the identity of those that will inhabit the White House is really a significant, market-moving factor –one which affects all kinds of policy choices which then can affect the larger market. And because markets are renowned for hating doubt, it is just normal that investors and their consultants would attempt for a read on who just {} probably likely be calling the shots at 1600 Pennsylvania Avenue.

While there’s absolutely not any lack of signs that prognosticators want to mention as their particular crystal ball each election cycle, a few have definitely proved popular–and, really, more true –than many others. Below are a few of Wall Street’s favorites and things they say about who’ll win the presidency that November.

The Stock Exchange

The stock exchange might not be a totally accurate reflection of this condition of the total market , however it’s a fairly good level of investor confidence in corporate America and also the company environment in the large.

On the 1 hand, it might indicate adverse small business opinion, raising the probability that voters decide to ring in certain modifications in Washington. And on the contrary hand, a sagging market could be viewed as a indication that investors think a shift is imminent–and also so are choosing to sit on the sidelines before that political instability moves.

There are several wider, popular manifestations of the American stock exchange compared to the S&P 500, therefore it is not surprising the S&P is still a favorite of Wall Street prognosticators so much as elections are involved. In actuality, the people at Boston-based broker-dealer company LPL Financial state the benchmark indicator has correctly predicted the winner of this presidential elections 87 percent of their time because 1928–and each time since 1984.

LPL’s metric is quite straightforward : whenever the S&P 500 is trending upwards over the 3 months ahead of the election, the incumbent party generally retains a grip of this White House. When it is trending lower, this normally means a shift is so.

For example, LPL senior market strategist Ryan Detrick claims to look no farther than 2016. Although Hillary Clinton had been a significant favorite top up to this fall’s presidential elections a tepid S&P 500 didn’t bode well for her. “Everyone believed Hillary was about to triumph, but the stock exchange did not,” Detrick states. In addition, he supposes the Dow Jones industrial average since the following index, noting the indicator undergone nine consecutive days of declines leading to this 2016 election. The current marketplace, Detrick states was”sending a sign that Trump’s opportunities were considerably higher” than folks believed.

A powerful S&P prior to the election”will imply that [shareholders ] consider the policies set up will continue, and you’ll be able to purchase stocks since you don’t need to be worried about a shift in coverage,” he adds.

What exactly does the stock exchange tell us concerning the 2020 election? Since Aug. 3–just 3 months prior to Election Day 2020–that the S&P 500 has increased roughly 5 percent, using rebounded from a feeble September that watched the indicator temporarily slip in the red. President Trump has grabbed a lot of his economic statement so far on the achievement of the stock exchange, and the economy seems to suggest he has got a better likelihood of keeping his office than several polls would suggest.

The buck

It has been a demanding year for the U.S. buck. The coronavirus pandemic, the consequent economic recession, along with the Federal Reserve’s following financial stimulation measures have led to a slow weakening of the dollar relative to other important currencies–resulting in to the likes of Ray Dalio along with Stephen Roach to wonder if the greenback’s standing as the international market’s preeminent money is currently under threat.

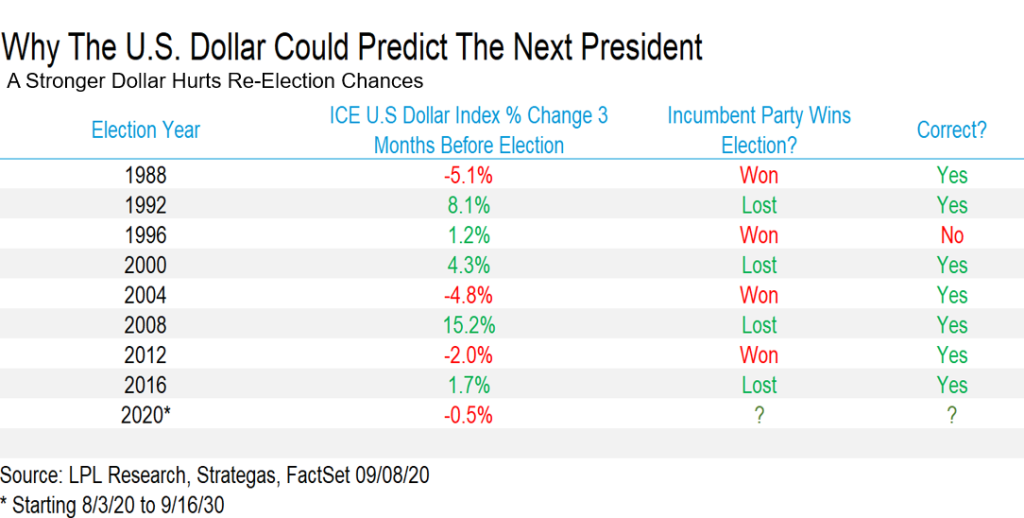

However, the dollar {} to present a window years to who is going to be the second President of the USA. “History indicates that a stronger dollar doesn’t bode well for the President,” based on LPL’s Detrick. That is because a slumping dollar will signify that a”risk-on surroundings”–one generally featuring healthy market conditions where investors are ready to pour cash into stocks along with also other, riskier asset types.

“The buck was strong [in 2008] because that is the place you go when you’ve got a pure risk-off mindset; folks still return to [the dollar] whenever the you-know-what hits the fan.”

As a particular measure of the way the strength of the buck is related to the results of the presidential elections, LPL points into the functioning of the benchmark ICE U.S. Dollar Index at the 3 weeks leading up to the election.” As stated by the broker, the indicator has correctly predicted the winner of all of those past eight presidential elections{} Bill Clinton’s landslide reelection in 1996 demonstrating the sole instance where a stronger dollar didn’t translate into a defeat for the inaugural party.

Even though the ICE U.S. Dollar Index has dropped 3 percent in 2020 so far, it has turned into a slightly different narrative since Aug. 3. In that moment, the catalog has increased slightly, to the song of less than 0.2percent. That might seem to spell decent news for Joe Biden and awful news for President Trump–however, as Detrick notes,” the buck’s comparatively meager movement will leave the metric”a clean” up to calling this election is worried.

Manufacturing information

As per a 2011 investigation from statistician and FiveThirtyEight editor-in-chief Nate Silver, the ISM Manufacturing Index had demonstrated that the”best-performing factor,” one of 43 distinct metrics, for {} the results of each presidential elections since World War II to there.

The yearly survey has stood as a standard measure of manufacturing activity from the U.S., also based on Silver’s evaluation, its functionality from January through September of the election year has shown a relatively reliable indicator of how the election goes. In case the ISM averages over 50 throughout this time (indicating a growing manufacturing industry ), which will function well for the incumbent party, whereas an ISM typical of under 50 (representing a contracting manufacturing industry ) generally corresponds with a fresh party taking charge of the White House.

In 2016, the indicator barely was able to typical in growth land in January through September–a lukewarm reading which indicated modifications have been in sequence in D.C., culminating in Trump’s success over Hillary Clinton.

Even though a fair ISM was great news for Trump last time round, it is a foreboding index because of his prospects from Joe Biden inside this election–and still another step of a struggling market that seems increasingly likely to price Trump that the presidency.

Additional election predictors

While other financial figures –such as project development and gross domestic product–are usually abbreviated as telltale predictors of presidential elections, what is clear is the condition of this market is generally high in head to American voters. “It is the economy, stupid,” moved the famous adage commissioned by James Carville, the political strategist who helped mastermind Bill Clinton’s success at the 1992 presidential elections –and it’s a credence that still rings true now, since the market continues to survey on very top of voters’ worries each election.

However he adds that this season, it is exceptionally tough to get a read on items. While recessions such as the one experienced from the U.S. market this season in the aftermath of this coronavirus pandemic are usually a surefire sign”the incumbent is not likely to win,” additional signs –like a slumping consumer confidence indicator –appear to indicate that a comparatively brisk recovery which may help President Trump remain in power.

“In our view, the election will most likely be a whole great deal closer than that which the polls are all saying,” based on Detrick, pointing into some constantly bullish stock exchange as justification. “The stock exchange has a humorous way of calling these items. In the event the issuer loses, there is always some skittishness, since the marketplace does not like doubt.”

However, TD Ameritrade’s Kinahan notes that shareholders may really be bracing for a few doubt, after all. He points to the way futures {} the CBOE Volatility Indicator , a favorite measure of sensed stock market volatility, which have been”raised” for a few weeks following the Nov. 3 election. That may imply that investors are mindful of the doubt which may stem from a possibly delayed outcome, because of thousands of anticipated mail-in ballots–and of course that the President’s own refusal to commit to accepting the results of the election.

“I feel that is a completely different element for this election we have not handled previously,” Kinahan claims of their possibility of article –Election Day volatility.

Like 2020 was not already inconsistent enough, it might be that the calendar year’s presidential election is still beyond the grasp of almost any signs we must offer you.

Research Fortune‘s Q4 investment manual :

- The largest economic threat confronting another government

- All these 6 economical graphs inform the narrative of Trump’s presidency

- What Wall Street’s treasured election indicators state about who’ll win the White House at 2020

- 10 stocks to buy today : All these titles must perform well regardless of who wins the White House

- ESG investing is much larger than everbefore. This ’s the way it is possible to conserve the Earth, along with your own portfolio

- Last season ’s ‘October surprise’ can affect your portfolio for many years to come

- The following President will hold a whole great deal of influence within Tesla’s largest profit centre

- Q&A: Former Commerce Secretary Penny Pritzker talks America’s R&D issue, taxation, along with the nation ’s economic standpoint