Fantastic morning, Bull Sheeters. It’s risk-off Tuesday as shares from Asia and Europe scale, and U.S. futures seem set to add to ’s profits. Energy, fund and traveling stocks are leading the way; primitive futures also are rallying.

Investors are currently Monday’s vaccine rally 3.0, President-elect Joe Biden’s projected choice of a rather recognizable face to conduct that the U.S. Treasury, and also additional signals the transfer of energy from Washington is eventually getting into equipment .

Speaking of tweaks, we dig farther to the pivot to value stocks beneath.

Allow ’s view where investors are placing their own money.

Dollar upgrade

Asia

- The most significant Asia indicators are largely higher in day trading with Japan’therefore Nikkei upward 2.5percent , Placing a multi-day slide.

- Huawei’s grasp to the entire planet handset marketplace is forecast to decrease significantly, falling by roughly one-third during the next year since the bigger effect of sanctions bite to a core company.

- Japan’s outstanding arrest and protracted detainment of prior Renault-Nissan CEO Carlos Ghosn was bashed because “unpleasant ” and sentenced to a human rights violation, a influential group of U.N. attorneys has mastered.

Europe

- The European bourses were at the green in the start together with London’s FTSE 100 upward 0.9percent aided by a large spike from British Airways parent IAG (+5percent ).

- Boris Johnson supported on Monday which Britain’s federal lockdown orders is going to be raised on Dec. two (with limitations, naturally ) since the teetering market heads in the Christmas season.

- Still reeling in the Wirecard fiasco,” German officials in Deutsche Boerse will enlarge that the grade Dax out of 30 to 40 established companies, and present new high quality standards as part of its main makeover in history.

U.S.

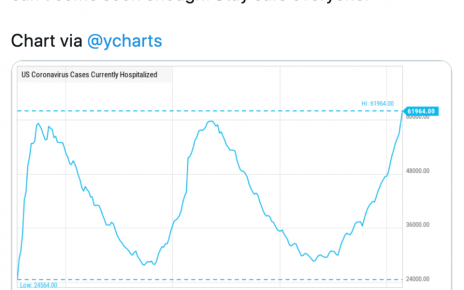

- The U.S. stocks stage to another strong open. This ’s following all 3 indicators rallied about the AstraZeneca COVID vaccine information , together with bank and energy stocks the huge gainers. Goldman Sachs has downgraded its own GDP predictions for the current quarter and also for Q1 2021 because COVID instances soar across much of the Nation.

- Shares in Tesla closed 6.6percent greater yesterday following über bull Dan Ives in Wedbush Securities slapped a $560 near future cost target about the EV manufacturer. He “upped his ‘bull situation ’ from $800 to $1,000, that will signify an over 100 percent soda in the inventory ’s present amounts,” Fortune‘s Anne Sraders accounts .

Elsewhere

- Gold has skyrocketed reduced within the last 24 hours, investing under $1,830/oz .

- The buck will be down.

- Crude is upward again about the vaccine news together using Brent trading about $46.30/barrel.

***

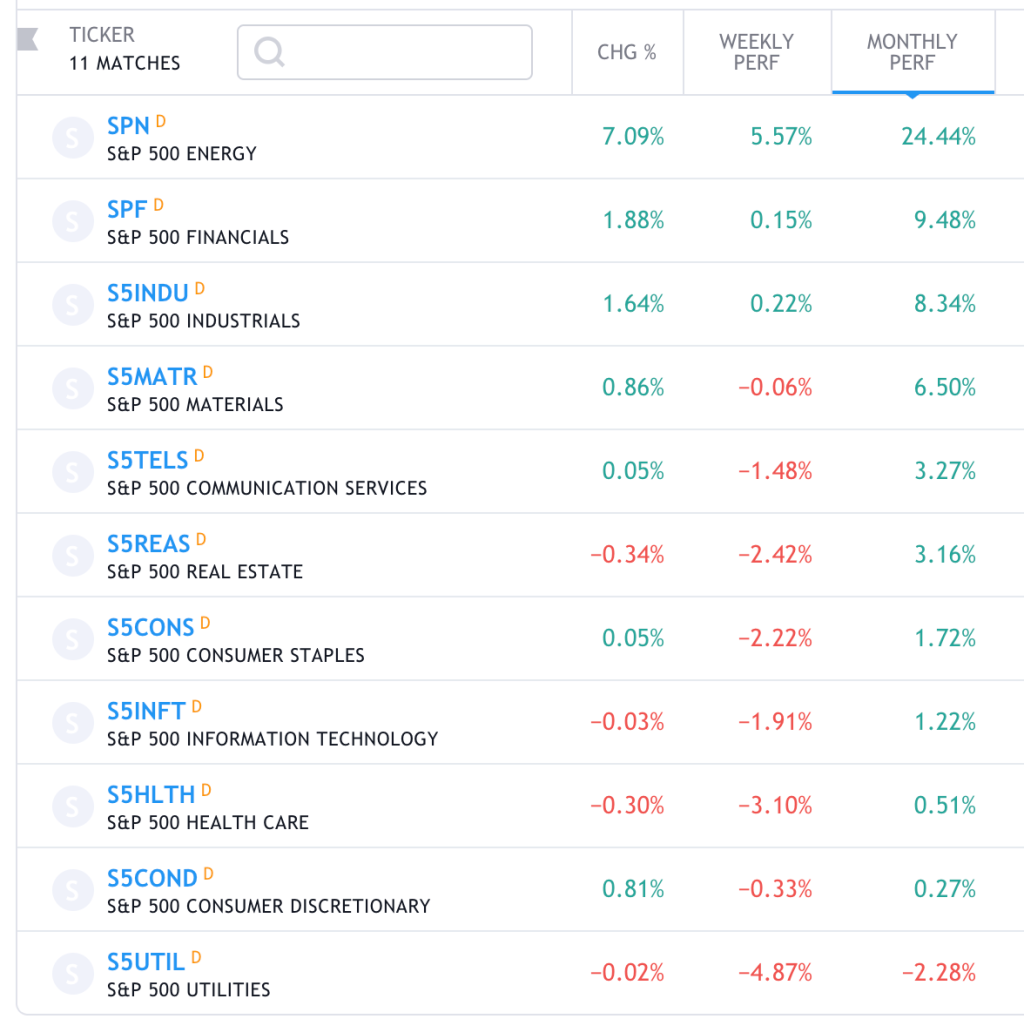

The S&P 500 is upward 1.9percent because we have our first dose of favorable vaccine news from Pfizer/BioNTech on Nov. 9. We’ve gotten two shots at the arm because, every coming on successive Monday mornings early and bright.

Public health officials look happy with the advancement from the labs, which ’s raising those corners of those markets which was trampled for weeks by grim COVID info and lockdown steps.

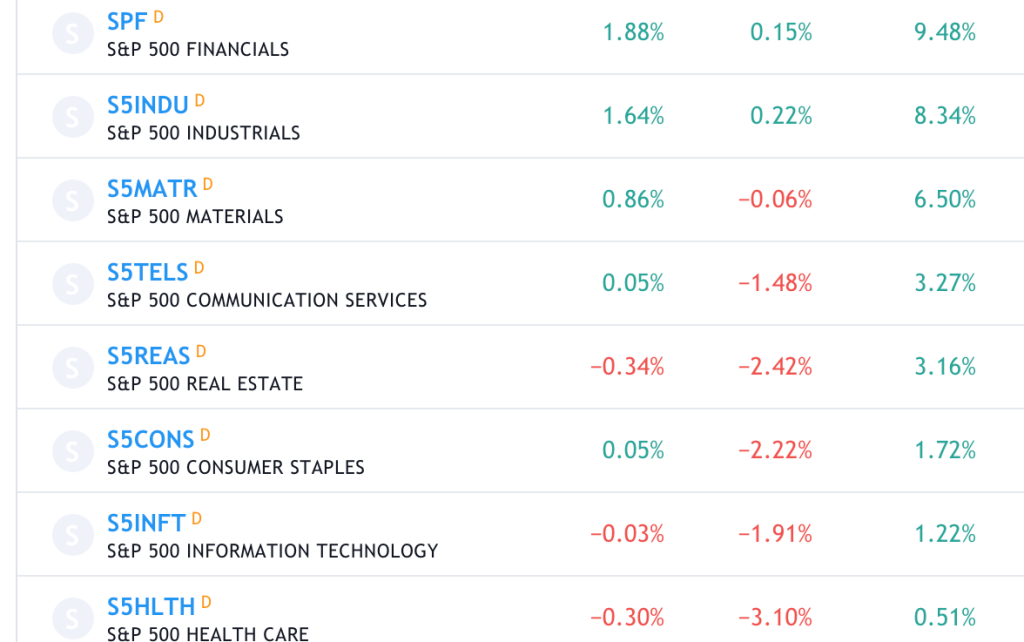

The energy section of this S&P 500 has surged 24.4percent previously month plus financials are upwards 9.5percent at the exact identical period. Meanwhile, the consumer discretionary, healthcare and IT are underperforming, at or close to the base of the package. It’s {} of what we now ’ve discussed here frequently, the fantastic turning into stocks.

This huge pivot is due to stop disease prosecution. That leads me to a few of the very bullish requirements of this week, courtesy of Lisa Shalett, chief investment officer in Morgan Stanley Wealth Management. “News about vaccine availability and effectiveness is a lot better than anticipated, increasing prospects for an end to this outbreak by 2021’s third quarter,” ” she writes.

No longer pandemic by following summer? Where can I subscribe to this?

This ’s {} news. The U.S. market is in very good position to get a major bounce-back. And ’s because of the U.S. customer the engine of this market.

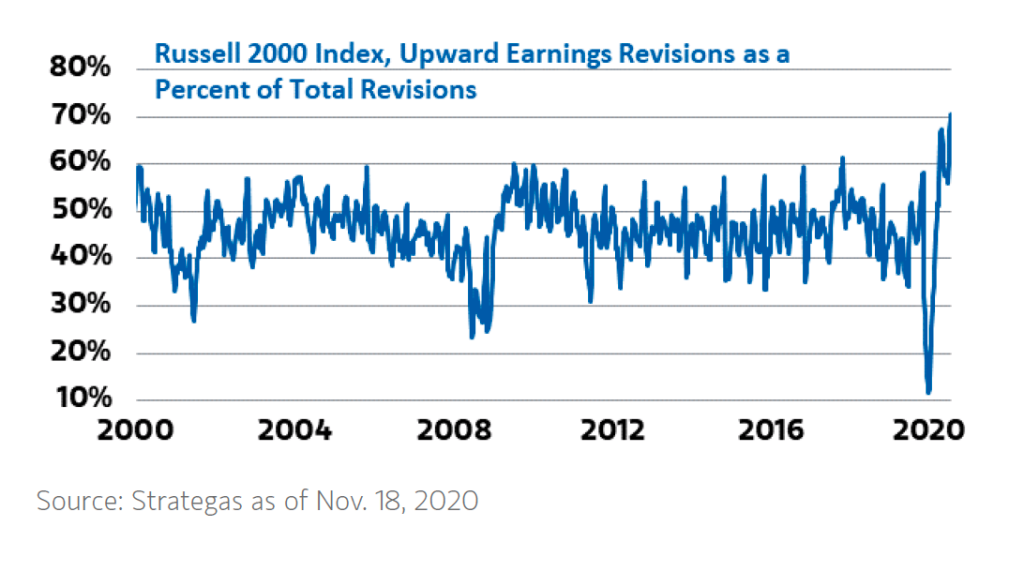

“Households who have enhanced balance sheets, even ” she writes,” “should aid with a spike in consumption spending once the economy completely reopens. That situation is directed by up earnings revisions such as the Russell 2000 Index, which can be in a 20-year large (see graph ). This type of development has generally augured well for a complete financial recovery. ”

This ’s the graph she describes, revealing Russell 2000 earnings enhancements hitting on a once-in-a-generation high:

This ’s a thing to be grateful for.

***

Have a great day, everybody. I’ll visit you tomorrow.

Bernhard Warner

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.