Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

And joyful Armistice Day to all of you veterans. The risk-on turning is currently in full swing because pesticide optimism continues to prosecute worldwide markets.

Bank stocks and stocks have been level now, but electricity continues to moan ahead, aided by rising crude rates. The sell-off in technology stocks, nevertheless, is still on end –with Chinese technology stocks the major exception.

Allow ’s check on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are combined in day trading using Japan’therefore Nikkei upward 1.8percent .

- It’s ’s Singles’ Day, Alibaba’s mega internet shopping occasion. This past year it’s anticipated to violate records, currently pulling in over $56 billion in earnings.

- Online retail treatment could ’t assist Chinese technology stocks. Last week’s abruptly stopped Ant Group IPO will be spooking investors, sending technology stocks falling again now , wiping out $260 billion in value within the last two days. Alibaba’therefore Hong Kong stocks are down almost 10 percent .

Europe

- The European bourses have been a smidge higher from the gates using all the Stoxx Europe 600 upward 0.25percent in the open, before edging high.

- Europe’s conquered down bank shares are once more in demand, but their problems are far from over. An EU banks watchdog cautions from the Financial Times the business faces a tide of nonperforming loans following calendar year.

- Investors aren’t simply snatching up stocks. The requirement for Greek autonomous debt was so lively that it pushed the return three-year notes into negative territory this past week, a startling original.

- This ’s following the small cap Russell 2000 (+1.7percent ) and blue chip Dow (+0.9percent ) closed on Tuesday, while technology stocks hauled down the S&P 500 and Nasdaq.

- Apple stocks are investing in a signal high in pre-market trading following the company introduced a new lineup of machines yesterday. (Can I be the only one that believes their last good notebook has been that the zippy MacBook Air, circa 2014?) Fortune‘s Aaron Pressman clarifies why these new versions are so important.

Elsewhere

- Gold will be downward, stuck approximately $1,875/oz .

- The buck is level.

- Crude is cruising back now. Brent stocks are trading over $45/barrel, also a 10-week high. It’s upward over $15,400.

***

Buzzworthy

We want a successful COVID vaccine. Stat!

The U.S. registered almost 140,000 fresh COVID instances on Nov. 10, a fresh album . The information looks poor.

Vaccine shorts

FAAMG dominance, YTD

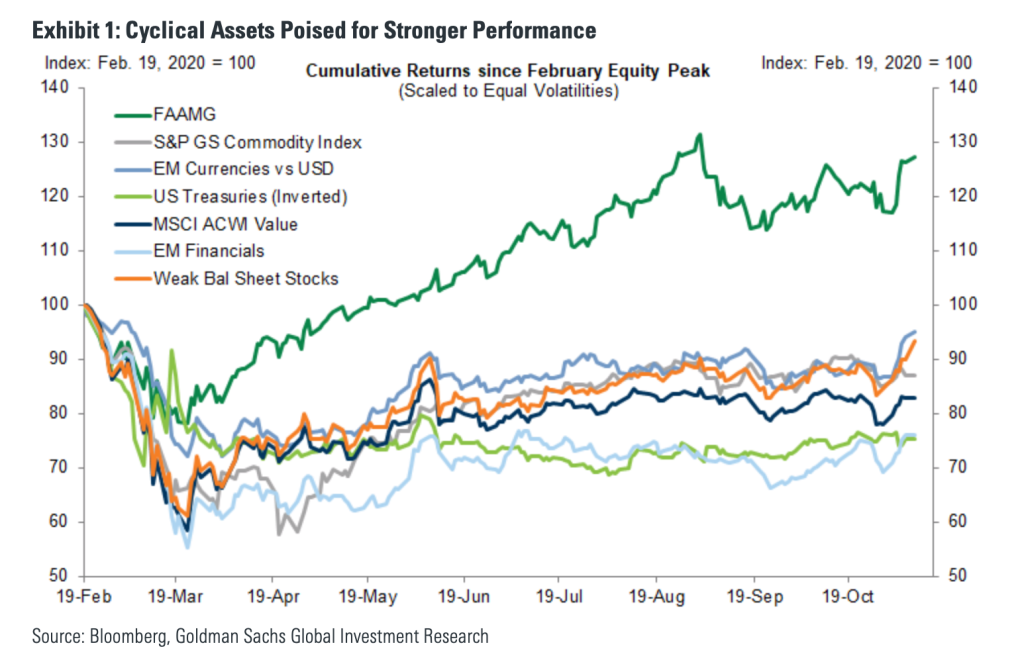

“while the S&P 500 is up this season, the profits are very narrow: the five mega-cap”FAAMG” companies (Facebook, Apple, Amazon, Microsoft along with Google, that accounts for approximately one-fifth of their indicator market capitalization) are upward approximately 40 percent , whereas the remaining part of the industry is still back on the year. ” — Goldman Sachs {} vaccine-led retrieval for real stocks is very long overdue.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.