Here is the internet edition of Bull Sheet, a yearlong day-to-day newsletter about what is happening in the markets. Subscribe to receive it sent directly to your inbox.

Great morning. It’s Day Britain: The very first nationwide rollout of a clinically examined COVID-19 vaccine is still underway. The markets’ response? A massive fat yawn.

Pfizer, among the manufacturers of this vaccine, is level in pre-market trading. The bourses in Europe and Asia are largely reduced, as are U.S. futures.

Allow ’s check out on what’therefore occurring.

Trader upgrade

Asia

- The most significant Asia indicators are a bit lower in day trading with Japan’therefore Nikkei down 0.3percent .

- Investors are bullish on Asian resources moving in the last months of 2020. Based on Bloomberg, the MSCI Asia Pacific Index hit album land a week, and also bonds have been nearing multi-year highs also. Meanwhile, the more U.S. sanctions loom for Chinese officials. The Stoxx Europe 600 is down 0.2percent hours to the trading session.

- Before this afternoon, a 90-year-old girl from the British town of Coventry obtained the very first Pfizer-BioNTech COVID vaccine taken from the U.K., a rollout that’ll be watched around the world. Even the pound sterling is downward along with also the FTSE is level. 2020 continues to be a banner season for Europe’s technology startup scene using the full enterprise investment poised to achieve $41 billion by year’s end.

U.S.

- U.S. stocks are reduced following the Dow and S&P 500 kicked the week off at the crimson; the Nasdaq nudged higher on Monday.

- Uber Technologies dropped 1.9percent yesterday after it declared it’d marketed its own self-driving automobile device to Aurora Innovation, efficiently becoming from the company. It did, but have a investment in the business, valuing Aurora in $10 billion.

- Water–especially, California wateris your latest trade-able advantage . The valuable product produced its Wall Street introduction on Monday, enabling investors to gamble on the pros and cons of the life-giving essence. Can clean atmosphere stocks be far behind?

- The buck is level.

- Crude is downward, using Brent futures {} $48/barrel.

- Bitcoin is right down, trading about $19,100.

***

The almighty consumer

Would you rather reside in a state with large sovereign debt, however very low family debt? Or, another way round –a location of non federal debt, nevertheless highly populated families?

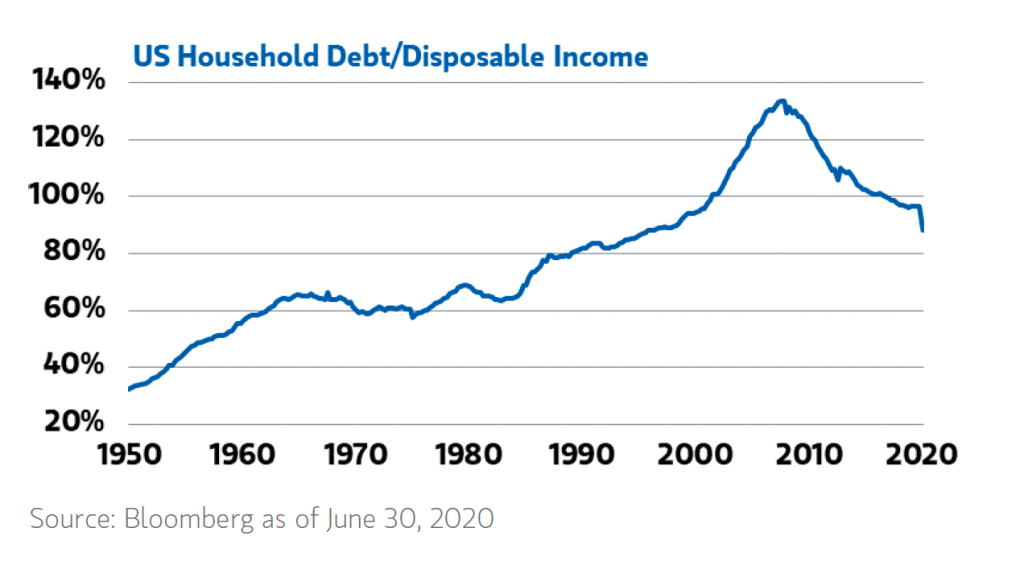

In the 1980s until about a decade past, household debt at the U.S. struck a crazy acute. As the housing bubble has been reaching its summit, U.S. family debt has been reaching 130 percent of disposable earnings. The bubble popped, and also Americans climbed more thrifty.

Something similar has occurred in the wake of COVID: family debt has dropped precipitously as now ’s graph, courtesy of Morgan Stanley, reveals.

“One special characteristic of the present downturn,” writes Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, “is that instead of customers tapping their charge cards, they’ve paid down debt, particularly relative to disposable earnings and net value. In reality, present readings will be the lowest since the late 1980s and almost 50 percent points lower than through the worst things in this Global Financial Crisis. ”

“This implies a vaccine rollout may easily unleash pent up demand for customer solutions,” she proceeds.

That might bode well for a few of the beaten-down investment businesses at the year ahead. Those could include leisure and travel, and energy and fund as individuals book travel, dine outside and start to go ahead.

This clarifies much of this thinking about why value shares (energy and banks, specifically ) are flourishing lately.

To borrow a word from the worlds of VC and private equity, most American families have a lot of abrasive powder as we venture into 2021.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.