Here is the internet edition of The Ledger,” Fortune’s weekly newsletter covering fiscal engineering and cryptocurrency. Subscribe here to have it free on your inbox.

Fantastic morning. The purchase cost of Bitcoin spanned the 18,000 mark nightly, the most current in a string of landmarks that has witnessed that the cryptocurrency’s cost rise by almost 400 percent since March.

Ryan Selkis, the creator of crypto research company Messari informs me he is”90% convinced we’ll find $20k annually end, [because it is ] blown through several key resistance levels. ” Selkis additionally cites Bitcoin’s recent adopt by PayPal and institutional shareholders, also believes that the price may soar much higher in January if greater fund managers, a lot of whom are firmly locking within their performance prices, opt to dip their feet in crypto at 2021.

The present rally is well known for longtime crypto bulls, but also increases the question of if or not last time, that may cause tears. The brief response is that a fall is almost inevitable–resources which move up 400 percent are expected to get a correction–however it will not be as intense as last moment. The background of Bitcoin was characterized by continuous but diminishing volatility. Throughout its initial huge bubble at 2011, the cryptocurrency jumped to $30 just to drop to $ two months afterwards. {Ever since that time, it has jumped and swooned many occasions but less radically than previously, meaning that the following crash could {} the cost to $8,000 but not $2,000.|}

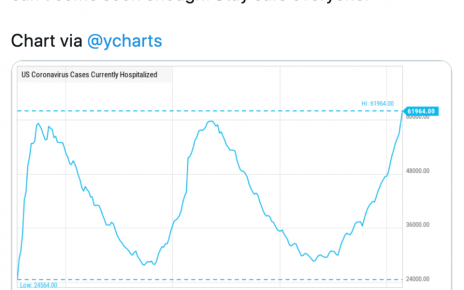

Another huge difference in 2020 is the present bull market is built upon stronger foundations. In 2017the bubble has been inflated by so-called First Coin Offerings, which found hucksters sell largely worthless new monies into some gullible and greedy people, {} {} the profits back to Bitcoin. Small wonder things pops up. This time round, tighter regulation implies there’less idiotic money sloshing about, while the press –diverted by COVID, politics along with a roaring stock market–was much more subdued in spite of the rally.

Bitcoin’s bases will also be more company in 2020 since it’s possessed by more individuals. A company named Grayscale was exceptionally successful in hurling Bitcoin as a option to gold, also selling it into countless millennial traders in the kind of stocks. Meanwhile, the leading institutional investors which range from Harvard University into billionaire John Tudor Jones are incorporating crypto for their portfolios, whereas people firms such as Square are gearing up Bitcoin to add into their own balance sheets.

{These days, the skeptics have {} –although Dimon, whose lender today {} services together with crypto giant Coinbase, this week stated Bitcoin is”not his cup of java .”|}

All this implies that, although the forthcoming age of 20,000 Bitcoin may be temporary, even the cryptocurrency is, even more than previously, here to remain. If you would like to have more insight into the larger image of Bitcoin, please have a look at my novel Kings of Crypto, that drops out of Harvard Business Review Press on December 15. Meanwhile, love the rally–and then await for the hangover.

Jeff John Roberts