By Tokyo to Madrid, there’so a lot of green onto the displays, with European monetary stocks, specifically, resulting in the way ahead.

Investors have a risk-on mood as COVID figures worsen and more constraints are mulled in a few of the planet ’s largest savings. However, the markets will be undaunted (that acquired ’t be the last time you see that phrase in now ’s Bull Sheet) as vaccine prosecution proves to be the newest overriding workforce.

Allow ’s see in which shareholders are placing their own money.

Trader upgrade

Asia

- The most Significant Asia indicators are rising again in day trading with Japan’s Nikkei upward 2 percent . KKR intends to construct up Seiyu and return it into the general public markets.

- In his last weeks at work, President Trump is devoting additional action against China, such as “shielding U.S. tech from manipulation by China’s army, countering prohibited fishing and much more sanctions contrary to Communist Party officials or other associations causing injury in Hong Kong or even the far western region of Xinjiang,” Bloomberg News.

Europe

- The European bourses are at the green from the gates using all the Stoxx Europe 600 upward 0.7percent in the start.

- The pound and FTSE are high as the U.K. authorities strikes an abysmal tone because a enormous Brexit trade bargain deadline this week. Both sides have dismissed through numerous deadlines, however that there ’s today discuss Brits will watch “the yield of quotas and tariffs for {} time in a production,” Bloomberg accounts .

- Spain’s BBVA consented to market its U.S. surgeries to PNC Financial Services Group to get $11.6 billion, “among those biggest bank tie-ups because the fiscal crisis,” that the Wall Street Journal accounts . BVVA stocks were up almost 15 percent in early-morning exchange, raising the Euro Stoxx Banks indicator by over 3 percent .

U.S.

- U.S. stocks stage to a strong open. This ’s following all 3 important exchanges completed the week with a high note, together using all the S&P 500 final with an all-time large on Friday.

- Exemptions in Johnson & Johnson were level within pre-market trading following the firm announced its own COVID vaccine innovative to some critical third stage of analyzing at the U.K.

- We should be getting towards the end of corporate earnings year since the huge retailers are up following.

Elsewhere

- Gold is level, trading about $1,890/oz .

- The buck will be down. {

- Crude is upward, with all Brent futures {} $43/barrel. |}

***

Investor danger: bring it around (for today )

In the close of each week that the “fund escapes ” reports property in my in-box on Fridays, nearly constantly after I’ve pressed “ship ” on Bull Sheet.

I typically scroll through the accounts quickly onto my phone like I create coffee on Saturday morning. (Not to worry; I’ve walked and fed with the puppy.) That can be my wife comes from and hijacks the radio to obey this Rai 1 information bulletin, which puts off grumbles about the Conte authorities.

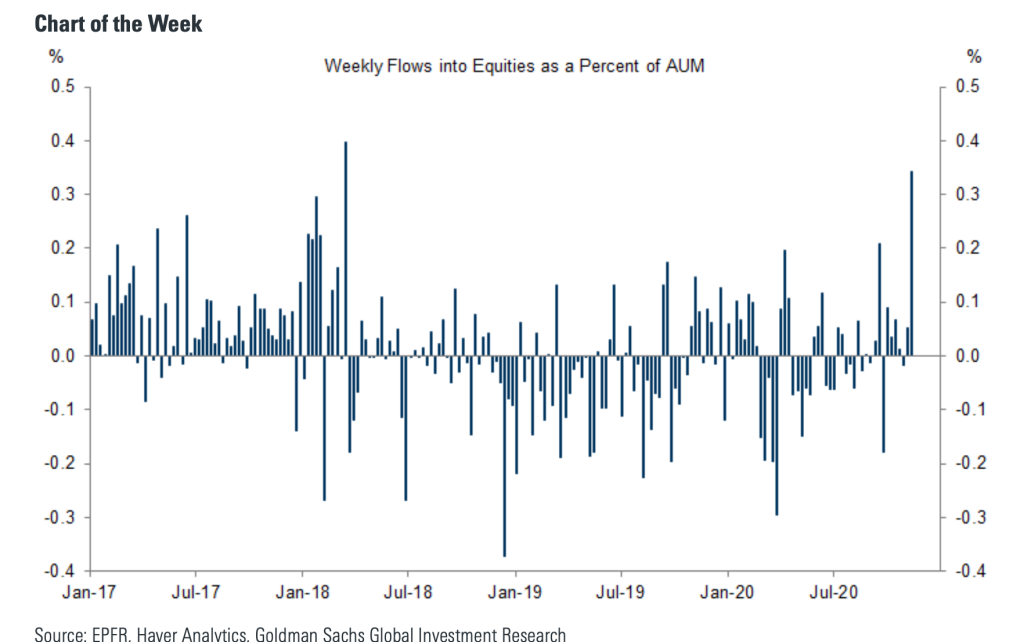

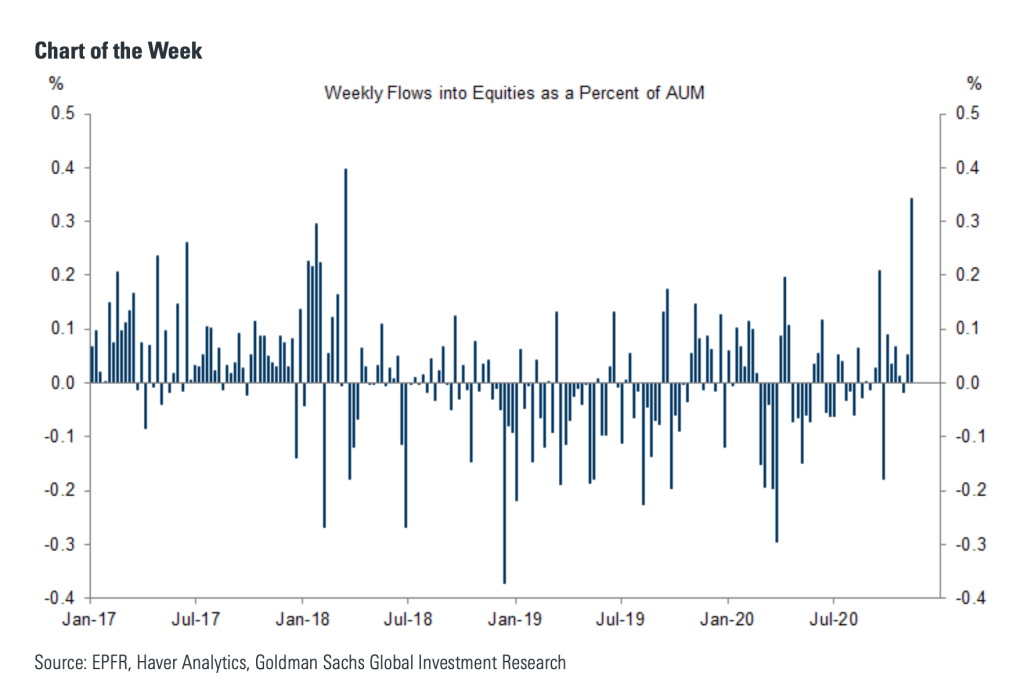

The finance flows reports quantify whether cash has shrunk to or outside of those markets in the preceding week, and therefore it’s a fairly good index for buyer bullishness.

Last week has been just one for the bulls. Recap: that the week had a great deal of momentous information, such as “that the U.S. election outcome and positive information concerning Pfizer’s COVID vaccine,” Goldman Sachs writes. ”

Both Goldman and BofA Securities compute the inflows last week were in a close three-year high. The last time we found a lot of money entering the economies (as a proportion of absolute assets under control ) has been January, 2018.

The web -$45 billion which entered the markets, even at straight-up dollar terms, was actually an album. The majority of the money went to U.S. equities. However there was also an obvious reduction in currency flowing into fixed-income (investment-graded and high-yield credit financing ) and FX transactions (from the buck ).

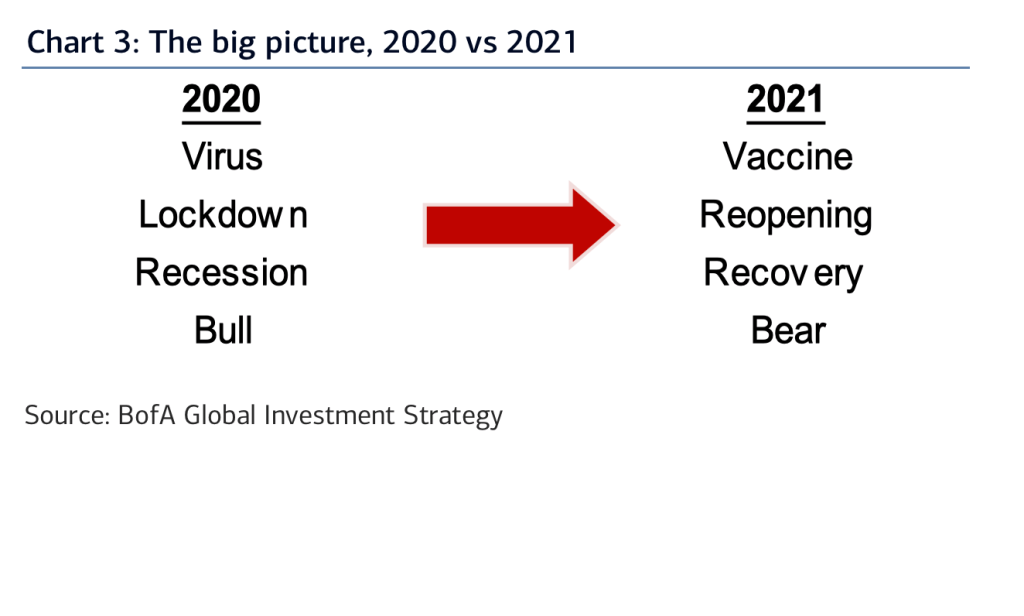

Lately, BofA sees the clear vaccine breakthrough since a huge catalyst to reverse belief going to the new calendar year. Simply speaking, they believe the market has mostly priced in favorable vaccine information. “We’re sellers-into-strength into vaccine in forthcoming weeks,” ” they compose. “mid century positioning, summit policy, summit gains [are] probably coming [from the] weeks [forward ],” they sign off.

This ’s the way they view the change in 2020 to 2021 acting out:

I wish I may feel much {} about the prognosis. The COVID amounts in Italy stress me. And that I ’m more spooked from the amounts in the U.S. in which my mother, my sisters and so lots of coworkers and friends live.

I respect anyone who can anticipate, also also make a statement regarding 2021. In my novel, those who {} the authentic bulls.

***

Postscript

Saturday mornings will also be homework period. This week’s mission: writing compositions. Sixth-grade stuff.

So I believed.

It’s ’s in Italian, therefore it’s great training for me to check my understanding of Italian Bible, among the authentic geeky joys of raising bilingual children. There’s {} which I’m studying for the very first time.

This week, it was the term impavido, which my kid slipped right into her makeup in writing concerning the similarities between Acchiles, he of their world-beating power but tender insides, along with Super Girl. (I’m imagining my girl nicked the phrase in my spouse; she implemented it into Super Girl, therefore it was the female, impavida.)

The sight of this word delivered me directly into this unabridged dictionary to discover the exact English equivalent.

The origin is Latin. Pavidus = “feeble ” (which derives in pavēre, “to possess dread ”). Im = maybe not. In most dictionaries, impavido is interpreted as “fearless” or even “undaunted. ” However there’therefore an a much more exact English phrase for impavido. Yepit’s “impavid. ”

… as in “that the impavid investor moved on technology and growth stocks at mid-March, also made a killing. ”

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]