Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

For all those people who chose to ditch tech stocks for stocks last week, then complimenti! The cigars and champagne will be at the email (after I can get control to accept the buy ).

Seriously, if some of you unwound your own WFH pandemic portfolio {} Election Day, drop me a line. I’ve plenty of queries for you.

Even the Monday rally at 2020’s misfit shares –that the likes of banks, airlines and vitality –has been fueled naturally by Pfizer’s “match changer” information of a drug trial breakthrough. At one stage, the Dow was upward 1,600 points yesterday prior to closing the afternoon 3 percent greater.

Regrettably, yesterday’s agent euphoria is petering on Tuesdaywith futures and stocks mainly horizontal. However, there are a number of sectors which are still in the green, such as large banks and Big Oil.

Allow ’s check on the activity.

Market upgrade

Asia

- The most Significant Asia indicators are largely higher in day trading together using all the Hang Seng upward 1.1percent .

- Not many offenses are exactly the exact same, seemingly. China’so called frontrunner, Sinovac’so called Coronavac, has been stopped in Brazil following what health officials that there are describing as “a severe adverse event. 1 major culprit: dropping pork costs as the nation ’s swine inventory recovers from African American fever. (I might have said this earlier here in Bull Sheet: ASF, or pig ebola because it’s understood, is not anything to mess with.)

Europe

- The European bourses are blended with London and Paris upward, and also tech-heavy Frankfurt down.

- This ’s something we all overlook ’t find daily. Stocks in Adidas are 0.8percent following the firm reported that a bottom-line beat as a result of powerful expansion in its home market, Europe.

- Norwegian Air was among those very few airline shares to falter yesterday{} over 11 percent on information Oslo won’t offer them some longer pandemic relief dough. {

U.S.

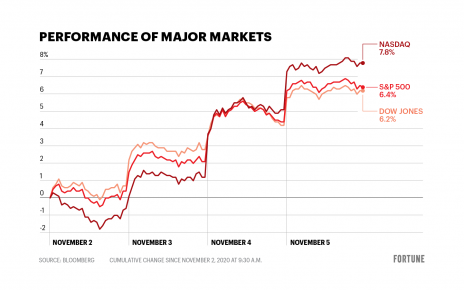

- Dow stocks are at the green, whereas S&P and Nasdaq stocks are {} in up-and-down commerce this afternoon. |} This ’s following the blue chip Dow saw its greatest one-fifth performance because June 5. I enter the winners and winners below.

- McDonald’s didn’t make it on yesterday’s large gainers record (nor is it a huge decliner, for that matter). ”

- Online trading platforms didn’t have a fantastic day. Many “across the globe broke down or have been inaccessible on Monday as human investors attempted to make the most of significant trading,” Bloomberg accounts .

Elsewhere

- Gold is rebounding modestly, investing about $1,875/oz .

- The buck will be down.

- Crude is blended following a leading Monday when both Brent along with WTI jumped to the Pfizer information .

- Bitcoin bulls are not any lovers, it appears, of asserting vaccine trials. The cryptocurrency is down almost 3 percent in $14,880.

***

The losers and winners, vaccine variant

Investors understood V-day will come. Finally.

Kudos to all those of you who thought it’d land, the very first trading day after a new president has been declared. (in case you’ve got an mad conspiracy theory concerning the time, don’t deliver me… unless they’re quite ridiculous. You are able to send me these.)

All kidding asidewe shouldn’t be {} by what we saw. The vaccine commerce was something we’ve discussed in this area a couple of times. A refresher: after there’s false improvement to a medicine, it’s time to recalibrate (or rethink) your extended spans, the thinking goes. In would be the beaten-down significance shares, the Wall Street specialists state; outside are more inflated growth stocks.

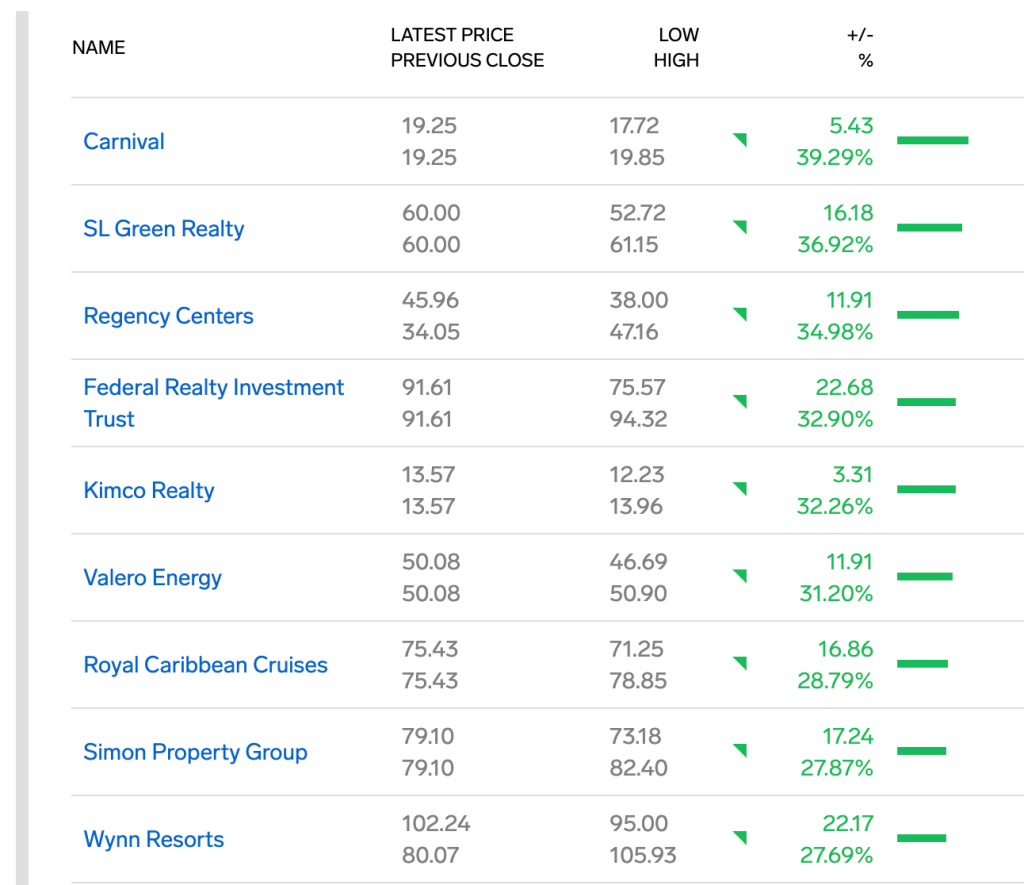

And, on cue, the Europe Stoxx 600 Banks indicator is more than 3 percent in morning trade this morning. This is reasonable. The banks, a bellwether for the bigger market, have submitted adequate results this past year simply to get penalized by shareholders. It’s tough to generate a similar research in regards to the casino and cruise shares, but there they’re topping the record (or close to the surface ) of Monday’s large gainers.

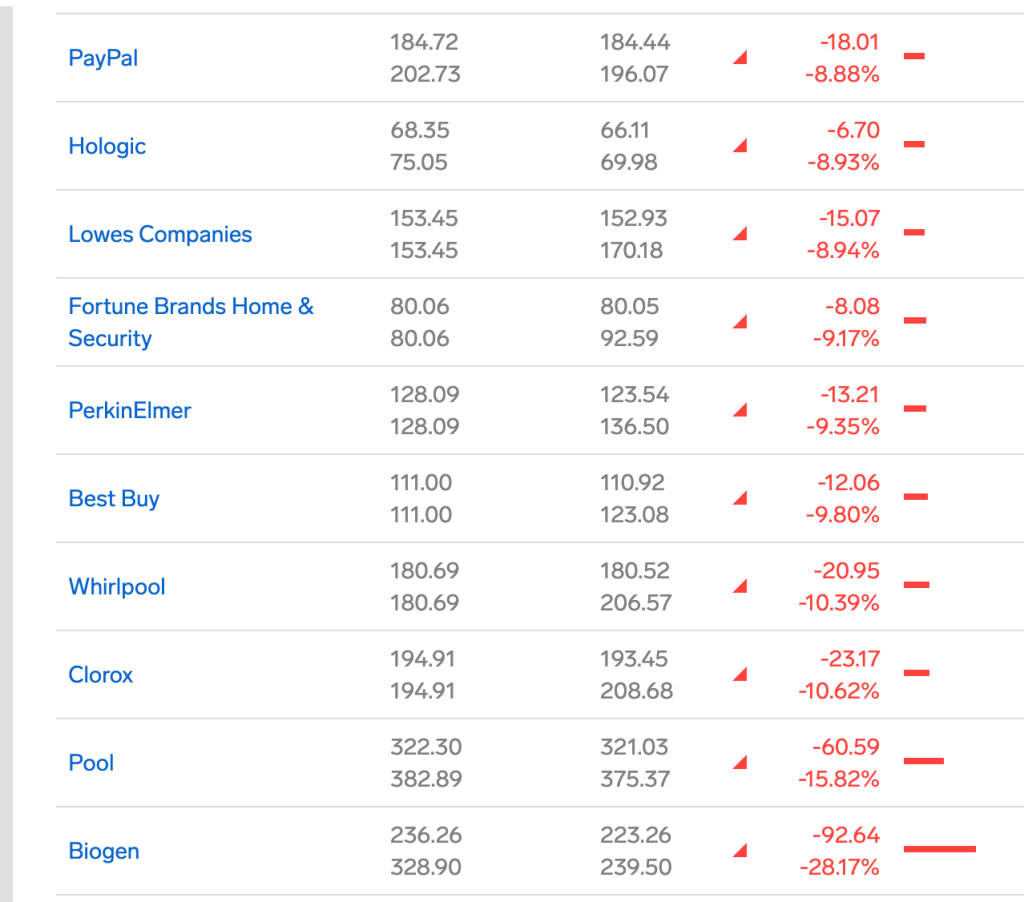

And the winners ? They comprise stay-at-home stocks such as Zoom Video, also DIY retailers like Lowe’s, also Clorox along with Biogen.

However, does this mean it’s time to ditch the likes of large cap technology and healthcare stocks? Not too quickly, analysts are already saying.

This ’s O: Even though these experiments prove powerful –a big in case –it might take a few months to receive meaningful supply. And, more quickly, a lot of the planet faces a mortal second wave which ’s becoming worse daily. Therefore, world leaders have been warning that this isn’t any opportunity to let our guard.

Regrettably the 2020 bull market was among FOMO-led rallies. As I glance {} the markets, traders are still provide a thumbs-down to heap and tech into formerly unloved stocks.

***

Postscript

This ’s a poignant story in the North of Italy, after more a place rocked by COVID.

{81-year-old Stefano Bozzini’s {} has coronavirus. |} And, needless to say, he can’t see her while she’s ’s educated.

The movie is actually sweet.

***

Have a great day, everybody. I’ll visit you tomorrow.

Bernhard Warner