Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

To begin with, a little politics.

He Wants to acquire Pennsylvania, Georgia, Nevada and North Carolina. Joe Biden includes four approaches to get over the hump, and win the presidency; he also needs only six votes. CNN is significantly less competitive calling countries, meanwhile, stating Biden retains a 253-213 lead.

The markets have crowned the winners, beginning with gold, technology, healthcare along with consumer optional stocks. Meanwhile, the financials and utilities–that the worth stocks that could have obtained by a giant Democrat-led stimulus package–are stumbling.

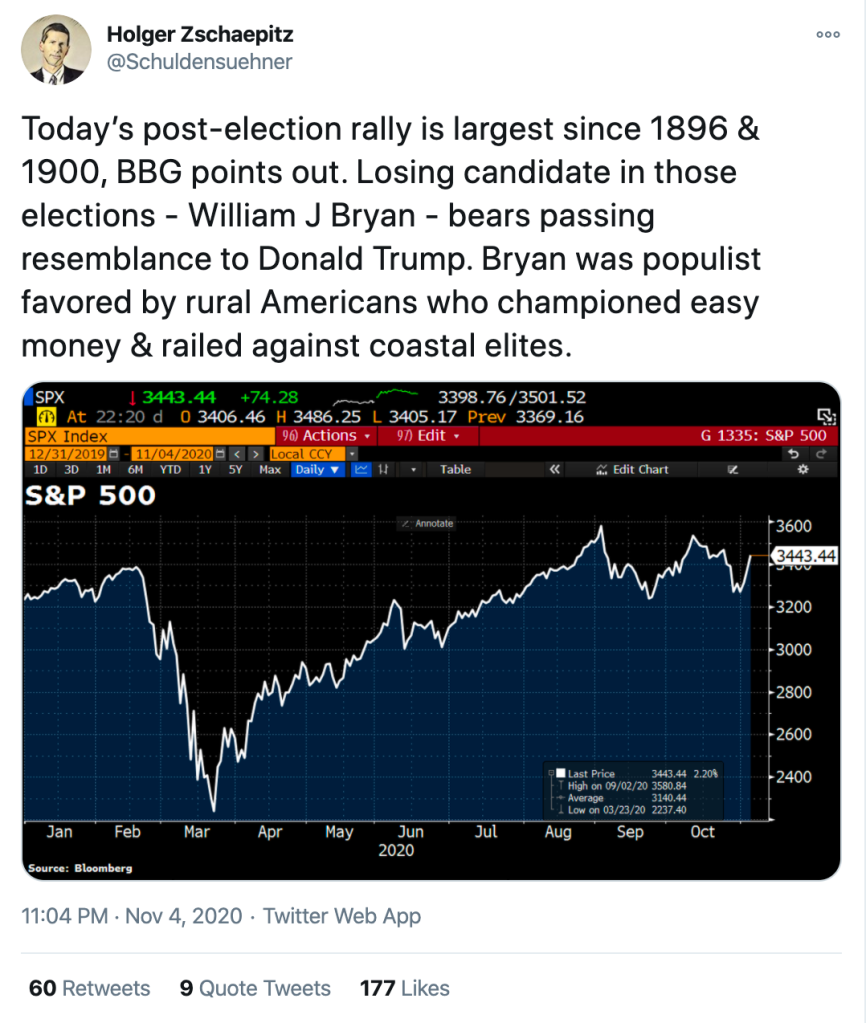

Impressively, meanwhile ’s post-election rally was only for the record books. Why? Because, despite the danger of loopholes and suits , the niches are gambling on a victor. “While neither candidate could authoritatively declare success, markets seem to anticipate former U.S. Vice President Biden to eventually become U.S. president-elect, having a Republican Senate and a Democrat House,” UBS chief economist Paul Donovan writes in an investor note that this morning.

An important reminder: that the election is far from determined. Stick together using Fortune for several of the most recent elections along with markets news.

Meanwhile, allow ’so view where investors are placing their own money.

Market upgrade

Asia

- The most Significant Asia indicators are high with Hong Kong’s Hang Seng the finest of this Group up 3.3percent in day trading.

- Two apparent winners have emerged thus far in the 2020 U.S. election: Russian President Vladimir Putin and Chinese President Xi Jinping, the two of whom are very most likely to gain from a split electorate and split Washington.

- Investors are calling the unexpectedly canceled Ant Group IPO that the “largest busted commerce in stock exchange history. ” The double listing had brought a shocking $ trillion in requests from investors seeking to cash in, Bloomberg reports. Yep, technology stocks were still soaring.

- The Bank of England this afternoon delivered a larger than anticipated 150 billion pound ($195 billion) chance of stimulation to some teetering British market which goes to a partial lockdown now. The pound sterling and FTSE rose in the start.

- 189 nations signed up the Paris Agreement back in 2015. It lost a crucial member, the United States, the very first big market to depart the climate-protection pact. Even still, there are reassuring signals the company world and local authorities will continue to perform their part to cut back emissions.

U.S.

- U.S. stocks tend to be a lot more secure than they were 24 hours before, solidly from the green. This ’s following all 3 important indexes rallied about the possibility of a Biden presidency and divide Congress.

- Tech shares have been the huge winners yesterday using Uber Technologies and Lyft shutting upwards by 14.6percent and 11.3percent , respectively, after California voters passed a proposal allowing the ride-hailing companies to keep to classify drivers as independent contractors.

- The “grim wave stimulation commerce,” because it had been called the eve of Election Day, appears remote. On signal, investors {} financials, utilities, industrials and stuff — even the businesses that could have profited from a large, fat Biden-Dems paying strategy.

Elsewhere

- Gold is upward, trading about $1,920/oz .

- Bitcoin bulls are delivering the cryptocurrency to brand fresh heights. It had been up roughly 6 percent , trading at the same point over $14,500.

- The buck is reduced, creeping down since Biden’s chances on the White House increase.

- Crude is reduced, with all Brent trading over $40/barrel.

***

Buzzworthy

A muster to the record books

William Jennings Bryan was also a Democrat.

In compliments of civic division

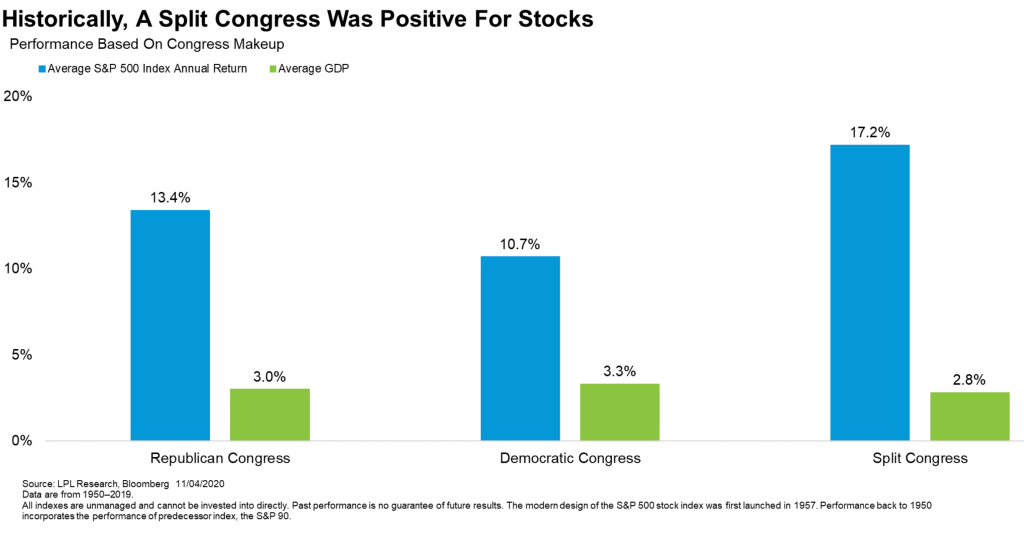

“The S&P 500 currently has performed very nicely under a split Congress, {} 17 percent on average,” analysts in LPL Financial composed in a note Wednesday. Fortune‘s Anne Sraders digs in the amounts .

Stimulus in doubt… tax increase out?

“A split Congress can make it even more challenging to maneuver the large $2 trn+ ‘gloomy tide ’ financial package that many market participants are awaiting. That is the situation that most in markets viewed as the most favorable possible outcome a little while back because a Republican-majority Senate can avoid tax hikes.

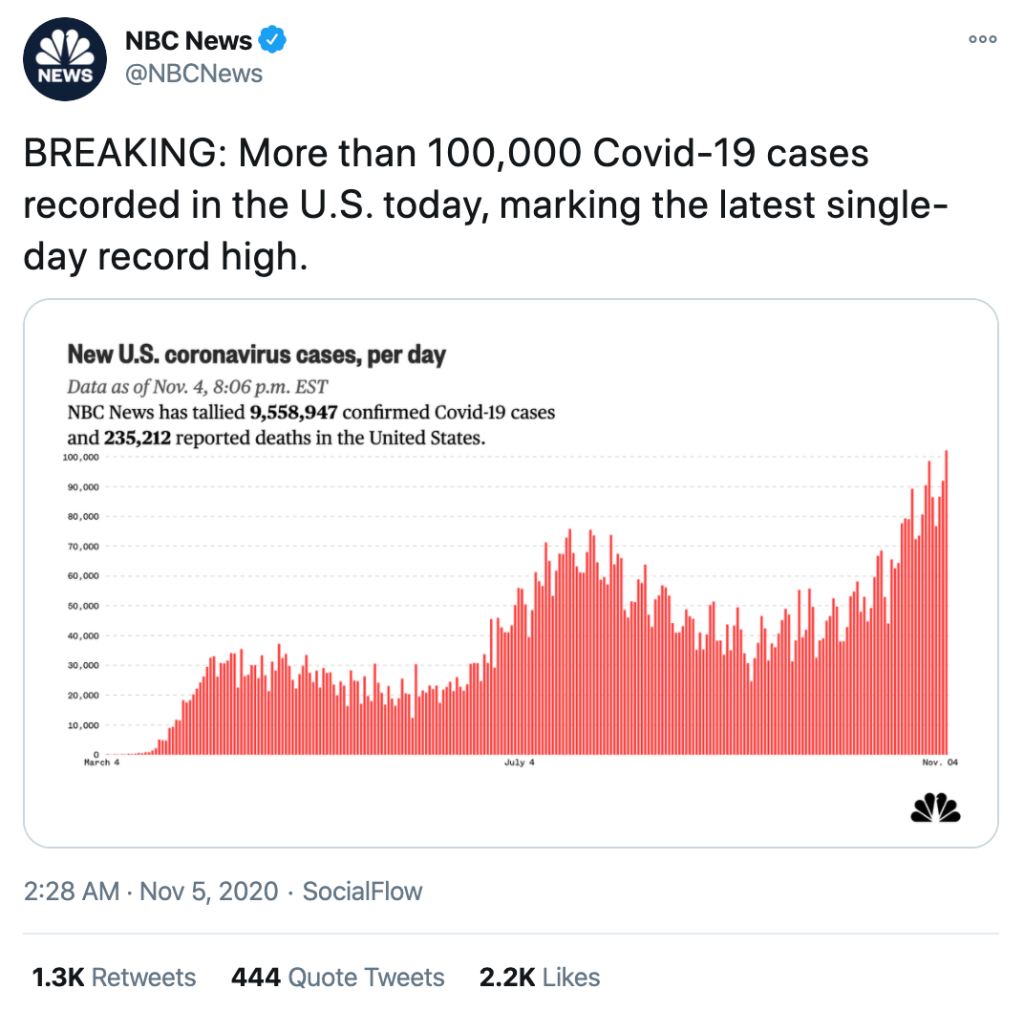

Even though the economies rally, public health officials worry

At this speed, the U.S. will exceed 10 million supported COVID instances by Monday.

***

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.