That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Happy Friday, Bull Sheeters. Substantial Tech’s large 4 –Apple, Amazon, Facebook and biotech ’s Google–declared Thursday a joint $38 billion in earnings, and Nasdaq stocks are bombing this afternoon about the cloudy outlooks that they provided.

Meanwhile, the COVID instances hit new records around much of Europe and the U.S. from the previous 24 hours. It’s completely possible that Americans will observe amounts payable 100,000 cases each day soon after Election Day.

Permit ’s check out on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are in the red in day trading using Japan’therefore Nikkei down 1.5percent .

- China’s newest five-year plan premiered yesterday. Outside is the tradition of GDP targeting; it’s a focus on “quality expansion . ”

Europe

- The European bourses proved sharply lower in the start, including pain into some brutal week for European stocks. Germany’s DAX was away 0.7percent a hour to trading.

- The French market climbed with a greater than anticipated 18.2percent past quarter, although none ’s cheering because the nation deals with a catastrophic second tide of COVID which will greatly dent GDP from the months and weeks ahead.

- Shares in Total proved down 0.7percent since the French power giant issued a enormous bottom-line beat on Friday, also shrugged off worries of petroleum prices hovering about $40.

U.S.

- U.S. futures stage to a demanding start with Nasdaq futures {} {} 230 points as traders weren’t happy with all the outlooks supplied by Facebook, Apple and Amazon.

- Investors cheered Netflix’s subscription cost increase because January 2019, pushing stocks up 3.7percent . It comes following Netflix disappointed a week subscriber numbers.

- The buck will be down. {

- Crude is falling back {} Brent currently trading about $37.50/barrel. |} Yes, petroleum bulls. Regardless of who wins the White House, it won’t facilitate Big Oil’s largest difficulty: an excessive amount of oil available on the industry .

- Bitcoin is upwards 1.3percent , trading over $13,300.

***

From the figures

-1,135

Permit ’s begin in Germany. The DAX at Frankfurt is down this afternoon, and is off 1,135 points (-9percent ) within the previous five trading sessions. You will find high-profile for European stocks entering Q4, however the next tide of coronavirus has squelched which commerce. In actuality, European stocks have been on pace for their worst week as March. A reminder: March wasn’t a fantastic month for stocks.

Yesterday, Fortune introduced its yearly fastest-growing businesses listing , calculating the 100 businesses who’ve increased their top-line, earnings and shareholder return in the strongest rate over the last calendar year. This is really an astonishing cohort. Normally, Fortune‘s Fastest Growing Firms delivered a 19 percent return to investors within the last few decades, easily outperforming the S&P 500 indicator (11 percent ). Four China-based firms made the record and California is the very best country in the marriage with 20 agents from the Golden State. Yes, technology organizations are well represented, however, it’s maybe not the very best industry. That honor belongs to fund. Yes, fund.

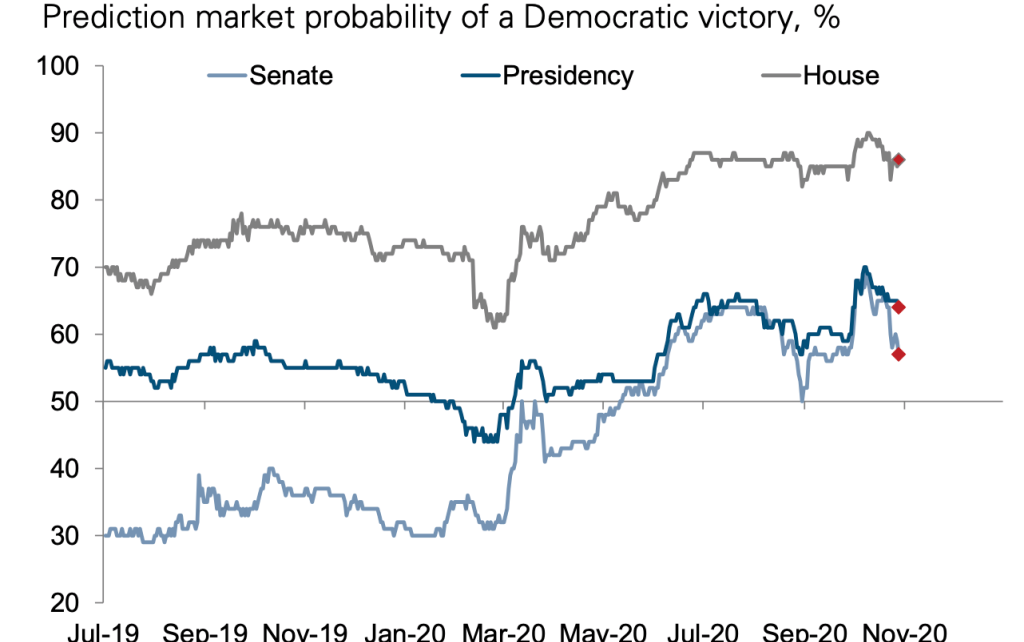

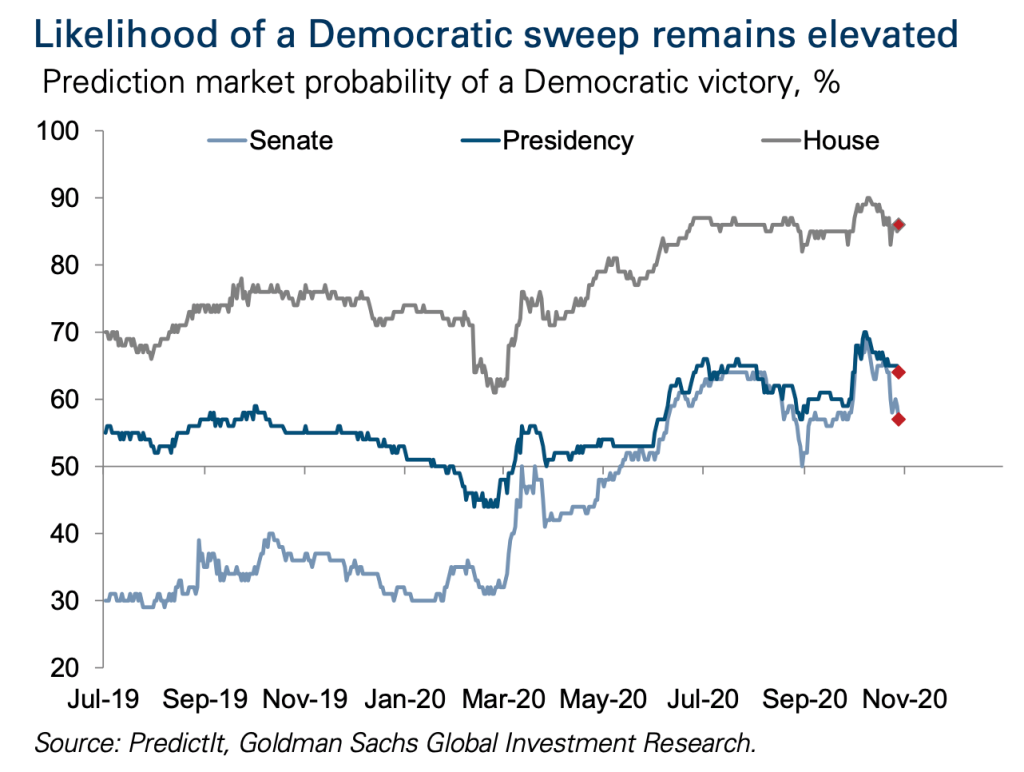

We’re only four days away from Election Day, therefore we’re planning to have a second look in the forecast markets to the White House and Congress. Wall Street continues to be handicapping the likelihood of weeks, also Goldman Sachs, amongst others, still considers a so-called “gloomy sweep” is a different possibility, even if the chances are falling. They see that the Democrats’ odds of gaining control of the Senate as a far tighter race of a sudden. Why is this significant? “Beneath a Democratic sweepwe believe Democrats would probably pass on a $2.5tn COVID-19 relief package,” Goldman analysts compose, which could offer a wholesome elevator to Q1 GDP. For my readers that are political junkies, have a look at Fortune‘s Shawn Tully’s bit on why those 2 countries –Florida and Pennsylvania–will be the ones to see next week.

***

Have a great weekend, everybody. I’ll visit you on Monday.

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.