Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Great morning. International stocks and U.S. stocks are beginning the week on solid footing with loads of green onto the displays by Tokyo to London. Strong Chinese financial statistics along with a fresh stimulus deadline are encouraging the risk-on disposition. Meanwhile, before looking back on the last month, we now examine the large operate by consumer discretionary stocks.

Allow ’s view where investors are placing their own money.

Dollar upgrade

Asia

- The most Significant Asia indicators are largely high in day trading together using all the Nikkei upward 1.2percent .

- China’s 3Q GDP climbed 4.9percent, marginally off economists’ expectations. Nevertheless, the strong pickup in retail revenue adheres well to get a continuous economic recovery.

- Time to ditch quarantine? This ’s what IATA believes. The planet ’s airline commerce body is pushing to an alternate into the 14-day quarantine, likening it into “shutting your own borders.

- Europe’s market is careening to your double-dip downturn since the fall wave of COVID instances are still swell.

- Meanwhile, the fund work in London are evaporating fast.

U.S.

- U.S. stocks are from the green that afternoon, also ticking higher. This ’s following the Nasdaq shut down Friday, capping a volatile week.

- House Speaker Nancy Pelosi place tomorrow because the last deadline of obtaining a stimulation deal done. Investors cheered the news, raising U.S. stocks overnight.

- It’s ’s official. The U.S. shortage topped $3.1 trillion from the financial year ending Sept. 30. We knew it’d be a listing, but the amounts continue to be eye-watering. It’s over twice the prior set of $1.4 trillion from 2009. Meanwhile, the America’s debt-to-GDP ratio is about speed to high 100 percent this season .

- The large earning calls deck this week include: Netflix, Tesla, Coca-Cola, AT&T along with Procter & Gamble.

Elsewhere

- Gold is upward, trading about $1,915/oz .

- The buck is level.

- Crude is right down before now ’s large OPEC+ assembly , together with Brent trading over $42.50/barrel.

***

Enormous returns

Tech stocks have taken a tiny breather in recent times with the Nasdaq completing {} four consecutive sessions. Even still, the indicator closed in positive territory for the week, talking to investors’ unflinching faith at the mega-cap stocks.

Zooming out within the last month, technology stocks have experienced one of the finest stretches of this calendar year, together with the Nasdaq 100 up 9 percent because mid-September. It’s a streak that number of Wall Street experts had predicted.

Having said that this rally doesn’t completely resemble the one that we found in August. And consumer discretionary stocks, headed by Nike, have taken off in the previous month.

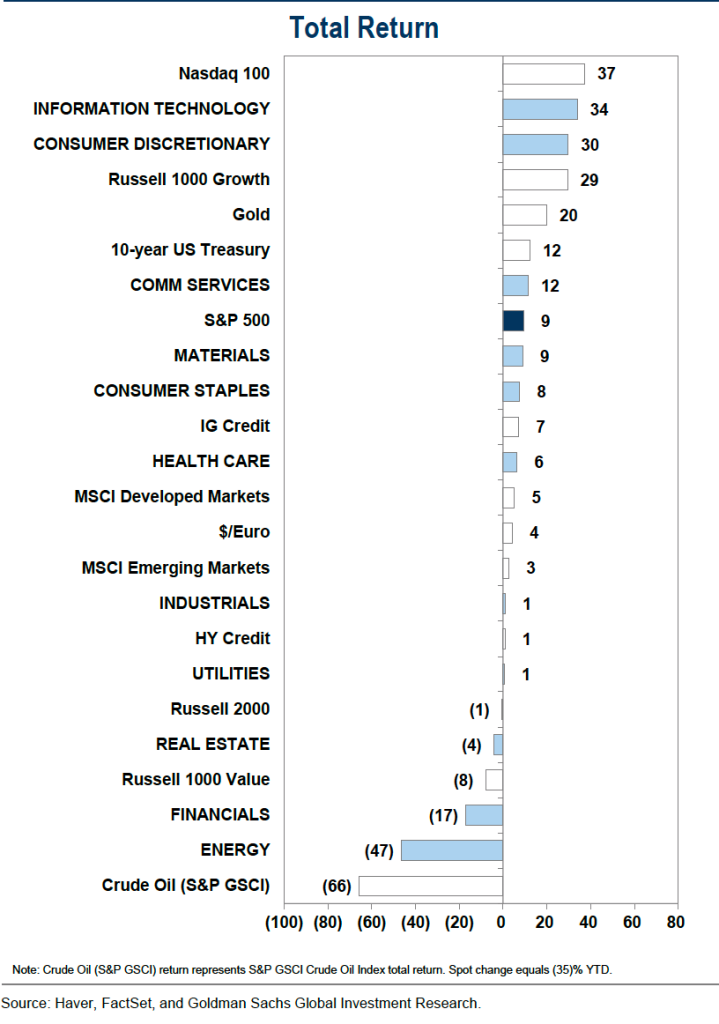

While this dawn ’s graph, courtesy of Goldman Sachs reveals, the customer optional group has jumped over golden and Russell 1000 Growth to turn into the third-best performing section of 2020.

That more businesses are contributing to the bull run is a good indication of a more rigorous restoration, or, at least, investors’ religion within an broad-based recovery.

And the big winners? Those titles harbor ’t altered. Financial stocks have achieved marginally better in yesteryear, however they’re down 17 percent over the year (vs. -18percent per month ago). Meanwhile, the energy stocks continue to drop (down 47 percent YTD) even as crude oil costs stabilize.

If you would like to discover bears within this current marketplace, then you ’ll discover them.

***

Postscript

Yesterday evening we gathered round the TV to grab Prime Minister Giuseppe Conte’s nationwide COVID speech. A whole great deal of Italian companies were fretting the authorities would impose new limitations across the lines of this French. In the long run, we dodged the worst–no more blanket curfews, no college closures without a shut down of restaurants and gyms.

Conte gave local mayors the choice to dial these actions where required. Italians may observe certain piazzas near at 9 p.m. to maintain massive crowds from collecting. But that only means la dolce vita is going to likely soon be limitata, maybe not eliminata.

Italy with no famous la dolce vita societal life is simply not the exact same nation. However, it appears secure for now, most of us expect, since the government opts to get a milder touch this time.

It marks a major difference in seven weeks back when the nation was overrun by the mortal initial tide of coronaviruses instances. Public health officials nowadays say the most recent outbreak isn’t an alarming one because the amount of hospitalizations and fatalities, a proposed index, continue under management.

And, being Franco Locatelli, a primary public health adviser to the authorities, stated yesterday Italian tv, a major proportion of the newest “optimistic ” COVID instances have the milder, more asymptomatic selection. “that I ’m panicked nor upset,” he further added.

Locatelli is Italy’s response to Anthony Fauci. I interviewed him lately just as examples began to spike in Italy. He explained that the situation load could make worse, but this time the nation was much better prepared.

As I wrote at this report, Italian politics can look to be a zoo at times, but throughout the COVID epidemic government officials’ve seemed clear-eyed and coordinated. There haven’t been any rambling endorsements of untested COVID remedies such as hydroxychloroquine or even awkward U-turns.

“I want to put it this way,” Locatelli explained,”some choices taken by other nations wouldn’t have been shot in Italy.”

Italy, now around is becoming far more focus on what it’so doing. There’therefore a powerful partnership between both politicians and the scientific advisers. Along with the people trust stays strong.

This fall spike feels quite different.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

Bernhard Warner

@BernhardWarner

[email protected]