Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Great morning. COVID vaccine jitters broke a four-day rally in U.S. stocks yesterday. Underwhelming bank earnings along with a ho-hum Apple iPhone occasion didn’t assist investor opinion either. U.S. stocks and international stocks are trading largely from the green that morning, but certainly are away from their highs, as the following large day of business outcomes –Bank of America,” Goldman Sachs and United Airlines–expects.

Allow ’s view exactly what ’therefore moving the markets.

Dollar upgrade

Asia

- The most significant Asia indicators are largely lower in day trading using Japan’therefore Nikkei the very finest of this group up 0.1percent .

- China’s Ant Group will be Seeking to increase a list $30 billion within an IPO. It’therefore a much better bet today after the obligations juggernaut reserved a $2.6 billion gain this past calendar year.

- China’s CSI 300 Index gained a huge increase out of President Xi Jinping, almost hitting a {} ,” on Wednesday. The president rolled his plans out to get Shenzhen and the Greater Bay region.

Europe

- The European bourses were apartment from their gates, prior to climbing. The Europe Stoxx 600 was upward 0.2percent 2 hours to the trading session.

- The British lb is down considerably this early as post-Brexit commerce discussions move down to the cable together with the two sides far apart.

- The World Trade Organization ruled in favour of Europe at a long-running dispute over subsidies into planemakers, enabling the EU to impose around $4 billion in tariffs from U.S. companies. Shares in the Boeing and Airbus dropped more than 3 percent on Tuesday since the markets are still expecting to get a negotiated bargain, maybe perhaps not more tariffs.

- I understand the bond market will be still upside down nowadays, but I never believed in my life I’d watch a news flash such as this one: shareholders have been snatching up Italian zero-coupon bonds. Zero coupon? Daje, ragazzi. Che destiny?!

U.S.

- U.S. stocks are up, even though off their highs. This ’s following all three important indexes closed from the red on Tuesday. Johnson and Johnson and AstraZeneca also have stopped their COVID job in recent months, providing the investment world that a crash course from the downs and ups of medication trials.

- Shares in Apple shut down 2.65percent following the firm introduced a variety of new goods , such as a 5G iPhone, on Tuesday. It’s ’s not unusual for Apple stocks to collapse following these occasions.

Elsewhere

- Gold is upwards after falling, under $1,900/oz , yesterday about the Most Recent setback on the disease front.

- The buck is upward.

- Crude is upward, using Brent trading about $42.50/barrel.

***

How a lot of you thought of pulling out your inventory holdings past month prior to the fantastic September swoon?

It turned out to be a full time moment. The economies were decreasing, COVID amounts were soaring, and also worries about a contested election were scrapped. My in-box stuffed with all sorts of analysis and commentary in Wall Street vets who trotted out historic data demonstrating the weeks before some U.S. presidential elections are typically a dud, or even worse. The suggested message: money out today.

Fast-forward to now and also the S&P 500 has shrunk 7 percent since Sept. 2. You’d find out a great chunk of change needed you ever pulled the plug {} .

Joachim Klement, head of investment research at London-based Liberum, shared with an investor notice yesterday regarding how market volatility will reduce the yields of active traders.

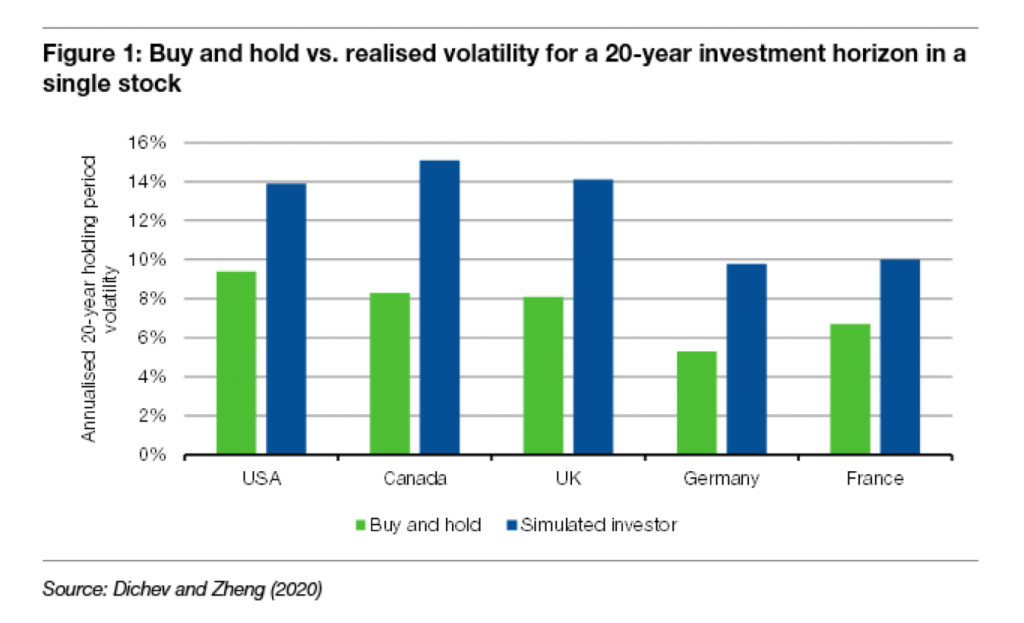

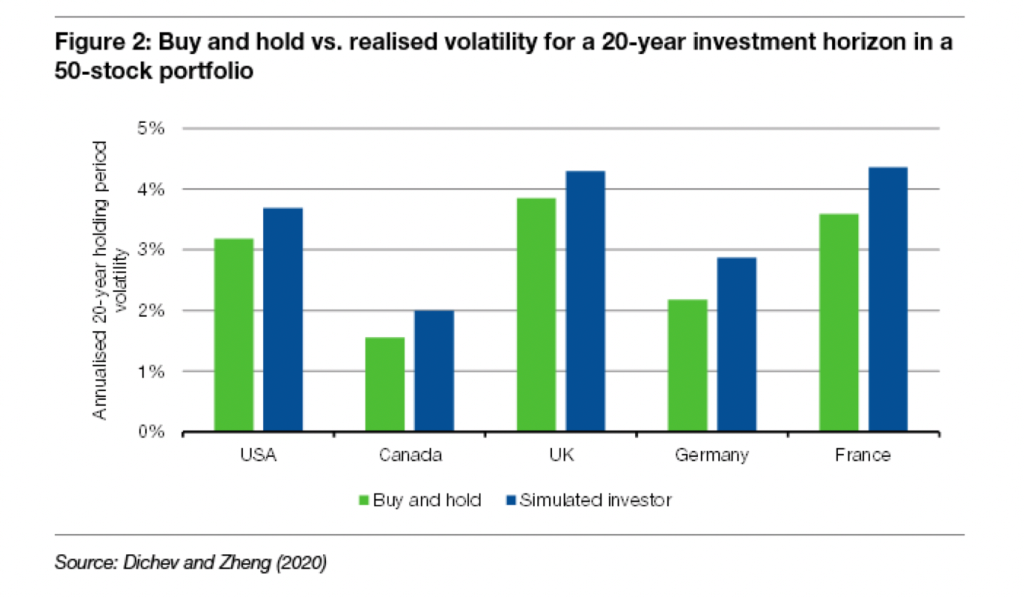

He cites a current study paper by two professors, by Emory University and the University of British Columbia. They seemed at average investor portfolios across several nations, comparing active dealers (people who attempt to time the current marketplace, getting in and out of shares within comparatively short periods ) using the buy-and-hold audience. The results were illuminating, since the 2 graphs (first, to get one stock portfolio; afterward to get a 50-stock portfolio) this reveal:

It is logical the more you trade, the greater volatility you will encounter. And ’s everything you see at those graphs. For the busy trader, time your transaction in order to prevent portfolio-sapping volatility is critical, and not very simple to pull away.

The study also demonstrated another lively. The {} risks missing out about volatility, and these obligations accumulate through recent years. Since Klement notes, “the volatility experienced from the investor was substantially greater compared to the volatility characterized by means of a buy and hold investor that reinvests all losses. ”

Patience, everybody. Patience.

***

Have a great day, everybody. I’ll visit you tomorrow.

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.