Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Fantastic morning. International stocks and U.S. stocks are beginning the week on solid footing, attempting to increase last week’therefore profits. More on this below.

Allow ’s view where investors are placing their own money.

Market upgrade

Asia

- The most Significant Asia indicators are largely higher in day trading using Hong Kong’therefore Hang Seng a whopping 2.3percent .

- Google intends to pull on the plug in on its newest News Showcase stage at Australia. The technology giant along with the Australian authorities are sparring within a brand new media bill that will require the stage to compensate publishers to displaying their own work.

- By Nepal to New York, coronavirus instances have been increasing at the fastest speed however with over 1 million brand new illnesses recorded over a span. What’s worrying is that this information stage: hospitalizations and fatalities are rising also.

Europe

- The European bourses are blended using London from the reddish along with Frankfurt a quarter-of-a-percent in the start. This ’s as federal governments mull further constraints as coronavirus instances rise.

- Boris Johnson has threatened to walk away from post-Brexit commerce discussions this Thursday when a deal seems unlikely. Meanwhile, he struck on the phones that weekend to attempt and draw concessions from Germany along with France on a significant sticking point, fisheries.

- Europe is seeking to escalate its own turf warfare from Big Tech. Based on this Financial Times, EU authorities are drawing a”hit list” which would contain companies considered to be abusing their market dominance.

U.S.

- U.S. stocks are from the green that afternoon, and also ticking higher. This ’s following the significant exchanges introduced that their very best week a week because the summertime. This ’s zero advancement on stimulation talks.

- JPMorgan, Citigroup, BlackRock and Johnson & Johnson are one of the big names to record earnings tomorrow since the Q3 earnings year starts.

- Together with three months prior to Election Day, the dollar exchange has become clearer. Fortune‘s Shawn Tully really does a deep dip around the planet ’s reserve money, detailing why a feeble dollar might be a massive issue for whomever presides within the White House next year.

- The buck is up marginally, also.

***

Twist a corner

Earnings season will get underway this past week, also now there ’s a little confidence in the atmosphere. No, profits continue to be anticipated to be quite bad, however there’s {} for an upside surprise since the market continues its long rally in the March-April lows.

We now have a whiff of investor excitement a week because the S&P 500 and Nasdaq both reverted for their highest yearly earnings in 3 months. 1 business that’s outperforming of overdue is that the banks. The KBW Bank Index is up 8.5percent since Oct. 1. On sign, Big Finance will probably likely be significantly represented within this week’s results. The atmosphere is that there ’s just 1 way for those banks to go.

Many Wall Street analysts agree that Corporate America will probably start to demonstrate expansion –strong expansion, even–starting next year. “awaiting, we work out a solid 30% earnings rally to our evaluation 2021 EPS forecast of $170, followed by 11% increase to $188 at 2022,” Goldman Sachs wrote in a recent investor note.

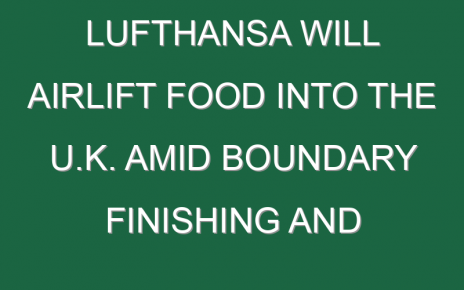

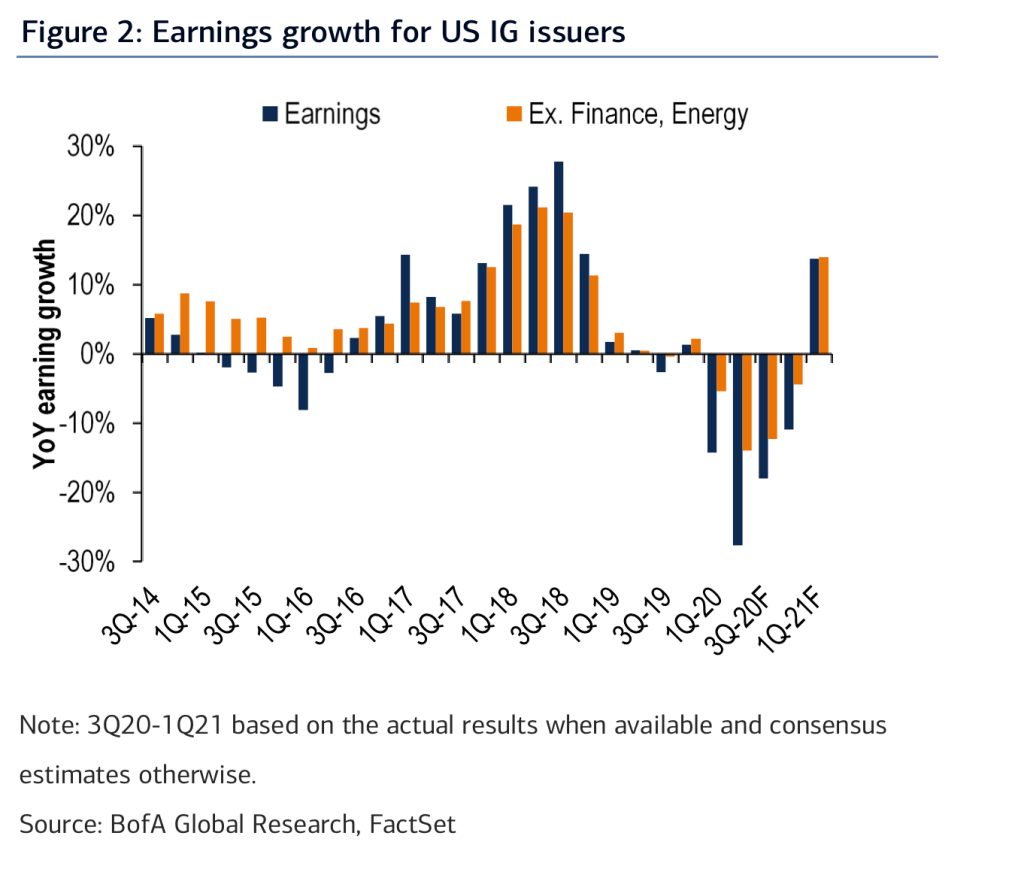

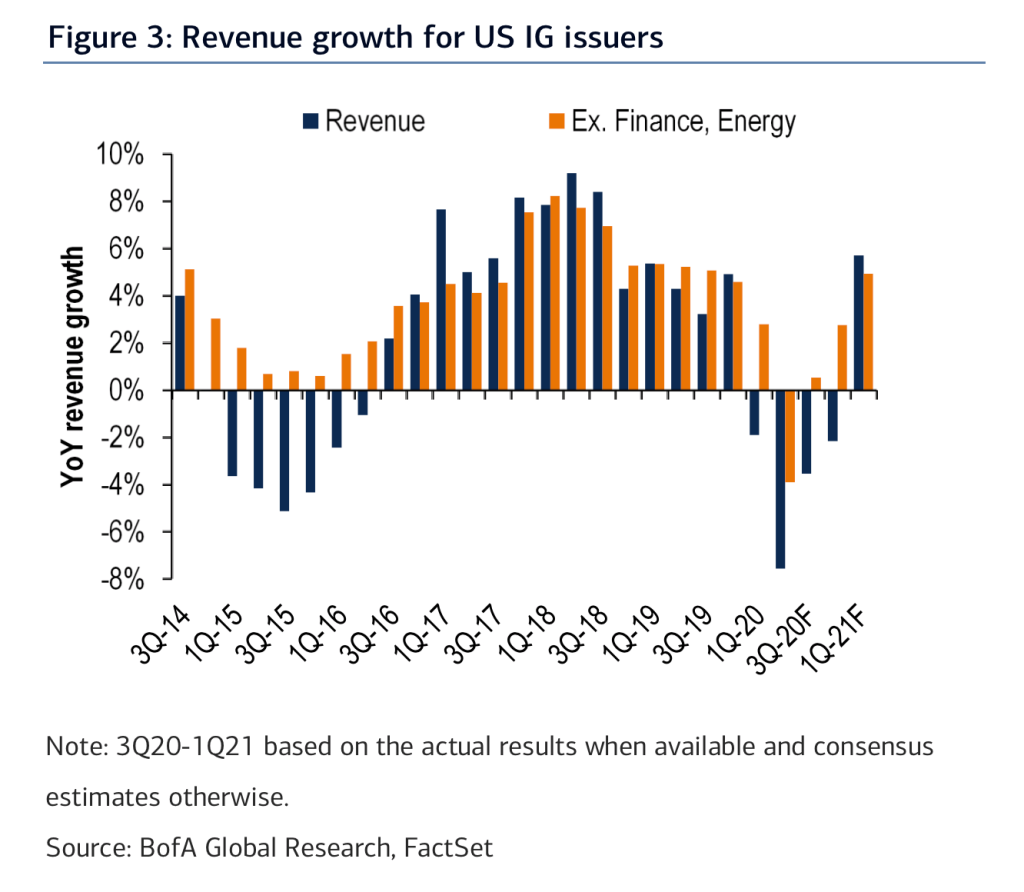

BofA, meanwhile, sees a strong possibility of a parade of earnings beats the moment this quarter. “Actual outcomes have a tendency to jolt to the upside on average +3.8percent for earnings increase and +0.6percent for earnings expansion versus expectations at the onset of the year, however we anticipate the significant defeats in 2Q to last for {} in 3Q,” BofA composed weekly.

This ’s BofA graphs out the upcoming few quarters. Watch for powerful butt performances at Q1 of next year. And, yes, actually fund and energy must demonstrate a rally by then (that can be no doubt why investors have been turning in to battered bank stocks today.)

However, the principles still look fairly forgettable.

Don’t charge on a lot of top-line surprises before next calendar year.

***

Postscript

This weekend my neighbor informed me he is a proud negazionista.

It is a tag with awful origins. Ahead of the COVID pandemic, the word was employed to Holocaust deniers. The Italian press –both right- and – left-leaning–currently employs the tag to describe people who don’t feel the COVID-19 epidemic is something.

My neighbor boast completely took me off guard, not because he had been masked up if he chased his denialist position to me and the other neighbor.

Even the negazionisti are displeased with the Italian authorities. They are displeased with the scientists. They’re miserable by public health officials. They are not satisfied with the networking. Also, for some reason that is beyond me, they’re miserable with 5G cell towers.

This weekend that the negazionisti coordinated a protest from Rome to call the coronavirus as an imitation, and also to carp about exorbitant new penalties for anyone caught in people with no mask. The turnout was meager the Italian paper, La Repubblica, called it”un flop.” The bad presence may have something related to the escalating COVID instances. Or, we are viewing with the negazionista motion for what it really truly is –an oddball fascination that is relegated to the fringes of Italian culture.

In terms of my neighbor, he did not bother going into the Saturday protest whatsoever. He can not manage to go broken for not even wearing a maskhe grumbled.

Why was he wearing a mask today? , he asked him. Certainly, there is minimal risk of being broken on our side road on a Sunday {} lunch.

Becausehe explained, he does not need to be regarded as a problem burglar. He has chose to waive his beliefs in order to not make waves with anyone in the condo he said, adjusting his hide to cover his nose and mouth.

I guess you can call him a denier wracked with self-denial.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

As always, you could write into [email protected] or response to the email with hints and opinions.