That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

The worldwide economies continue to rally because U.S. stocks have but recovered in the September swoon. The S&P 500 completed higher at 3446.83 on Thursday, in accord with its own Sept. 3 near. This ’s as stimulation hopes and large M&A news consider investors’ heads off rising coronavirus cases along with the continuous drip-drip-drip of Advances.

Allow ’s check out on the activity.

Trade upgrade

Asia

- The most significant Asia indicators were mainly higher in early afternoon trading together using all the Shanghai Composite upward 1.7percent since the indicator after the holiday season.

- The China new is very much a brand new one since a new Pew Research Center survey showed that respondents in 14 nations today hold a negative opinion of the nation.

- Sorry, petroleum bulls. Peak oil has arrived for a lot of the planet ’s wealthiest markets. The origin? Nope.

- Since coronavirus instances spike, and ICU beds meet up, France intends to place more towns on high-alert. This ’s {} the figures rise in Good Britain, Spain, Germany along with Italy.

- EasyJet stocks were up 1 percent in the start after the discount airline Thursday comprehensive its 2.3 billion lbs ($3 billion) money position was sufficient to weather a demanding winter, but not far beyond that.

U.S.

- U.S. stocks are upward marginally because the on-again-off-again stimulation talks simply won’t expire. This ’s {} to keep investors happy in spite of the fact both sides look very far apart within a pleasant number.

- Meanwhile, the U.S. labour market appears wobbly. The jobless claims quantity arrived in in a worse-than-expected 840,000. Prior to any reader mails me to mention I’m becoming a true downer, think about this: This figure was over 800,000 each Thursday for 2 consecutive months. A great deal of Americans are actually suffering.

- Shares in Morgan Stanley are up almost 1 percent from pre-market trading following the company declared its purchase of mutual fund Eaton Vance to get $7 billion. Even the Wall Street giant is seeking to push in the less insecure wealth management firm . This ’therefore a reminder for why riches management is now this kind of strategic critical for banks at an era of reduced rates of interest and at a shaky, pandemic-stricken market.

- The buck will be down.

- Crude is level, using Brent trading over $43/barrel.

***

From the amounts

608.61

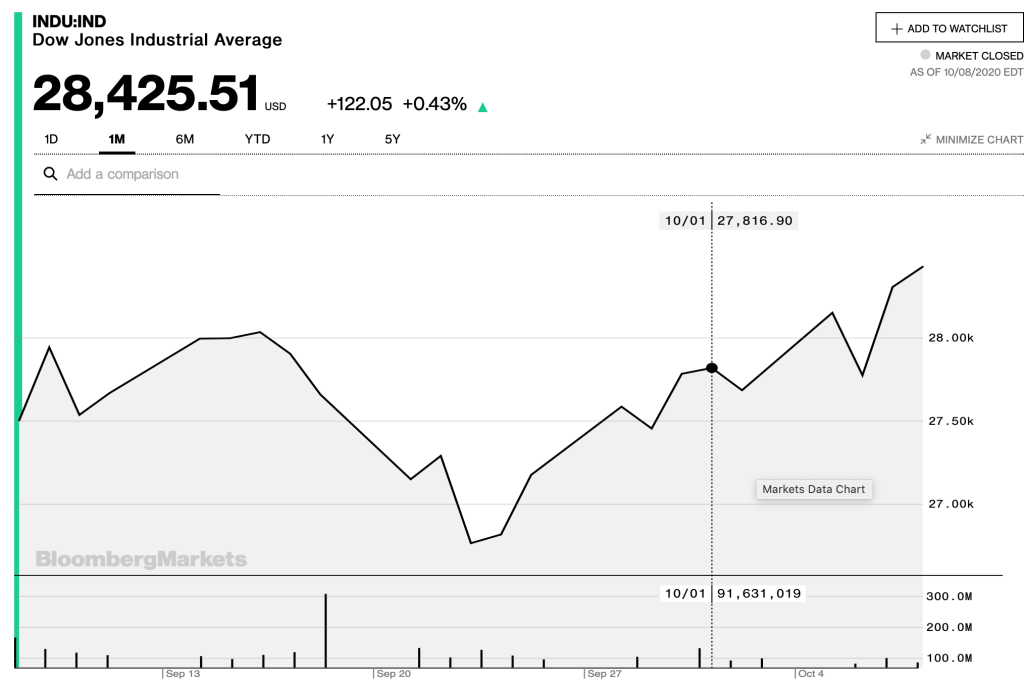

Last week at the moment, the U.S. stocks have been at freefall as news broke that President Trump had tested positive for COVID. But that was shown to be quite a mere dip in an otherwise remarkable rally. The Dow Jones Industrial Average consists of 608.61 factors (+2.2percent ) within the previous five trading days. Along with also the blue chip indicator has closed higher in eight out of the previous 11 trading sessions. Inspired by this morning’s futuresit seems set to expand these profits farther. So much for its research which investors would be a good idea to pull from the sector and wait till after Election Day.

33.7percent

Allow ’s visit commodities today. Nonot to gold. Not aluminium. Not primitive. Silver. The metal is upwards 33.7percent YTD, the top acting product of 2020–easier than gold, actually. The silver exchange is a lot more indicative of the way the international economy is performing as over fifty percent of that which ’s mined can be employed in industrial processes. As demand for silver goes it up ’s a indication that crucial production industries are invisibly into top gear. It ’so important to notice that the silver exchange is more prone to nasty lumps. It plummeted in September, however it’s outpacing the area this season, because this Wonderful Wall Street Journal asset-tracker reveals :

This item comes directly from Federal Reserve Bank information . {The central bank computes which America’s {} —the best 1 percent –have a combined wealth of $34.2 trillion. |} The weakest 50 percent of all wage-earners, meanwhile, leading out in a joint $2.08 trillion. Trillions seems like a good deal, before you place it in this perspective. Bloomberg took this information, then calculated out of the Billionaires Index the 50 wealthiest Americans possess a combined wealth that’s almost equivalent to the lowest 50 percent. It’s reminder that the pandemic has surpassed riches inequality in a lot of the developed world, which the harm will survive long following information shows the market goes back to pre-pandemic amounts.

***

Have a great weekend, everybody. I’ll visit you on Monday.

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.