That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Superior morning, Bull Sheeters. {Investor exuberance over President Trump’s truncated COVID convalescence is currently {} to evaporate –investors are a tough audience –since U.S. futures fight to cling to yesterday’therefore profits. |}

In a video address from the White House,” Trump informed America, “escape there, be more cautious. ” Judging from the markets now, they’re accepting the “be cautious ” message to center.

Allow ’s view exactly what ’s driving niches.

Trade upgrade

Asia

- The most Significant Asia indicators are combined in day trading, together with Hong Kong’therefore Hang Seng the top of this Group up 0.8percent .

- In accordance with the World Health Organization, almost one in ten individuals on Earth have been infected from the coronavirus. If appropriate, that could be 20 occasions the amount of recognized confirmed instances.

- Alibaba will get up into some 10% bet in Dufry which will enlarge the Swiss responsibility free class ’s footprint in Asia.

- Including a no-deal result to Brexit commerce discussions in addition to a pandemic could be nothing short of “reckless ,” cautions Germany’s Foreign Minister. Meanwhile, the discussions end up with minimal improvement.

- The Russian ruble was among those casualties of all Trump’therefore {} at the surveys in recent days. After decreasing a shocking 9 percent in the previous few weeks, the Russian central bank has been made to suspend interest charges .

U.S.

- U.S. futures stage to some negative start. Instead, they ’ve been losing ground throughout the day. This ’s following a remarkable tech-led rally Monday raised the 3 main exchanges.

- A amount of surveys revealing Democrat Joe Biden using a widening guide –reminder: all These are surveys; include salt{} lower market volatility,” Wall Street will be saying. Anything but a protracted, contested election could be good for shares, CitiGroup and JPMorgan Chase state .

- Shares in biotech company MyoKardia jumped 58 percent on Monday following Bristol Myers Squibb consented to Purchase that the heart-care professional for $13.1 billion.

Elsewhere

- Gold is downward, trading about $1,915/oz .

- The buck is upward marginally.

- Crude is a sign up, together with Brent trading about $41.50/barrel.

***

Time to ditch the 60/40 rule?

There aren’t a lot of investment experts advocating the older 60/40 stocks/bonds allocation plan nowadays.

This ’s too awful. The plan made sense for several decades. The concept of investing approximately 40 percent of the money in bonds and the remaining stocks gave you the upside down of a slumping stock markets when they were great and the security net of bonds once the rally disappeared.

Such logic would imply that at times of downturn or political doubt, stocks ought to diminish and bond values need to grow. To put it differently, sometimes like today bonds are a wonderful security pillow –a strategy B to the portfolio.

But that’s barely been the situation in 2020.

Economy observers figured each month that we ’d eventually see bonds rally as inventories faltered. What occurred rather from the bond market?

Crickets.

“Yields finished the month basically unchanged since the MOVE Index, a measure of bond market volatility, also dropped to a all-time reduced. Even though the Federal Reserve’s remarkable policies retained short-term prices immobilized, the behaviour of long-term prices has been vexing, revealing no sensitivity to changes in economic information, vaccine-related headlines along with even the shifting narrative on additional fiscal stimulus. ”

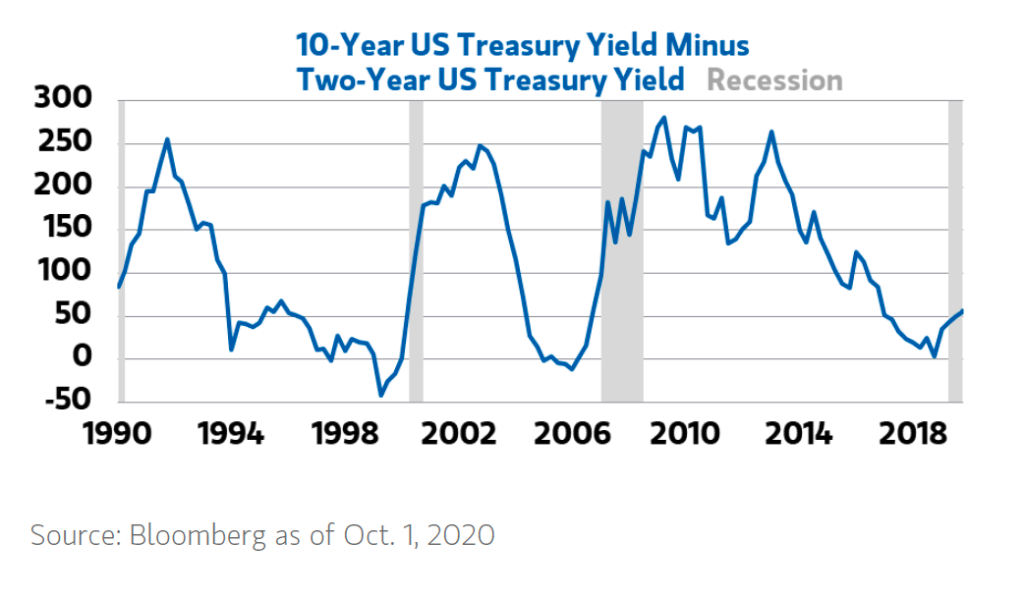

Even the 10-year/two-year Treasury yield curve would be your large indicator to see. It usually increases in {} of Wonderful volatility, so as the following Goldman chart reveals:

The grey-shaded bars signify instances of downturn. During those decades, the 10-year-two-year return curve generally climbs to 150 basis points. However, it’s {} in the present time down in a level of approximately 50 bp, that informs Goldman that, among other matters, bonds earned ’t even come to the rescue of investors in the long term if America input a double downturn or a constitutional catastrophe.

It’s among these recession playbook indicators which have broken down throughout the pandemic.

It’s not only the sole one.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.