Investors are throwing cash at the possibilities of a virtual world—but we also need to think about what can go wrong. Read More

Tag: fintech regulation

Amid SEC battle, crypto company Ripple Labs buys back its Series C investment

In an unusual move for a startup, the cross-border payments company has taken its governance and dividends rights back—for a premium. Read More

The 10 IPOs you need to watch in 2022

Last year was a record one for public offerings. This year might look different. Read More

Klarna has big plans for the U. S. Will the CFPB probe get in the way?

The BNPL company valued at nearly $46 billion is planning further expansion in the U. S. Read More

Klarna has big plans for the U. S. Will the CFPB’s buy now, pay later probe get in the way?

The BNPL company valued at nearly $46 billion is planning further expansion in the U. S. Read More

Blockchain, Chief Data Officers, and fraud: Here’s what the Crystal Ball predicts for 2022

We asked our readers to tell us what comes next. Here’s what they told us. Read More

All eyes on buy now, pay later with latest CFPB probe

The regulator is eyeballing some of the highest-valued fintech startups. Read More

‘Crypto kryptonite’: A digital euro would be dual threat to banks and fintechs, a critical new report warns

The European Central Bank could decide as early as April whether to push ahead with its planning for a digital euro, a move closely watched by the banking and tech sectors. Read More

The cashless economy: How fintech is approaching the future of finance

Subscribe to The Ledger for expert weekly analysis on fintech’s big stories, delivered free to your inbox. Cashless payments were on the rise before the pandemic hit, and now, eight months into its grip on the U.S., their use is accelerating even faster. This was the topic of conversation at Fortune’s latest Brainstorm Finance panel […]

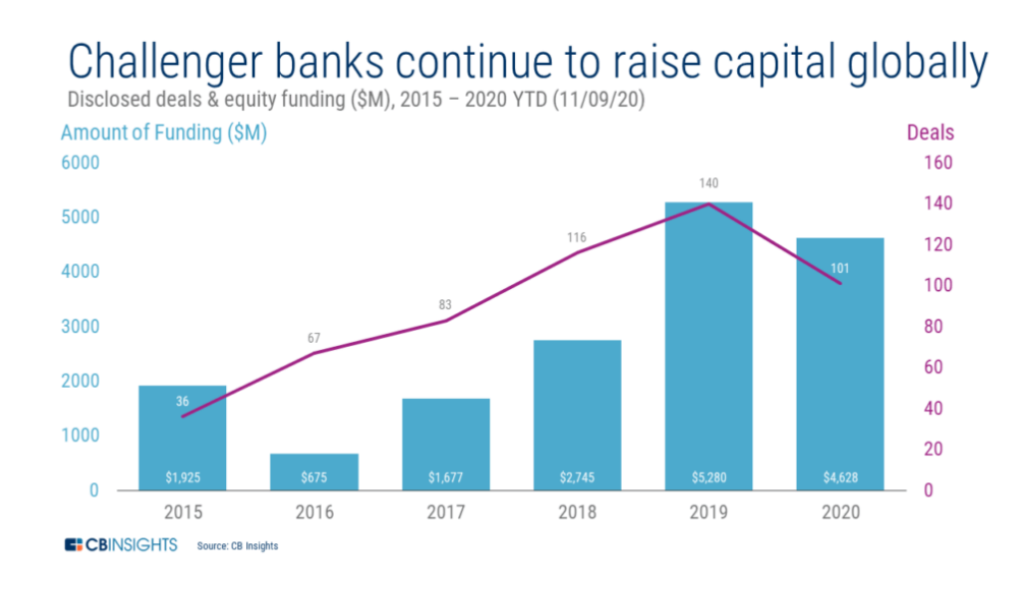

‘Challenger’ banks Have Been Available to Get a record year as Company model remains Unclear

Big investors are financing online banks greater than {} , betting these upstarts’ low overhead and nimble technologies piles will allow them keep catching clients from conventional financial institutions. {This season, all these so-called “challenger banks” have {} a total of $4.6 billion over 101 prices –and are on pace to break up the record […]