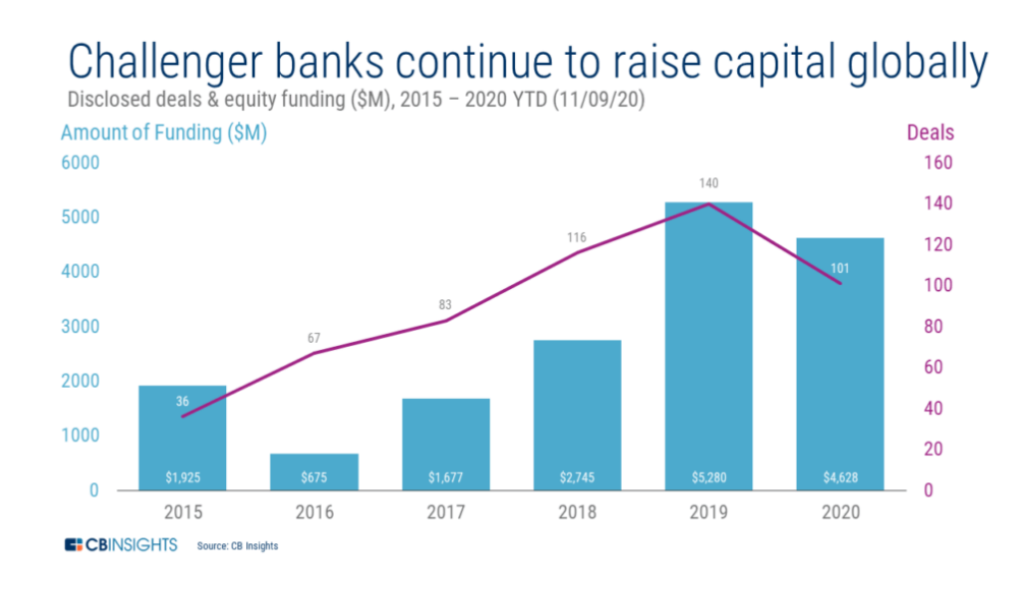

Big investors are financing online banks greater than {} , betting these upstarts’ low overhead and nimble technologies piles will allow them keep catching clients from conventional financial institutions. {This season, all these so-called “challenger banks” have {} a total of $4.6 billion over 101 prices –and are on pace to break up the record $5.3 billion that they pulled in throughout 2019.|}

These characters, set out from fresh report from CB Insights, represent part a string of massive stakes on the likes of Chime, that lately increased a 485 million Series F around that appreciated the online lender at $14.5 billion. The Prevalence of challenger banks among enterprise and private equity companies is represented in this graph:

CB Insights notes {} challenger banks are in a position to flourish thanks to a 2011 law, referred to as the Durbin Amendment, which allows banks with over $10 billion in funds bill retailers around 1.5percent on debit card defaults –that will be more than seven days what giants such as Bank of America will bill.

However, while earnings from card defaults has aided challenger banks develop a foothold in the bigger banking marketplace, the banks {} face challenges in the upcoming year. When these banks have included tens of thousands of clients –Chime’d 10 million and also bigger rival Current had just 1 million of September based on CB Insights–that they also confront a tide of contest.

At the U.S.the industry is already crowded as Chime counts competitions such as Varo, MoneyLion, Dave, HMBradley and many others, such as just-launched Jiko, that places consumer deposits into U.S. Treasury bills. The U.S. challenger banks face new strain from cross-Atlantic competitions such as Revolut and Monzo, in addition to competition from giants such as Venmo and Square, that are expanding their own financial offerings.

Even though CB Insights notes the internet banks are profiting from tailwinds from the kind of greater online trade and a dip back into debit card it’s {} open question when you can find sufficient debit slips to move around. A few of the upstarts are looking for a subscription version –requesting users to pay a small charge for overdraft or investment providers –even though it’s uncertain how users will adopt this.

Meanwhile, conventional banks have been fighting back with jazzing up their programs and internet offerings as they like record amounts of consumer deposits from the COVID age. Based on Federal Reserve statistics, | the total quantity of deposits in U.S. consumer banks increased to $15.9 trillion in $13.2 trillion in the beginning of the season –much as the banks were doubling savings prices. These large scale money reserves are a blessing for the huge banks’ core financing industry, which will be something that the challenger banks mostly don’t possess.

Mark Goldberg, a partner at Index Ventures who specializes in fintech, states that the present surroundings signifies some challenger banks may fight or view themselves becoming obtained. He included achievement will be particularly demanding for the more recent entrants and for the ones that are relying upon social networking advertisements to sign new clients –a favorite strategy for several challenger banks.

Goldberg also forecasts that the future will appeal to ancient leaders such as Chime and Robinhood, which can be winning the race to get new clients have a powerful position to cross-sell brand new goods. He adds that upstart banks at the most powerful position also contains those who have targeted a market, mentioning such as Greenlight, which lately increased $215 million because of the “debit card to get youngsters ” offering.

In the long run, the achievement of banks–old and new –will likely depend on their capacity to keep customers and extract greater value from them within the span of a life states CB Insights.

Much more must-read fund coverage out of Fortune:

- Exactly why the counties Joe Biden won signify 70 percent of U.S. GDP

- Can an additional $1,200 stimulation check come? Here is what we understand

- DoorDash IPO submitting reveals that it may turn a profit just at elevation of lockdowns

- The pandemic might be the best environment for company fraud in years

- A journalist-turned-detective on the way corporate America is determined by personal sleuths