Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Great morning. It’s Monday, so a brand new batch of COVID vaccine information jolting the niches. Their hottest trials show remarkable results, {} the markets think. Stocks in Asia and Europe are upward, and U.S. stocks are at green.

The vaccine may ’t come soon enough. The U.S. COVID amounts are terrifying (however ’s barely stopping travelers away from getting on airplanes to watch grandmother ).

Allow ’s check on the activity.

Trader upgrade

Asia

- The most Significant Asia indicators are combined in day trading with Japan’therefore Nikkei down 0.4percent along with the Shanghai Composite upward 1.1percent .

- The Trump Administration has drawn up an inventory of 89 firms , largely in aerospace, which will be prohibited from performing many forms of company with U.S. businesses, Reuters reports.

- An aviation “bubble” linking Hong Kong along with Singapore surfaced this weekend since COVID instances rose in Hong Kong, placing on hold that this exceptional travel version which was being watched all over the world.

- Exemptions in AstraZeneca were 1.7percent in early trade following the drug manufacturer reported–combined with its associate, Oxford University–its COVID vaccine trials as successful as far as 90 percent of their time. Those are remarkable effects, even should they drop a bit short of past week’s Pfizer-BioNTech benefits. However you will find large benefits on storage and storage also cost.

- The pronouncement is raising beaten-down traveling, energy along with bank stocks using all the Euro Stoxx Banks indicator up two% along with Stoxx Europe 600 Travel & Leisure upward 1 percent . Food delivery shares, however, spilled about the information. This ’s following the Dow (-0.7percent ) and S&P 500 (-0.8percent ) posted each week declines a week.

- November is the cruelest month: using over 3 million instances because Nov. 1, the amount of fresh COVID diseases reported America this season will be well on its way to greater than doubling the October event load, the former document.

- As we all venture to Thanksgiving week, using all the markets hovering near all time highs, and there’so lots to be grateful for. But please give an idea to the millions that are fighting as America’s K-shaped retrieval trudges on. What’s a K-shaped retrieval?

Elsewhere

- Gold comes downward, trading under $1,870/oz .

- The buck will be down. {

- Crude is upward, with all Brent futures {} $46/barrel. |}

***

Year-end, also outside

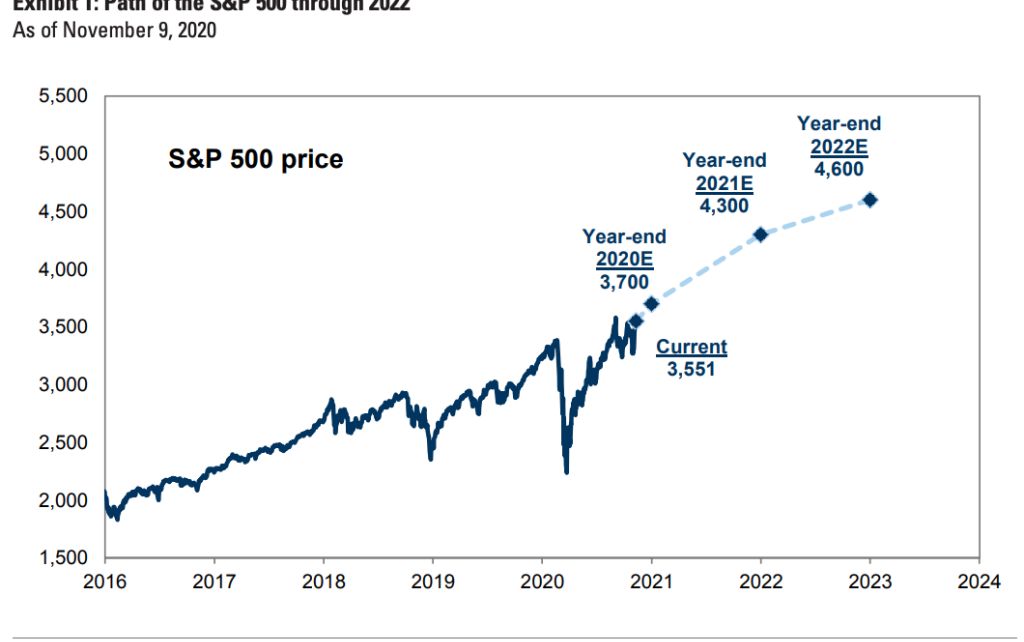

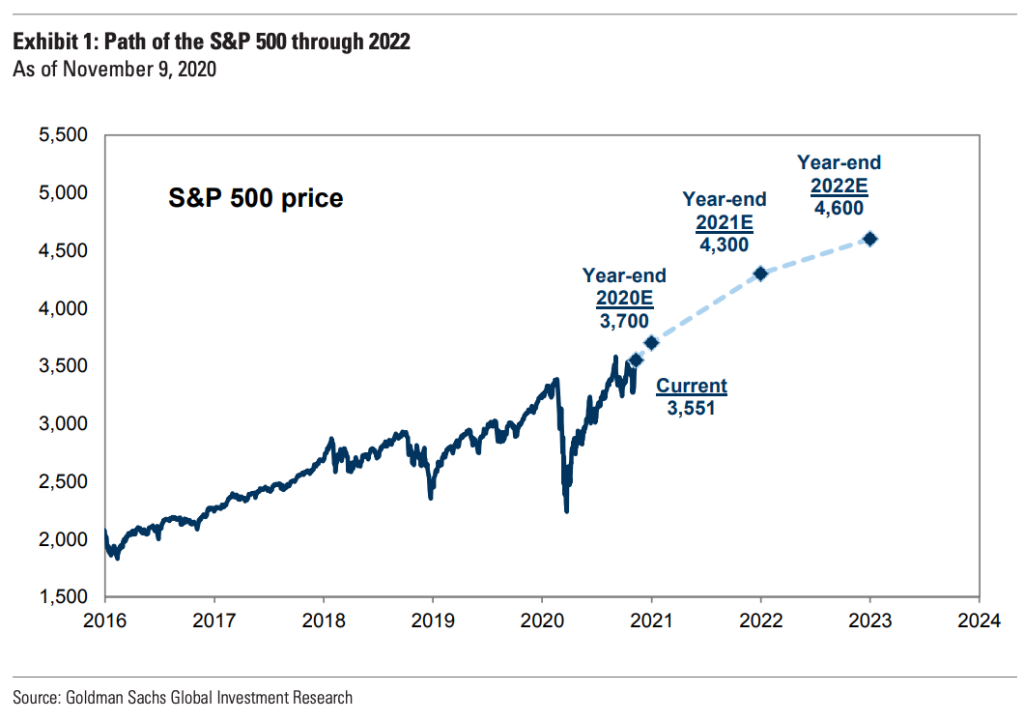

Goldman Sachs earlier this month presented a collection of outlooks for shares, for example its year-end telephone and its 2021 yearlong price.

And, according to Goldman, a reasonable number of Americans had been unimpressed with those predictions. Meanwhile, another team believed they were far too preoccupied.

Recap: Goldman computes that the S&P 500 will shut this year in 3,700up approximately 4 percent in the Friday close. As for 2021, it is going to rise a {} 16 percent to high 4,300.

A 4,300 year old 2021 close presumes a 21% profit in the Friday close. This ’s not helpless.

And there’so lots of debate.

“people who think we’re overly bullish normally point to the possibility of increasing inflation and rates of interest,” David J. Kostin’s group in Goldman writes. “But we find little reason to anticipate {} inflation within the upcoming few decades, and also our economists think the Fed will stay on hold till 2025. ”

“Investors who believe we’re overly careful point to the continuing strong development of this mega-cap FAAMG stocks together with a probably ‘catch-up’ of their additional 495 S&P 500 components,” Goldman writes. “Investors also have concentrated on TSLA, which can be set to combine with the S&P 500 next month and might behave as the 8th biggest indicator component. ”

Last week was a very interesting test for the Goldman telephone on shares. We began the week with blockbuster Pfizer disease information, which forced the Dow and S&P to all time highs. Grim COVID data then pushed down stocks, and we ended the week at the red.

We begin the week with all the promising AstraZeneca vaccine trial information, raising the markets. However, it’s no broad-based rally. There are losers and winners as traders rotate from expansion and to stocks.

Whether this turning trade will probably be sufficient to push up stocks a {} 20-plus-percent during the next 14 weeks is the huge question.

***

Postscript

A programming note: because of the Thanksgiving holiday after this week,” Bull Sheet will print Monday, Tuesday and Wednesday, but will probably be off Thursday and Friday.

***

Have a great day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]