That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Fantastic morning, Bull Sheeters. It seems investors do a little bit of profit-taking as international stocks and U.S. stocks dip in early Tuesday trading.

{

This ’s following Monday’s Moderna rally pushed the Dow Jones Industrial Average and S&P 500 into record territory with investors {} carves in to value stocks (more about this below). |}

Permit ’s check out on the activity.

Trader upgrade

Asia

- The most Significant Asia indicators are largely higher in day trading with Japan’therefore Nikkei upward 0.4percent .

- To protect its own company from additional U.S. sanctions,” Huawei Technologies is currently now promoting its funding telecoms provider Honor. There’so no cost on the price, but preceding speculation has been Honor would bring roughly $15.2 billion at a purchase.

- Stocks for commodity-dependent markets –believe the Aussie dollar along with Norwegian kroner—are pegged because the huge currency winners to get 2021. This ’s {} the buck is called to grow by up to 20 percent in the season ahead,” Citigroup states.

Europe

- The European bourses were apartment in the start using all the Europe Stoxx 600 downward 0.1percent Half an Hour to the trading session. Hungary and Poland are more threatening to veto the help package on premise that the proposition makes it much easier to allow Brussels to slap sanctions on states that flout the rule-of-law.

- The meltdown of Wirecard is currently almost full following the scandal-rocked German fintech consented to market core technologies into Spain’s Banco Santander. The financial terms weren’t disclosed. This ’s following all 3 indicators rallied about the Moderna news, compelling the Dow along with S&P 500 to brand new all-time highs.

- Moderna closed up almost 10 percent yesterday after its blockbuster vaccine trial information . It’s {} 400 percent this season. It’s with an excellent pandemic.

- Shares in Tesla are upwards 13 percent at pre-market trading following gatekeepers in the S&P 500 declared the high-flying EV manufacturer on the indicator, ending weeks of speculation. (I admit this, I didn’t believe it could happen this fast believing Tesla’s gains come in the fast disappearing company of selling carbon licenses ; it loses money earning automobiles .)

- U.S. retail revenue is going to be published ahead of the bell.

Elsewhere

- Gold is level, trading about $1,885/oz .

- The buck will be down.

- Bitcoin is upwards 3 percent from the previous 24 hours, exchanging over $16,750.

***

The worth trade

Is the worth muster for real?

After yesterday’s Moderna vaccine information, that the Dow and S&P rocketed to new all-time highs with all an unloved misfits of this marketplace –electricity, financials and industrials–resulting in the way bigger.

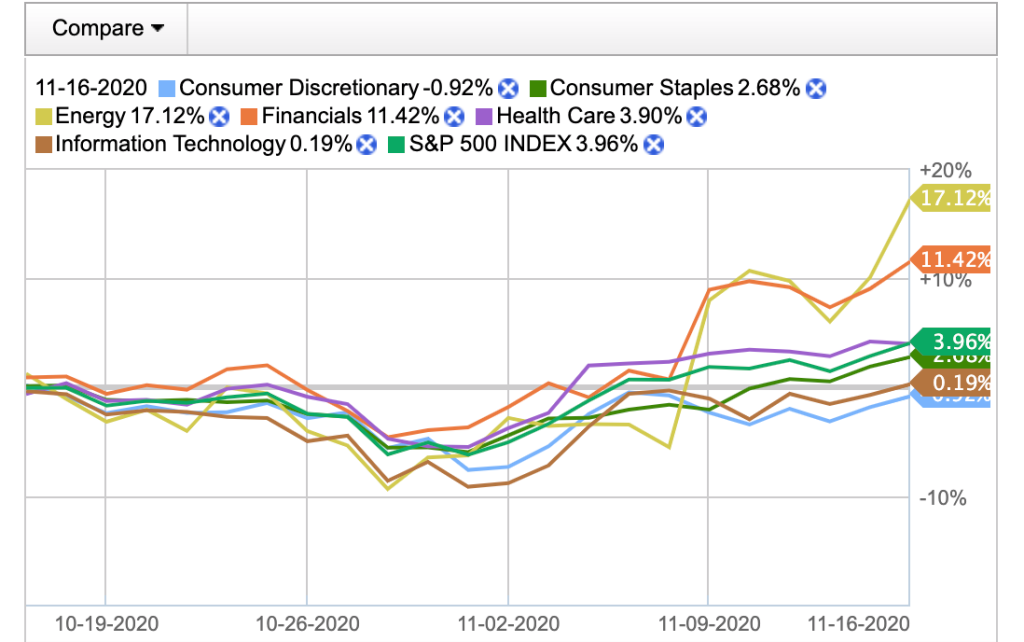

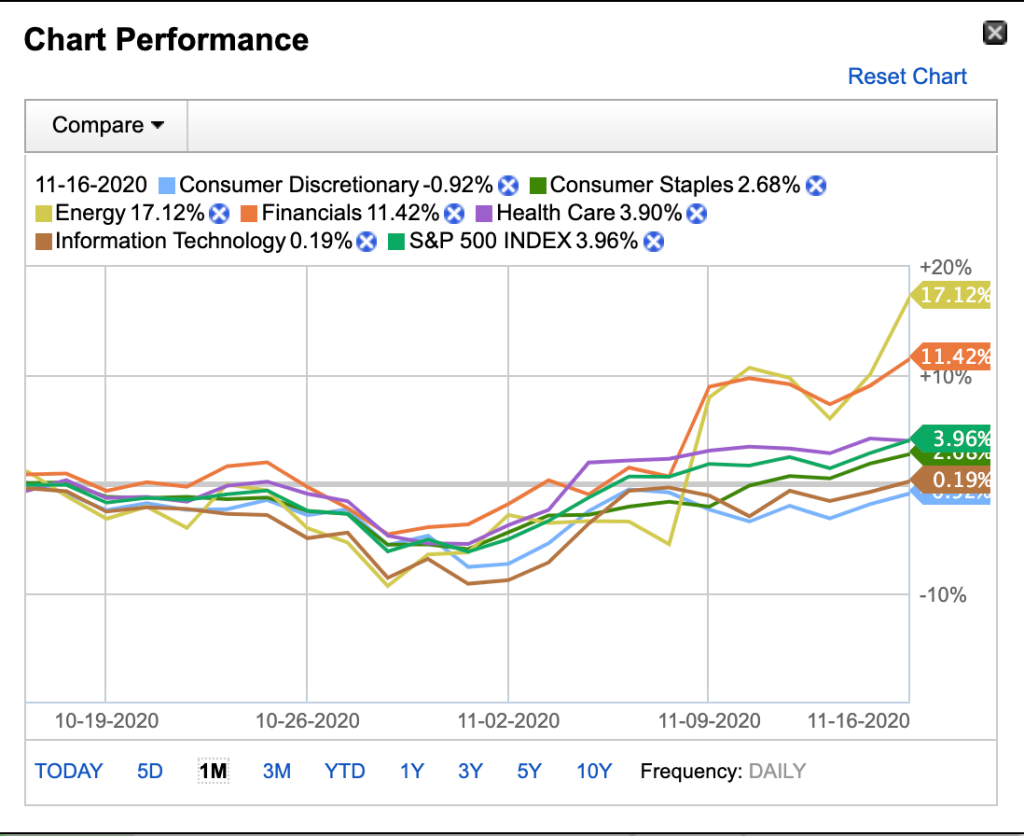

It has been the situation for much of this last weeksince the Pfizer,” the earliest of the group, declared on Nov. 9 its promising COVID trial advancement. The assurance of a vaccine is currently developing a large rotational change from stocks and to beaten-down stocks. It’s possible to observe that this play from the likes of electricity and financials stocks, so the two ratcheting up remarkable gains lately, as the graph shows.

Energy is currently up 17 percent in the last month, outperforming the wider S&P 500 with a multiple of 4X. Financials are around 3X around the S&P within the Exact Same period.

J.P. Morgan mind of European and global equity plan Mislav Matejka reckons the worthiness commerce has thighs . “Our base case is we can have 3-4 quarters values of spinning, like the amount of this’16-’17 commerce,” he wrote in an investor note.

“It is reassuring that we are seeing a turning from expansion and momentum-oriented stocks to both appreciate and searchable titles,” he {} the markets have been booming. “The further debate about local markets reopening and also a diminished chance of important lockdowns ought to continue to encourage this transaction for now. We have seen similar price, cyclical rallies before but these phases are short-lived since expansion, momentum businesses eventually reasserted their direction. Any continuing movement towards fewer lockdowns ought to continue to encourage value-oriented businesses of this marketplace for the near future. ”

These developments bode well for many of you {} Dow stocks. The blue chip index is a whisker away from 30,000. The value shares Will Probably push it over that milestone.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

Bernhard Warner

@BernhardWarner

[email protected]