There’s no improvement on a stimulation deal, however there’s lots of financial data, political and corporate news to concentrate on.

On this note, we now ’re a mere twenty four days into the presidential elections. Over 47 million Americans have worked. This ’s a list .

Meanwhile, the U.S. stocks have been trading all morning. Stock profits are muted although for a lot of the last two months as investors brace to its likeliness there won’t be a stimulation deal before Election Day.

Allow ’s check on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators were largely higher in day trading using Japan’therefore Nikkei upward 0.2percent .

- Not long past Chinese startup Renrenche has been a darling, bringing unicorn evaluation status along with also a roster of bluechip shareholders, such as Goldman Sachs. Now it could have to market its core advantage for {} 1,200 dollars .

- Goldman Sachs is expecting to eventually set the 1MDB bribery scandal supporting it later agreeing to pay almost $3 billion in penalties to settle on the event that began a decade back from Malaysia. The payoff “has the maximum penalty {} the Foreign Corrupt Practices Act,” Bloomberg accounts . And Germany reported greater than expected production data, raising the euro and shares. The Europe Stoxx 600 was upward about 0.5percent 2 hours to the trading session.

- Economists currently forecast that the ECB will increase financial stimulation by a {} $500 billion–bringing the total $1.85 trillion ($2.18 trillion)–when a month to maintain the COVID-stricken market from falling into a heavy downturn .

- Daimler stocks were up 1.7percent in foreign commerce following the carmaker revised up its own full-year prediction as a result of strong expansion in China.

U.S.

- U.S. stocks have been at the red. This ’s following the three significant indicators eked out gains yesterday in exceptionally explosive trade.

- In premarket trading, Gilead Sciences stocks are up a whopping 7 percent following its remdesivir obtained FDA approval to deal with COVID-19. Since Fortune‘s Sy Mukherjee notes, remdesivir is “not a save-all” remedy, but also the regulatory acceptance is important.

- Stocks in Tesla are level in pre-market trading following a tiny bulge yesterday. Investors cheered the newest profit conquer , but doubts linger over if that would be sufficient to vault the EV manufacturer to the S&P 500.

- Looking forward: we receive the most recent batch of fabricating data prior to the bell. Allow ’s see whether it may match now ’s rosy Italian amounts.

Elsewhere

- Gold is level, trading only over $1,900/oz .

- The buck is upward.

- Crude is now down. Brent proceeds to trade only above $42/barrel.

***

From the figures

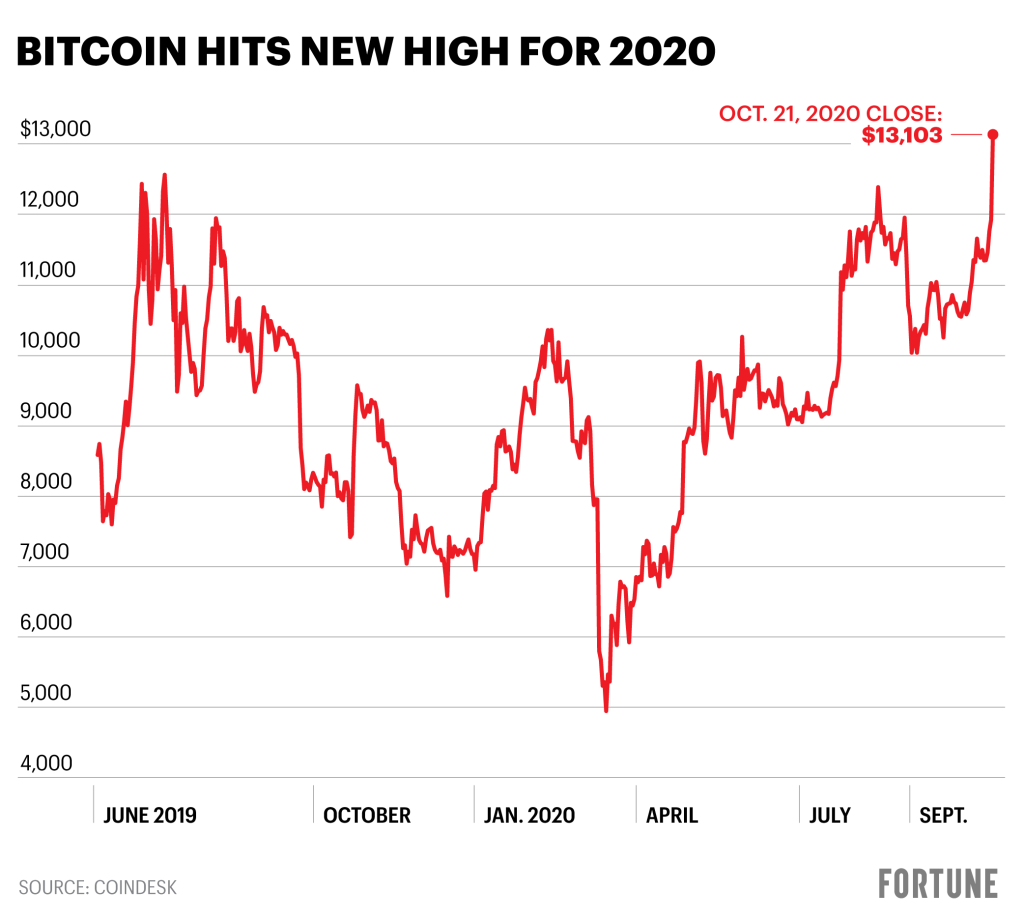

13K

We neglect ’t speak frequently about Bitcoin and its ilk on Bull Sheet, though simply because there’so far to say regarding stocks and other asset classes. However, cryptocurrencies are still on a rip in the present time, and worth discussing now. Yesterday, Bitcoin struck a 16-month large, topping $13,100, following PayPal declared it’d let users purchase a couple of cryptocurrencies, such as Ethereum along with Bitcoin. Since Fortune‘s Bitcoin professional Jeff John Roberts notes, “Bitcoin is famously volatile (though less than through its first days), and it’s frequently tough to determine single things that describe price swings. Although this week’s {} was nearly definitely surpassed in large part from the PayPal news, there can be other tailwinds forcing the cost up. ” One concept is that traders are souring on the golden trade, and leaping about the crypto bull conduct.

-130.54

Even the Dow Jones Industrial Average closed yesterday in 28363.66–which ’s a reduction of 130.54 factors (-0.4percent ) within the previous five trading days. The stimulation rally proceeds to show signs of running out of gasoline. The 3 key exchanges are investing in a tight range for a lot of the last two months.

5 495

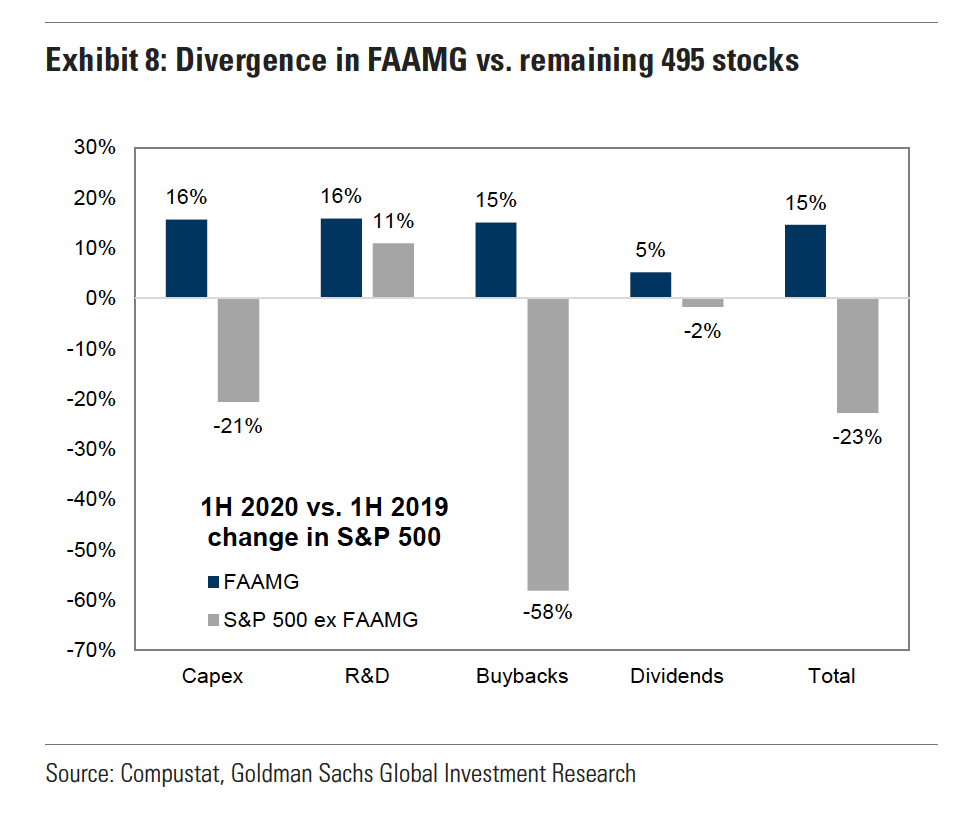

Their dominance looks locked for quartersand possibly decades –to emerge since they aren’t only out-growing the bunch they’re additionally out-investing the package. According to Goldman Sachs, the cash-rich FAAMG quintet possess a sizable advantage in Capex and R&D spending, implying that they ’re sinking large amounts into longterm stakes while the laggards return again. In addition, it helps FAAMG stocks are well beforehand in depositing money into buybacks and dividends, assisting forcing their stock rates.

***

Have a great weekend, everybody. I’ll visit you on Monday.

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.