Very good morning. Following Monday’s extreme sell-off, U.S. stocks are rebounding back as the clock ticks down on stimulation talks. European shares, meanwhile, are still largely from the green, buoyed by adequate bank earnings. Ironically, the honored “conquer ” simply isn’t impressing investors some more. I’ll explain more about this below.

But, let’so view exactly what ’therefore moving the markets.

Trade upgrade

Asia

- The most significant Asia indicators are largely lower in day trading with Japan’therefore Nikkei down almost 0.5percent .

- Foxconn Technology Group has thrown into doubt the future of its own much-ballyhooed Wisconsin mega mill. Creator Terry Gou states the entire job hinges becoming more state help from Wisconsin.

- Apple is seeing solid demand for the iPhone 12 versions, based on information leaked into CNBC.

Europe

- The European bourses are starting after a poor start with all the Europe Stoxx 600 upward 0.2percent in mid-morning commerce as investors consider the effect of tighter COVID constraints throughout the country and upbeat earnings information.

- Shares in UBS grew upward 2.7percent in early trading following the Korean banking giant delivered that a huge bottom-line conquer this afternoon. It had been the previous analyst phone for incoming CEO Sergio Ermotti, among the longest tenured of Europe’s bank supervisors. I interviewed Ermotti to get a magazine piece. He’s got an intriguing turn-around narrative to inform.

- Economists are managing the figures on the likely situation of a no-deal Brexit. It’d hit Britain difficult, but so also could it dent the GDP of gambling spouses Ireland, the Netherlands along with Belgium. This ’s following all 3 trades faltered in day trading on Monday, extending the Nasdaq’s losing streak to five consecutive days. Even the Dow and S&P 500 have shut in the crimson four of the five times.

- Can won or they ’t they? This ’therefore the big question hanging on the markets because a large deadline looms around stimulation talks. Even though Nancy Pelosi and Steven Mnuchin hit an arrangement –a Washington Monument-sized in case –that the tough part is accessing it through the Senate.

- What’s on tap for now? Netflix accounts its Q3 results and there’ll be a brand new batch of home data prior to the bell.

- The buck is upward.

***

Conquer it

They reported remarkable earnings “defeats ” yesterday just to observe stocks, gulp, autumn.

There is a time after a high – or bottom-line conquer would ship stocks soaring. Since CEOs are discovering, this ’s no more a promise.

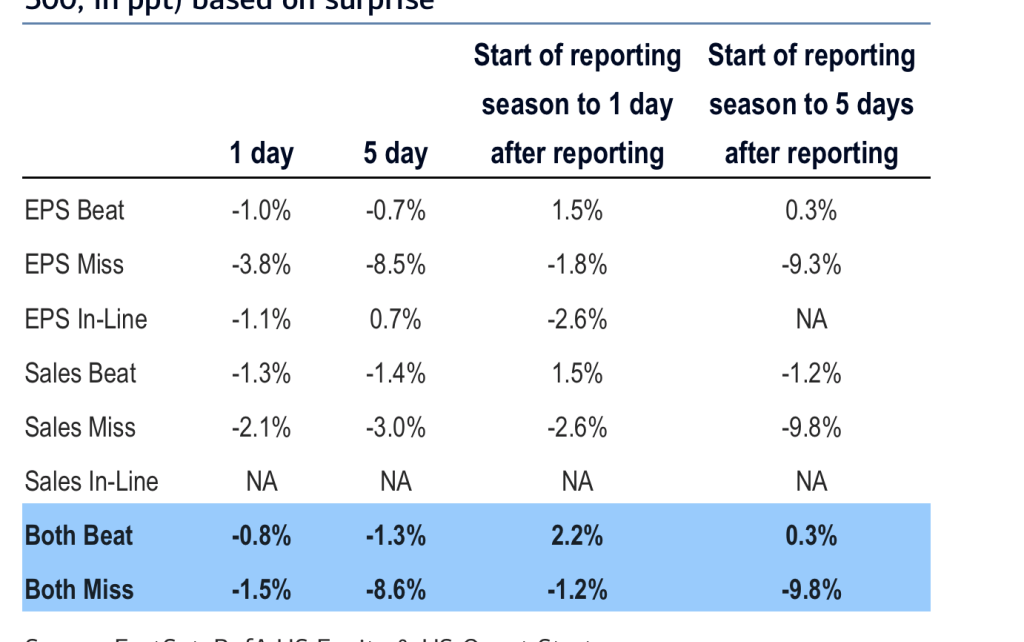

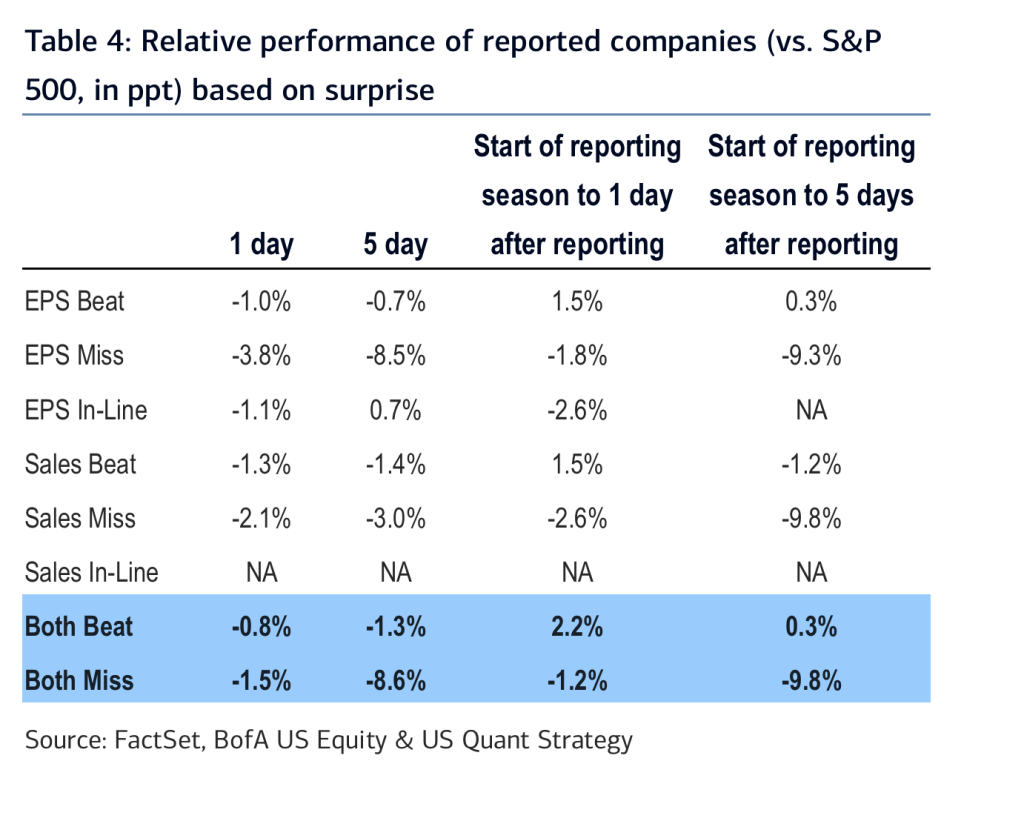

“While it’s too early to draw any conclusions, there haven’t been any benefits for beats whatsoever thus far this earnings season,” BofA stocks analysts wrote in an investor note yesterday. “Businesses beating on the top and bottom lines underperformed the S&P 500 from 0.8ppt the afternoon following (-0.7ppt ex-Financials). ”

This happening isn’t a fluke of this COVID era. It’s portion of a fashion that BofA says extends at least the previous six quarters.

It ’so important to remember that it’s {} better for a business to report a defeat compared to a miss, since this BofA chart reveals.

A business which overlooks both profits and earnings will see, normally, stocks underperform the S&P 500 by 1.5percent in the very first full trading session, also watch much more a downturn within the initial five trading days. (See blue bottom line in the base of the graph ). A double sales/profits conquer, meanwhile, contrasts into a underperformance of 0.8% and 1.3% on the exact periods. (Watch penultimate blue-shaded lineup in graph above.)

What’s irritating to CEOs, undoubtedly, is that there’s not so much of a justification past this being the newest standard of those markets. The earnings calendar simply isn’t exactly the catalyst that it was.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.