That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Fantastic morning. Bad bank earnings plus a dimming prognosis for stimulation spending sent stocks tumbling on Wednesday. This risk-off disposition is hanging on the markets {} . Europe is falling much tougher as COVID figures spike, and demanding curfew steps come into position. On cue, the buck, that timeless secure harbor, is upward.

Allow ’s check on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are at the reddish with Hong Kong’s Hang Seng away 1.2percent in day trading.

- IPO-bound Ant Group is your Hottest Chinese technology company in the areas of this Trump Administration. Reuters reports that the U.S. State Department has filed a proposal to bring the payments firm to a commerce blacklist.

- In Korean boy group information, Big Strike Entertainment, the audio tag for K-pop band BTS, experienced a rousing stock exchange introduction in Seoul now. Not Knowledgeable about BTS or even K-pop? This ’s Fortune‘s Grady McGregor about all you want to understand concerning the happening. The Stoxx Europe 600 was 2.4percent 2 hours to the trading session.

- Europe’s COVID amounts struck a listing from the previous 24 hours, forcing France to impose rigorous 9 p.m. curfews throughout nine towns, such as the City of Light, Paris. Tighter constraints in London are equally too .

- Haul your noseagain. The most recent on post-Brexit commerce talks took a sudden turn with Germany pressing on the French to back down on an integral sticking point in the discussions with its cross-Channel neighbour: bass .

U.S.

- U.S. futures stage to a different feeble open. Instead, they ’ve been slipping all morning. Even the Dow and S&P dropped for a second consecutive day on Wednesday, now with technology and banking stocks leading to autumn.

- Shares of Wells Fargo along with Bank of America dropped greater than 5 percent after reporting large earnings drops. The feeble amounts by the bellwether banks suggests that the financial recovery remains on shaky floor .

- Another worrying news stems out of Washington. Treasury Secretary Steven Mnuchin confessed yesterday the likelihood of attaining an impending stimulation bundle are nearly zero. He also House Speaker Nancy Pelosi meet again now, however, the two sides are nevertheless a fantastic $300 billion aside from their amounts.

- The buck is upward, rising as auctions fall.

- Crude is right down, with all Brent trading over $42/barrel.

***

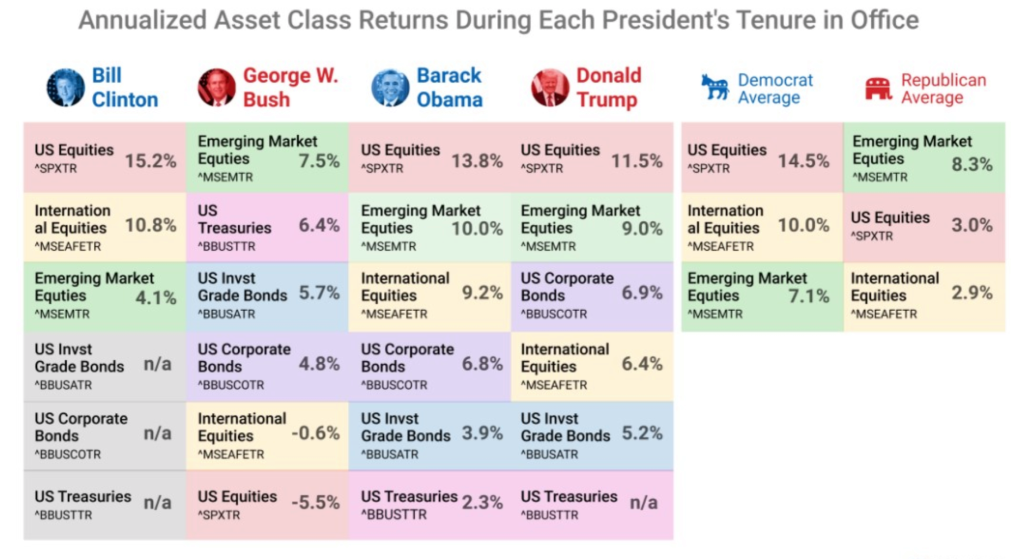

This one comes courtesy of Fortune columnist Ben Carlson who breaks the markets functionality.

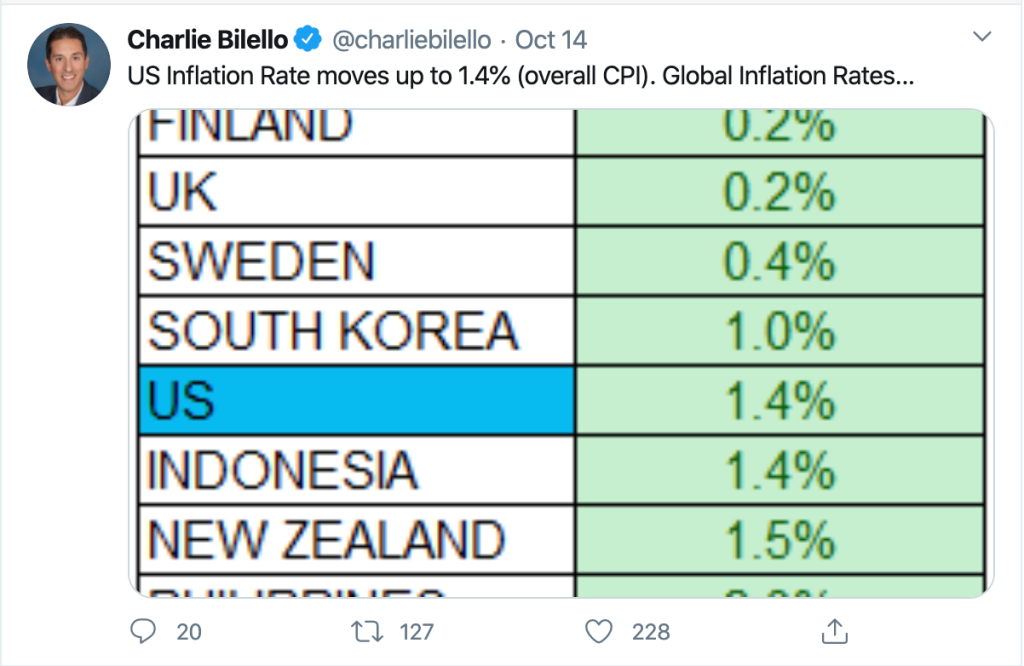

Inflation using a bit I

When several ticks more than 1 percent counts as large (ish).

Don’t inform anybody seeking to purchase a new pair of brakes which inflation remains dead. “secondhand automobile and truck prices soared by 6.7percent m/m in September, representing strong demand that’s outpacing supply,” notes Berenberg chief economist Mickey Levy.

When Abenomics goes worldwide .

I’m old enough to recall when the bond markets aided knock Silvio Berlusconi from electricity, not the Communists because he’Id been warning about for decades. Last week, even the Italian Treasury offered zero-coupon bonds. It had been over-subscribed. It is possible to thank the European Central Bank’s desire for autonomous debt for it.

***

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.