Good morning. U.S. futures are nudging higher ahead of today’s jobless-claims data dump. Why should investors care about something as mundane as jobs? Answer: because the U.S. labor market is a “long way” from healthy, says Fed Chairman Jerome Powell, and that weakness will hamstring the central bank’s monetary policy going forward.

But never mind all that. We are living in a golden age of SPAC exploration. The great SPAC race. So take your protein pills and put your helmet on.

These lesser-scrutinized blank-check IPOs, often backed (or just pumped) by a celebrity, are hitting the market at a furious pace. According to Dealogic, SPAC IPOs have raised $38.3 billion so far this year. We are well on our way to surpassing $300 billion in new SPAC listings this year—a four-fold increase on 2020, the so-called “year of the SPAC.”

Yes, we will get into some of the latest SPACs below.

In the meantime, let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading, with the Shanghai Composite up 1.4%. Reminder: the Shanghai Exchange will close for the next week in observance of the lunar new year holiday. Hong Kong is closed tomorrow and Monday.

- President Joseph Biden and Chinese President Xi Jinping spoke by phone yesterday. While there was no talk of a “reset” between the world’s two biggest economies, there were a few topics that were new to the agenda, including climate change.

- Remember that deal in which Walmart and Oracle were to buy the U.S. operations of TikTok? Well, it’s been shelved.

Europe

- The European bourses were modestly higher with the Stoxx Europe 600 up nearly 0.2% at the open.

- Peak oil has already arrived for Royal Dutch Shell, with output of “traditional fuels” set to more than halve by the end of the decade. Perhaps this is good news for ESG investors: the energy giant’s carbon emissions outlook has probably never been better.

- Heading to Africa now… It’s looking increasingly likely that Johnson & Johnson’s single-jab COVID vaccine will be rolled out for the first time anywhere next week—in South Africa.

U.S.

- U.S. futures point to a decently positive open. That’s after the Dow closed in record territory on Wednesday.

- Shares in Uber fell 4.8% in pre-market trading this morning after the company reported an eye-watering $6.8 billion loss for 2020. Über-bull Dan Ives, on cue, calls it “a major step in the right direction.”

- Holy flying SPACs, Batman! In a deal valued at $3.8 billion, flying taxi startup Archer merged with an NYSE-listed SPAC yesterday, giving rise to a new class of special purpose acquisition companies—the eVTOL SPAC.

Elsewhere

- Gold is flat, trading below $1,850/ounce.

- The dollar is down.

- As is crude. Brent is trading around $61/barrel.

- At 10 a.m. Rome time, Bitcoin was trading at $45,000, down 3%.

***

Buzzworthy

R&D, pffft

This tweet stunned me. Sure enough, I double-checked Tesla’s latest regulatory filings, and here’s what I calculated: $TSLA spent $1.5 billion on Bitcoin in 2020, and $1.491 billion on R&D over the past four quarters.

*Get a Clue

*Yes, that’s a Lohan film. Not her best.

Coming up short

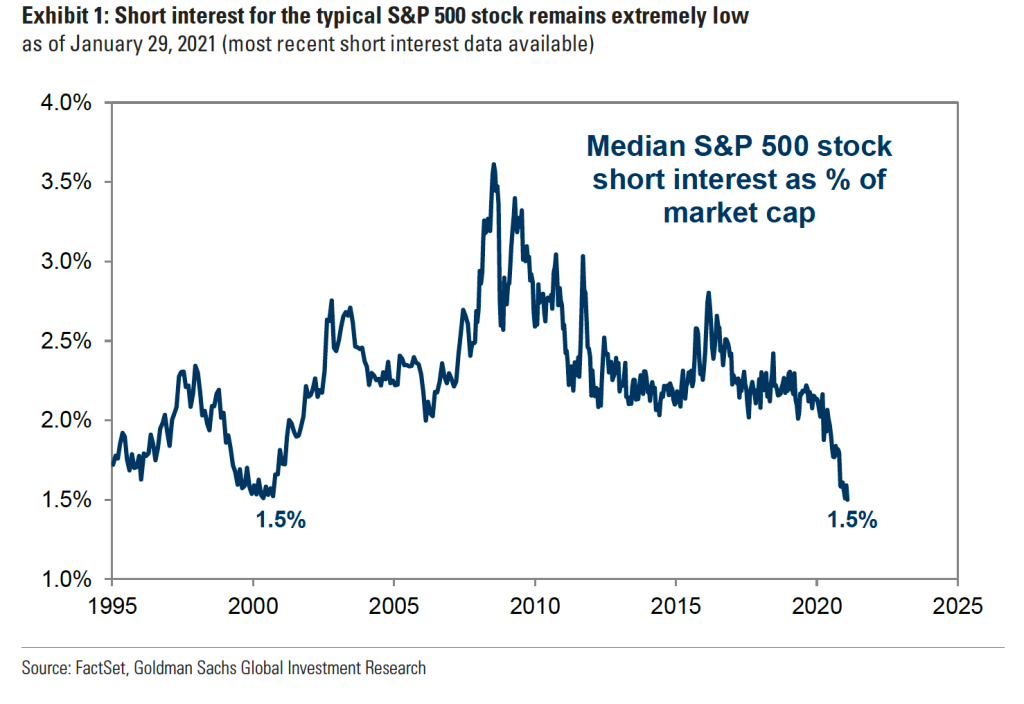

You have to go back to the dot-com bubble days to find a period when investors, collectively, have been so loooooong equities, reports Goldman Sachs.

SPAC-a-mole!

I know, who’s got time for the Cassandras of the market during a historic decade-long bull run? But you should familiarize yourself with the work of activist short-seller Nathan Anderson (before he takes aim at your SPAC-tacular portfolio.)

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.