Good morning, Broadsheet readers! Nasdaq celebrates its 50th anniversary, Ngozi Okonjo-Iweala is set to become the new leader of the WTO, and female founders were left out of 2020’s VC boom. Have a productive Monday.

– Boom or bust? At the beginning of every new year, Fortune examines how the venture capital industry supported female founders—or not—the year before. We just published our look back at 2020, and the results aren’t pretty.

Early in the pandemic, VC activity slowed to a crawl—but ultimately, that slowdown was short-lived. Startups as a whole raised 13% more from venture capitalists in 2020 compared to 2019, for an annual total of $150 billion, according to PitchBook data.

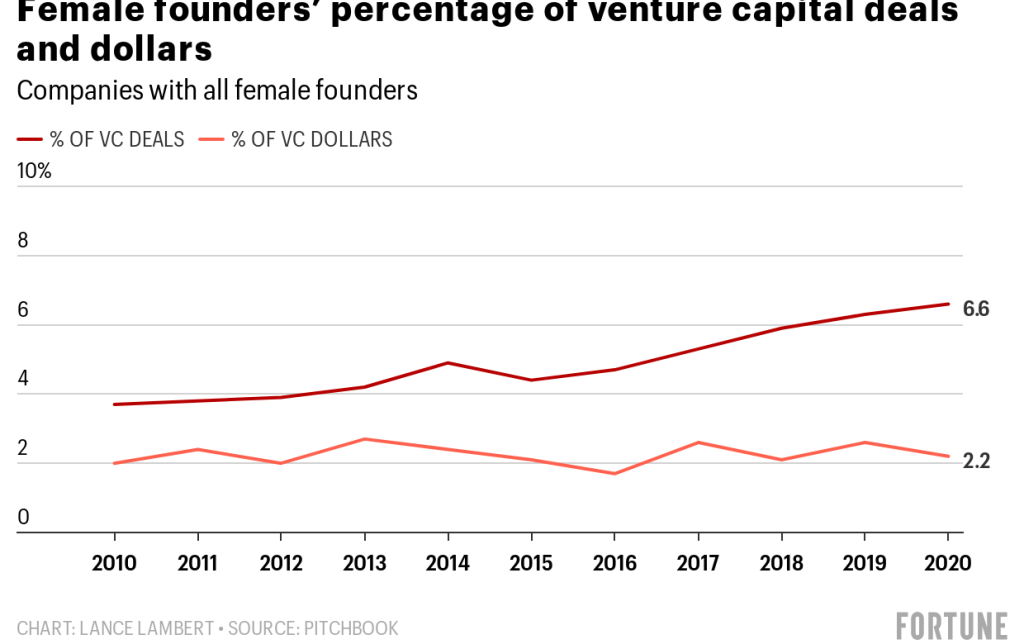

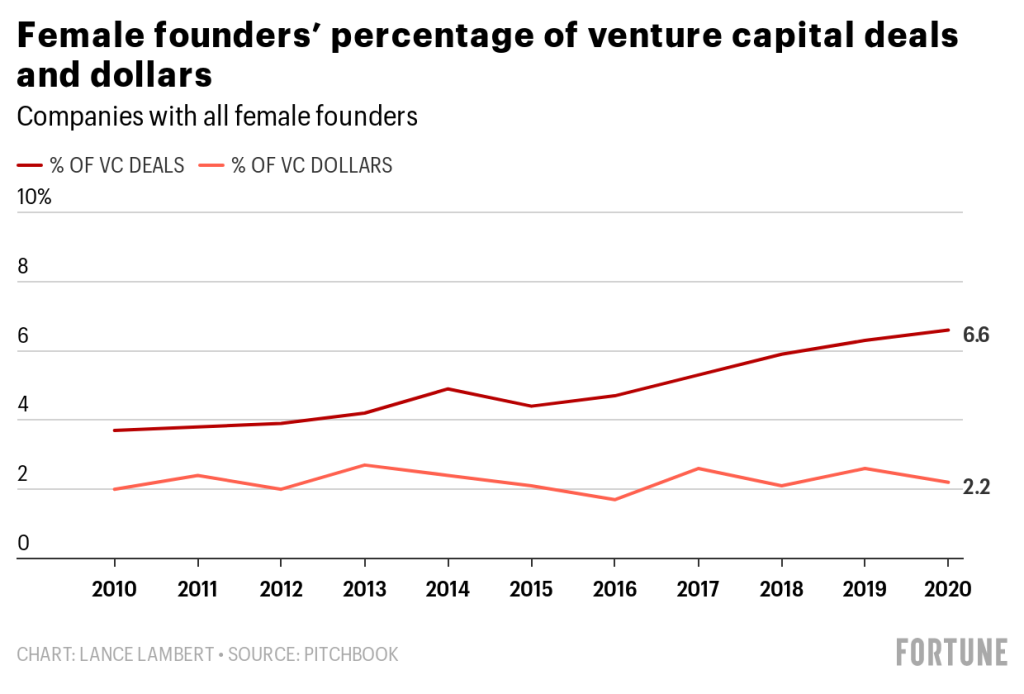

And how did female founders fare? Companies founded solely by women (to distinguish from companies with male and female founders) received less investment than in 2019, both by share of the pie and total dollars. Female-founded companies raised $3.31 billion in 2020, or 2.2% of the year’s total sum, compared to $3.5 billion and 2.6% in 2019.

2020’s VC boom, it’s clear, was not distributed evenly.

Pam Kostka, the CEO of All Raise, pins the blame on what she calls the “known founder effect.” Faced with challenging circumstances, investors retreated to what they already knew, choosing to back later-stage rounds for founders they’d already invested in or new founders who were already within their networks. Women and people of color are less likely to be in either category.

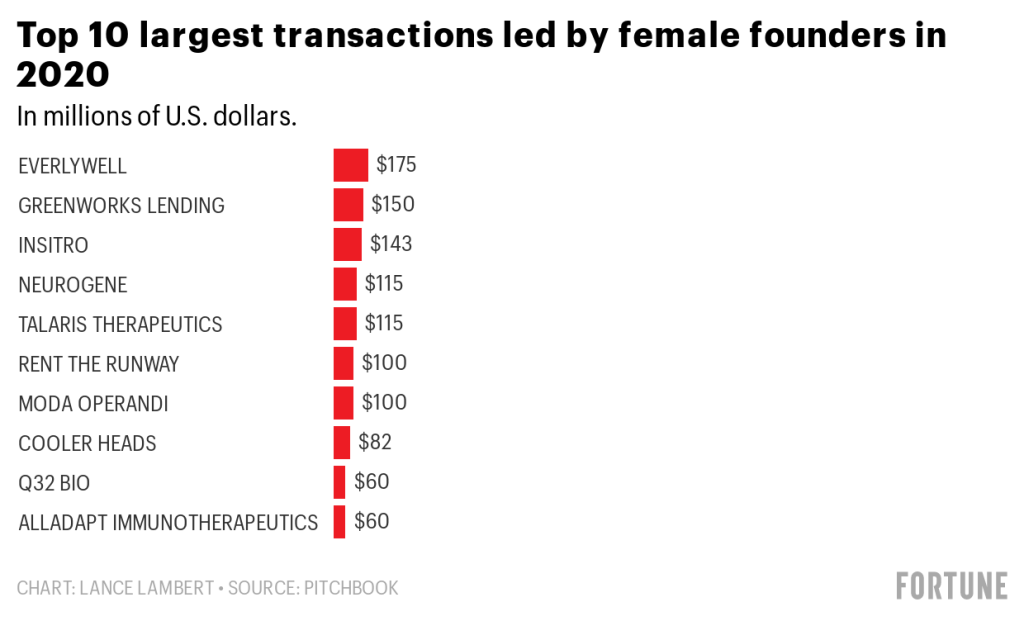

Among the female founders who succeeded in raising last year, Everlywell, the at-home lab-testing startup founded by CEO Julia Cheek, claimed the top deal of the year for a startup founded by a women-only team, with a $175 million Series D round. Gro Intelligence, whose mixed-gender team of founders includes CEO Sara Menker, closed one of the largest deals ever for a Black female founder: an $85 million Series B round.

For more analysis, read my full story here.

Emma Hinchliffe

[email protected]

@_emmahinchliffe