This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. As we’ve learned from the meme-stonks trade, what goes up, must also come down. Gulp. Not only is GameStop in a tailspin, but traders are quickly unwinding Monday’s silver rally.

Alas, stocks in Asia, Europe and U.S. futures are higher ahead of today’s big earnings calls from Amazon and Alphabet’s Google.

In today’s essay, I dig deeper into how last week’s short squeeze went down. It really was historic.

But first, let’s see what’s moving the markets.

Markets update

Asia

- The major Asia indexes are higher in afternoon trading, with the Hang Seng up 1.4%.

- Call it the snub heard round the world. China is honoring its top tech entrepreneurs. Left off the state-media-compiled list is Jack Ma.

- Australian mining giant Lynas scored a $30.4 million grant to build a rare earth metal processing plant in Texas, an effort to block China’s dominance in the market for the vital raw materials.

Europe

- The European bourses were gaining out of the gates with the Stoxx Europe 600 up 0.45% at the open.

- Shares in BP were down 2.7% at the open after reporting its first full-year loss in a decade. “It was a tough quarter at the end of a real tough year,” BP CEO Bernard Looney told Bloomberg TV this morning.

- Should you invest in countries that are leading the way in delivering COVID vaccine shots? Consider the U.K. The pound sterling is on a roll, and now analysts think it could be one of the strongest currencies of 2021, helped by the country’s lead in delivering COVID jabs.

U.S.

- U.S. futures point to a positive open. That’s after the major indexes bounced back on Monday following last week’s slump.

- Here’s some positive macro news: the Congressional Budget office yesterday delivered an optimistic outlook, saying the U.S. economy should reach pre-pandemic levels by mid-year.

- Want more good news? The U.S. hit a milestone yesterday with more vaccinations than COVID cases. That, and Moderna said it may be able to include more doses in each vaccine vial.

Elsewhere

- Gold is slipping after yesterday’s rally, trading below $1,850/ounce.

- The dollar is down.

- Crude is climbing, with Brent trading above $57/barrel.

- As of 10 a.m. Rome time, Bitcoin was up nearly 2% at $34,400.

***

A basket of shorts

GameStop is down nearly 30% in pre-market trading this morning. That’s after a plunge of 31.5% yesterday. More interesting for the Reddit brigade, short positions have dropped from nearly 140% of shares outstanding to roughly 50% yesterday, says the shorts-trackers at S3 Partners.

Translation: GME is no longer America’s most shorted stock, suggesting retail investors—what Wall Street types used to call the “dumb money”—have come out on top in the mother of all short squeezes.

Before anyone starts handing out cigars, let’s see what lessons can be drawn from the feeding frenzy of recent days.

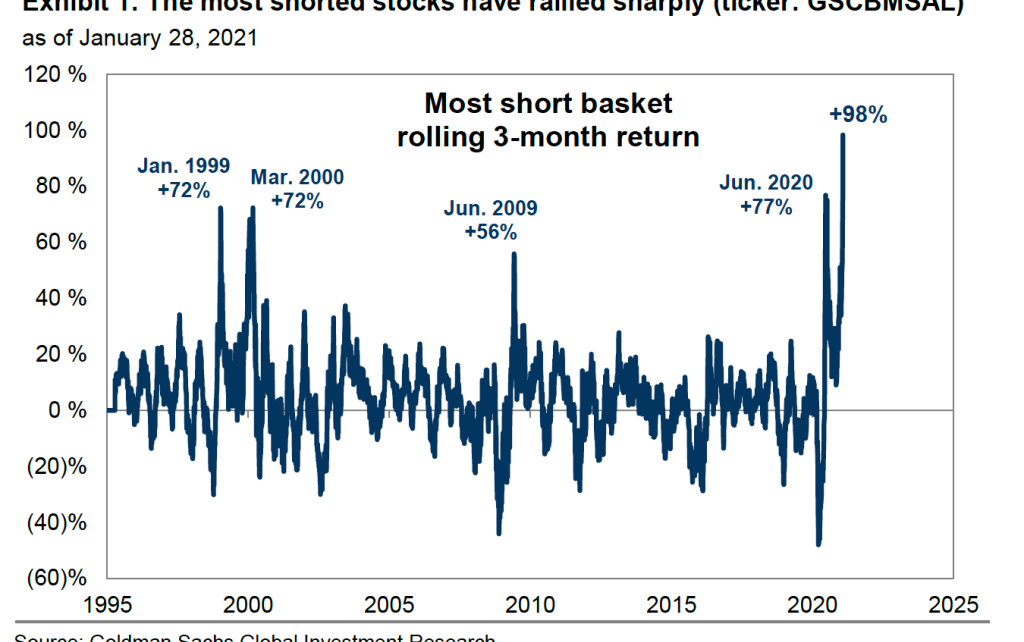

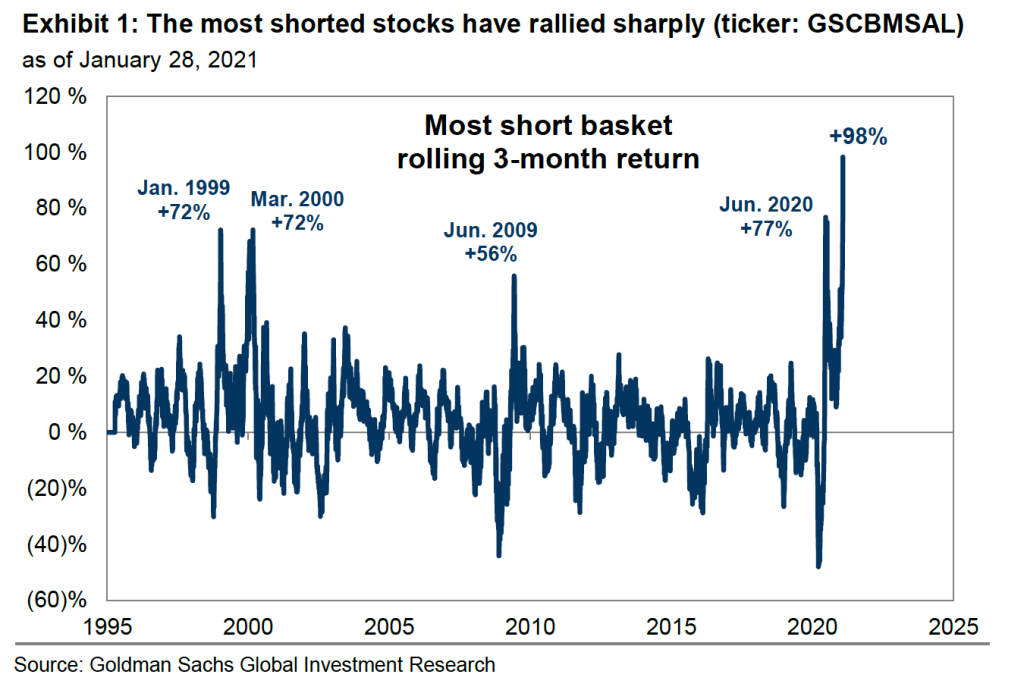

According to Goldman Sachs’ equity team, last week’s squeeze was one for the record books. “The past 25 years have witnessed a number of sharp short squeezes in the US equity market,” Goldman wrote in a recent investor note, “but none as extreme as has occurred recently.”

Goldman goes on to lay out something they spotted that, on the surface, seemed downright wacky. The 50 most shorted companies on the Russell 3000 (each with a decent market caps above $1 billion), have been on a tear recently. This basket of shorts has rallied by 98% over the past three months. (Okay, if you’d had any of these stocks in your portfolio during that time, you do deserve a cigar right now.)

Here’s the Goldman chart putting this latest 3-month shorts-rally into some historical perspective. Notice the +98% spike on the right-hand side.

What makes this rally so different is the outsized role the retail traders played in driving up the share price of the most shorted stocks. What’s also notable: the pain they inflicted.

Last week’s rally in shorted stocks and the subsequent plunge in other parts of the market “represented the largest active hedge fund de-grossing since February 2009,” Goldman wrote, referring to one of the most brutal stretches of the global financial crisis more than a decade ago. “Funds…sold long positions and covered shorts in every sector.“

It certainly went off like a bang.

If you’re wondering about the fuse, look no further than this long-known truth about the perils of shorting stocks. Throughout the years, “the rally of the most heavily-shorted stocks has taken place against a backdrop of very low levels of aggregate short interest,” Goldman notes. “At the start of this year, the median S&P 500 stock had short interest equating to just 1.5% of market cap, matching mid-2000 as the lowest share in at least the last 25 years.”

GameStop aside, short positions are really in the minority these days. That makes some sense during a bull market. But whenever the ratio of longs to shorts gets this out of balance, the conditions are ripe for epic squeezes.

That’s what the canny retail investors spotted when they decided to target GameStop. I’m not making any predictions on GME share price, but it will be harder to push the stock to the stars with so many shorts having covered their positions, and getting out of the trade all together.

Still, if you’re a GME believer, drop me a line.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.