Good morning, Bull Sheeters. Tech stocks are leading the way this morning, sending U.S. futures mostly higher, and lifting global stocks, too.

It’s a big earnings week for Big Tech with one half of the FAANGM sextet reporting in the coming days.

In today’s essay, I look at the bubbly trade in penny and loss-making stocks, including the crazy surge in GameStop.

But first, let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with Hong Kong’s Hang Seng up 2.4%, continuing an impressive monthlong rally.

- The big gainer is Tencent, which at one point was up more than 10% on Monday as bulls poured into call options at a staggering clip.

- China is the new global leader for business investment. The much watched figures on direct foreign investment came out this weekend, showing the U.S. lost the No. 1 position in the past year, thanks to COVID-19.

Europe

- The European bourses were mostly higher out of the gates with the Stoxx Europe 600 up 0.5% at the open, before slipping.

- President Biden phoned a slew of world leaders this weekend, including Britain’s Boris Johnson. Downing Street was quick to highlight that the topic of a trade deal came up on the call. The White House had a different recollection of the conversation.

- The one-two punch of Brexit and COVID is jangling nerves in the U.K.’s financial and business capital. Roughly 40% of Londoners say they’d consider a move across the Channel to Europe.

U.S.

- U.S. futures point to a positive open. That’s after all three exchanges closed out last week in the green.

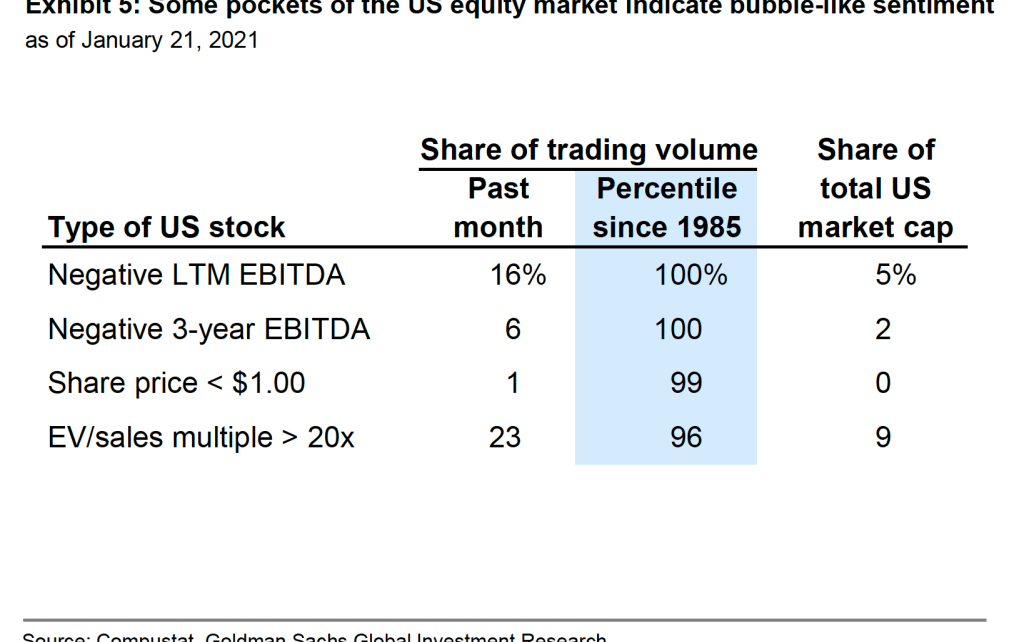

- Goldman Sachs equity strategists see signs of “froth” and “unsustainable excess” in the U.S. stock market. It’s not just with SPACs, they warn, but also the “bubble-like” enthusiasm for stocks with negative earnings. There’s more on this below in today’s essay.

- Big tech dominates the earnings calendar this week. The big names include: Microsoft (Tuesday), Apple and Facebook (Wednesday).

Elsewhere

- Gold is flat, trading around $1,850/ounce.

- The dollar is down.

- Crude is up, with Brent trading above $55/barrel.

- As of 9 a.m. Rome time, Bitcoin was up around 1%, at $33,300.

***

Game on

The B-word comes up a lot on Wall Street these days.

As Goldman Sachs equity analysts wrote in a note this weekend, “among the questions we receive most frequently from clients is whether U.S. stocks trade at unsustainably high levels (read: “Bubble”).”

The answer to that question is: yes, bubbles abound. But you have to know where to look for them.

For example, equities pros struggle to find an adjective for the craze in blank-check SPACs. There have been 56 SPAC IPOs so far in 2021, raising $16 billion. (If SPACs still puzzle you, check out Fortune‘s Jeff John Roberts analysis of what a “lousy” investment the SPAC is for anybody looking to make a quick and decent return.)

There are other alarm bells Goldman sees in the markets—namely, the robust trade in penny stocks, in companies hemorrhaging losses and in overvalued stocks (as represented by EV/sales multiples hitting or exceeding 20X). It almost goes without saying that such risky bets usually don’t end well. And yet volumes in these YOLO (you only live once) trades are reaching historic highs.

EV/sales is a much watched metric. It gives investors a good idea of whether the market value of a company (factoring in its level of equity and debt) is in line with revenues. A stock with a relatively low EV/sales—say, under 1X—may be a company that’s under valued despite decent top-line growth. A high EV/sales ratio, meanwhile, indicates investor exuberance is running hot for a business whose stock price is growing faster than sales—or so it often seems.

“Since 1985,” Goldman writes, “the median stock trading at an EV/sales multiple above 20x has generated a subsequent 12-month return of -1%, compared with +6% for the median US stock.”

In the past month, nearly one-quarter (23%) of shares that have changed hands are companies with out-of-whack inflated EV/sales, as the table above shows. Meanwhile, there’s been a similar surge in the volume of trading in firms with negative earnings.

One such beloved loser is GameStop; it’s soaring again this morning in pre-market trading. The loss-making video game retailer is up nearly six-fold since Jan. 12 as retail investors go all in to punish the many shorts that are betting on its crash. It’s being called the mother of all short squeezes, and it’s triggering a whole slew of vicious take-downs on Twitter. The big scalp for the WallStreetBets crowd is the veteran activist short Andrew Left of Citron Research, who it appears is losing huge sums on his bearish position at the moment.

At one point on Friday, GameStop was the most actively traded U.S.-listed company, Bloomberg reported. Never mind that it had a rough Christmas sales period, and recently delivered a sobering outlook that involves further belt-tightening to weather its COVID-battered market. Retail investors are going all in on the stock as if it were an e-commerce juggernaut.

If you were a bubble hunter, stocks like this one would be worth examining.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.