Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Happy Friday, Bull Sheeters. In the most recent installment of Groundhog Day, Congress failed to reach a deal to get a stimulus package, making shareholders not to mention countless struggling American households –at the lurch. Again.

Spoiler alert: They can do this all over again now, and shares will rise and drop on any understanding of advancement, irrespective of how infinitesimal.

Trade on Friday was choppy on each side of the Atlantic using U.S. stocks level, but off their highs. Adding to the volatility–it’s quadruple witching day at the U.S.

Allow ’s check on what’therefore moving the markets.

Trade upgrade

Asia

- The most significant Asia indicators are piled in crimson in day trading together using all the Hang Seng downward 0.7percent .

- The Trump Administration will include heaps of Chinese companies, such as chips giant the nation’s leading chipmaker SMIC, into its commerce block record, Reuters reports, a transfer that’s {} Chinese niches. SMIC, in one stage, was 5 percent , at Hong Kong.

- Before this past week, I shared with poll information revealing the stampede to emerging markets in recent months. Now, we’ve got hard-currency data. Spoiler: that the in-flows quantity into EM is in the fastest rate in seven .

Europe

- The European bourses were at the red from their gates prior to rebounding. 90 minutes to the trading session, the most Stoxx Europe 600 was upward 0.2percent .

- The barbarous COVID second tide is now still adding to trading volatility. Yesterday, France’s Emmanuel Macron revealed that he ’d analyzed positive, and Europe’s capitals have been faking to include a dreaded COVID-19 bunch similar to the one that we saw at Washington in October.

- Yesterday’s confidence for an impending Brexit bargain has faded. Britain is currently warning that talks have now been”obstructed and time is running out” since the two sides cannot reach an accord on fish… Fish? fish. Even the pound dropped on the information. This ’s following the significant averages a record-setting session Thursday–each of three shut in all-time-highs.

- I awakened this afternoon, also there was no bargain to get a brand new stimulation package–like each morning for the previous six weeks. Certainly, Congress isn’t data-dependent. Brutal jobless figures, anemic retail revenue information, an escalating poverty speed –not one of those flashing-red warning signals can bring them into an accord.

- Shares in Alphabet’therefore Google dropped a just 0.95percent yesterday after the research giant obtained slammed using its third largest case at the previous two weeks. My colleague, Aaron Pressman, combed during the 130-page Texas-led lawsuit filed before this week, also decoded all of the redacted passages. It’s ’s worth checking out.

Elsewhere

- Gold is downward, trading about $1,885/oz .

- The buck is upward as futures spout.

- Crude is level, however Brent stocks are trading over $51/barrel.

- Bitcoin proceeds to signal higher. It’s upward 3 percent , trading about $23,000.

***

From the amounts

$88 billion

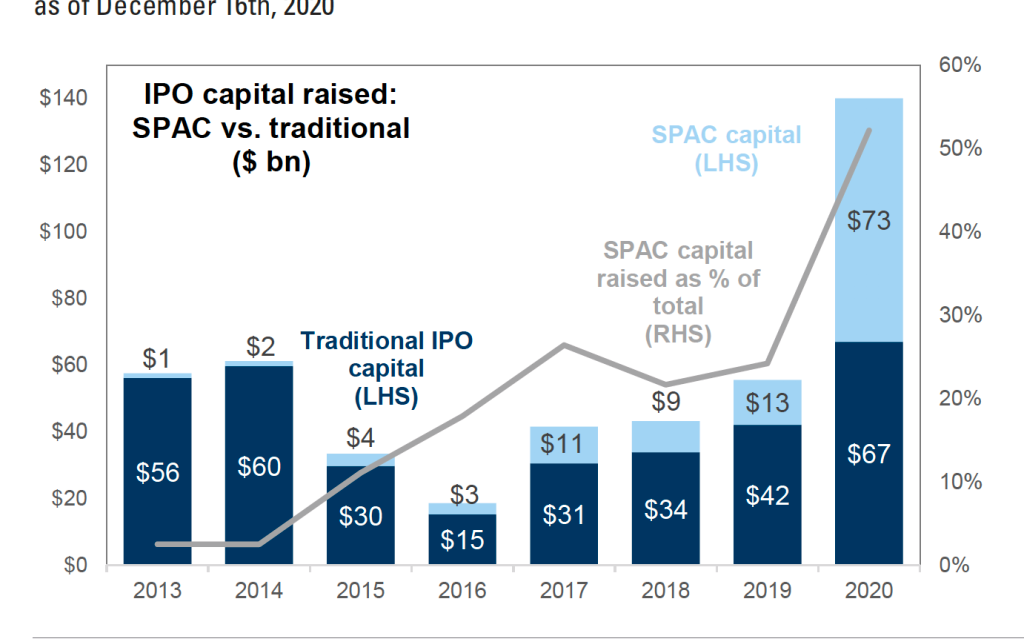

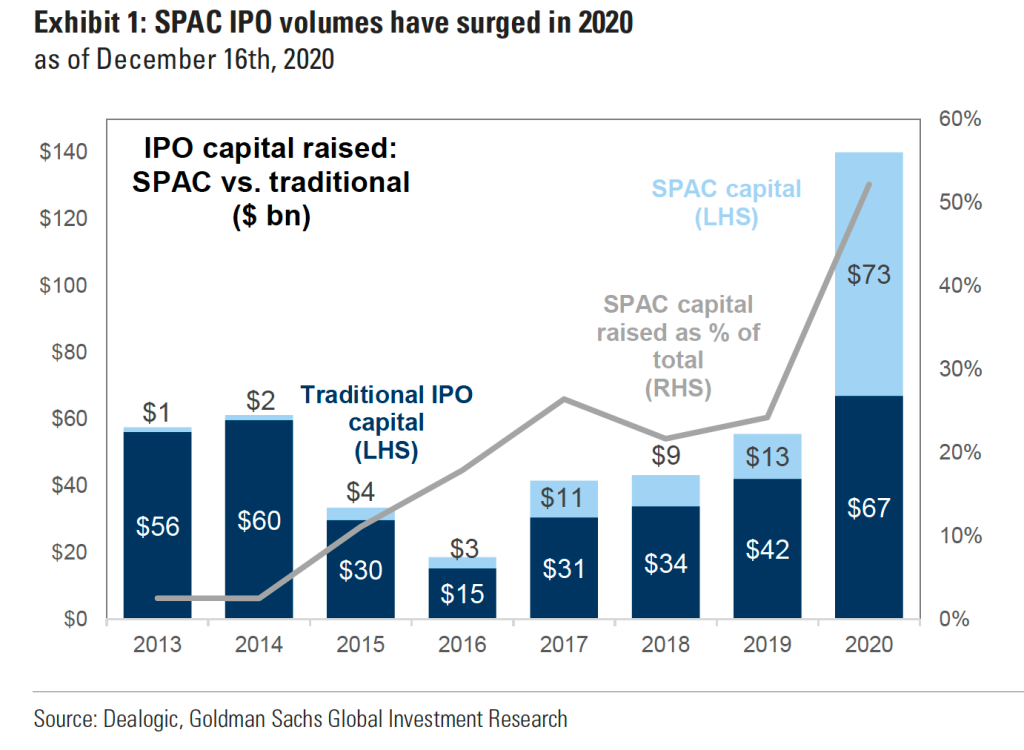

We’ve spoke quite a little about IPOs here, however maybe not so much concerning SPACs. A refresher: SPACs are all blank-check companies created with the express aim of merging with or acquiring another firm. Typically, if this type of bargain isn’t fated in a couple of decades, the seed traders receive their money back. Over the last 28 months, 272 SPACS have now formed, increasing $88 billion. A prosperous SPAC is one which goes people and then locates a company to unite, basically filling the vacant box with a genuine business. Based on Goldman Sachs, an overwhelming amount of SPACs (71 percent ) have to come across a dance partner. This ’s no wonderful success rate. The clock has been ticking all those misfit empty-box SPACs, and the cash continues to flow in the invention of new types. What can go wrong?

29 percent

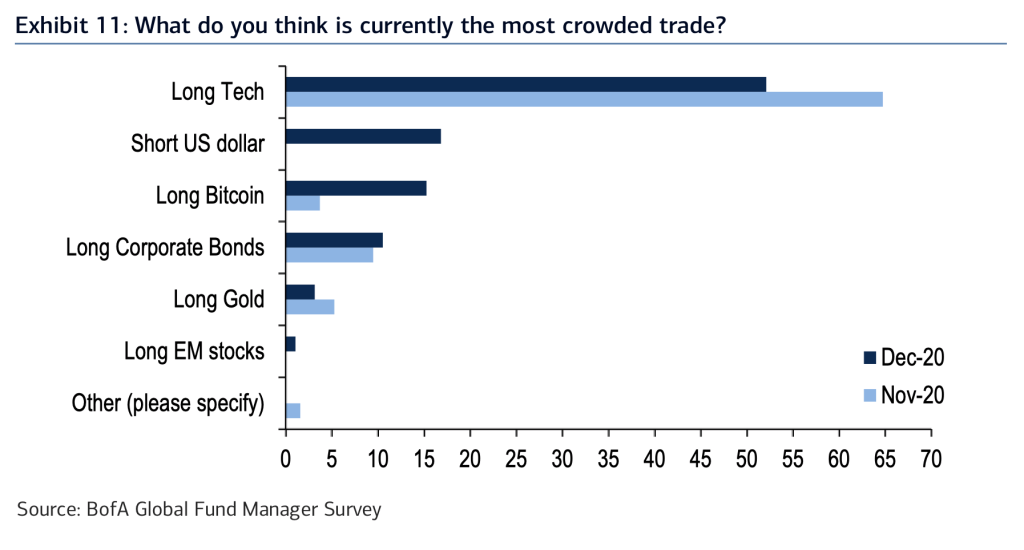

Crypto has been the commerce of this week, together with Bitcoin upward 29 percent previously seven days. This is only one of these atypical transactions because it began as a retail drama, and institutional forms have jumped into. Perhaps too many institutional forms; Bitcoin currently ranks as the next most overcrowded commerce, based on BofA’s latest fund manager poll.

25,000

Here is the final Bull Sheet book for 2020. The very first issue came out from mid-January. At that moment, I had been writing to a little neighborhood of approximately 3,000 subscribers. We’ve because developed over 8-fold within the previous 11 weeks to enter right around 25K subscribers. By this step, Bull Sheet has increased at a faster clip than Tesla, Moderna along with the FAANG shares. Thanks for stirring those minutes I went {} {} , to riff in my roast chicken recipe or maybe to take you around several journeys about Italy— even detours which can do nothing to get your own portfolios. I shall see you back in January, 2021. I wish to want you and your families a joyous holiday season, and my best wishes for a prosperous new year.

***

Have a wonderful day, everybody. I’ll find you back {} 2021… But {} there’s additional {} below.

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.