Here is the internet edition of Bull Sheet, a yearlong day-to-day newsletter about what is happening in the markets. Subscribe to receive it sent directly to your inbox.

U.S. stocks are on the upswing again on Wednesday as investors stake Congress might hit a very long anticipated stimulation deal at any stage that week. If it feels like we’ve been saying that for weeks, then it’s {} . And you bulls haven’t lost religion.

That confidence is raising international stocks.

Allow ’s check out on which ’s moving markets before a large update today by the Fed that may affect the bond marketplace.

Trade upgrade

Asia

- The most Significant Asia indicators are piled in green in day trading using all the Nikkei upward 0.3percent .

- In Washington they could ’t even appear to agree on funds and stimulation, and Japan is now going to maneuver its third “additional ” funding this year–this one between an excess $210 billion to assist the COVID-battered market. Phone it “Suga-nomics. ”

- In case you believe America’s IPO marketplace is frothy, have a gander in China’s. Startups at China have increased a record number up to now from 2020, Bloomberg oversaw .

Europe

- The European bourses are high from the gates, together with all the Stoxx Europe 600 upward 0.9%. This ’s worsening COVID information from all over the continent, also also fresh lockdown steps entering force. Big penalties and also break-up would be the huge sticks that they ’Id pulled outside.

- The Euro Stoxx Banks indicator was upward 0.3percent in early trading this afternoon following the ECB raised its ban on gains along with share-buybacks to Europe’s creditors. This ’s following the S&P 500 snapped a four-day losing series on Tuesday, and all three main indexes closed higher on the session.

- Stocks increased on Tuesday, along with also the Nasdaq notched a fresh ATH, on expects of a stimulation deal. A genuine thing. When I received a fractional share in certain dull, all-market ETF to each and each time I noticed that you … that I ’d be writing this book out of Portofino. (I’d {} to invest in Bull Sheeter’s own yacht. Ahem. )

- Shares in Moderna dropped 5 percent yesterday following the FDA revealed that the drugmaker gets high marks for its COVID vaccine, paving the way for emergency approval. Don’t feel terrible for Moderna. Shares are up 652 percent at 2020.

- The buck will be down.

- Crude is upward, together with Brent futures {} $51/barrel.

- Bitcoin is upward almost 2 percent on Tuesday, investing about $19,500.

***

The crowded commerce

We discussed that the loneliest exchange . Now, allow ’s move in the opposite way, and discuss the you-too? Commerce of this moment.

I’ll give you a clue. It succeeds using “mess. ”

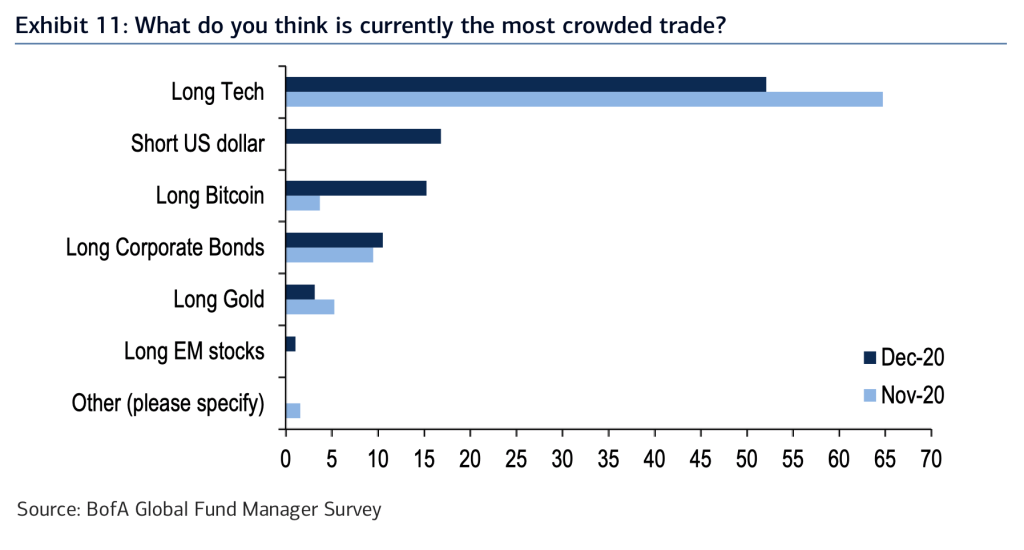

Yes, being technician is regarded as the very crowded commerce on the market. Again.

This ’s based on BankofAmerica’s newest international fund manager poll.

However, as the graph above demonstrates, the tech-bull audience is thinning. The transactions which are gaining prefer are shorting the inadequate buck (grumble, grumble), leaping about the Bitcoin wagon, also moving long company bonds.

What else grabbed my attention? Gold also is losing desire, no uncertainty as Bitcoin enjoys. Gold bulls ought to be losing patience. The glistening yellow stuff was investing in a tight range for weeks, also so is currently down 10% since its August high.

Extended gold, nevertheless, isn’t the very contrarian of transactions. Investors can also be rotating from health care and U.S. shares, and, first and foremost they’re becoming from money.

In accordance with BofA, the flight away from money is in a seven-and-a-half-year large, which ’s tripping a “sell sign. ”

What exactly does that involve?

Be aware: that BofA information is to get its contrarian investor, those that would like to enter a new place before the audience.

***

Have a wonderful day, everybody. I’ll find you {} … But {} there’s additional {} below.

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.