Here is the internet edition of Bull Sheet, a yearlong day-to-day newsletter about what is happening in the market. Subscribe to receive it sent directly to your inbox.

Excellent morning. Stocks and Stocks have been rebounding on Tuesday. This ’s little to no advancement on stimulation negotiations in Washington, or about Brexit trade discussions in Europe.

Elsewhere, investors’ are so much cleaning off the most recent lockdown information, which threatens to put the straps Christmas on either side of the Atlantic.

In now ’s article, I get in the loneliest commerce from the marketplace: equipping the S&P 500.

Allow ’s check on which ’s transferring markets.

Market upgrade

Asia

- The most Significant Asia indicators are largely lower in day trading using all the Shanghai Composite downward 0.1percent .

- The Chinese market is completing 2020 with powerful momentum. Factory output along with retail revenue statistics for November climbed in line with analyst estimates, also unemployment dropped .

- Equities analysts in Citigroup, Goldman Sachs, along with Nomura Holdings are {} bullish on Asian stocks such as 2021, saying inventories must climb at 20 percent during the subsequent 12 weeks. With only 10 days prior to Christmas, demanding new lockdown steps will go into effect in London, Germany along with that the Netherlands this week, and Italy also is mulling new steps for the vacation season –grim news for markets teetering on collapse.

- The following day has passed without any progress in Brexit trade discussions , but ’s not quitting the area ’s largest companies out of sounding the alert. Yesterday it had been Airbus CEO Guillaume Faury stating a tumultuous divorce could induce it to mull a huge scale-back from the U.K.

- Substantial tech may be facing tough new information utilization principles, or have slammed with a fine {} 10 percent of yearly earnings , based on EU draft law noticed by Bloomberg. This ’s following the S&P 500 dropped for a fourth successive day on Monday. The powerful Russell 2000, meanwhile, continued its remarkable streak; the little cap index is upward 19 percent because Election Day.

- Recently Launched IPO darlings Airbnb and DoorDash dropped sharply on Monday, also so are trading reduced from pre-market trading. As my colleague Aaron Pressman miracles , failed their stock market debuts only split the IPO marketplace ?

- An intriguing story to see for 2021 is the streaming wars. Disney stocks Friday struck an all-time large much after it demonstrated its enormous investments at Disney+, Hulu along with other steaming providers would have a huge bite out of earnings.

- The buck is level. {

- Crude is down to vaccine expects, together with Brent futures {} $50/barrel. |}

***

The loneliest exchange

Because the March nadir, U.S. shares (as measured from the S&P 500) are a startling 66 percent. And this bull rally is providing investors a feeling of invincibility.

Only look at short rankings. Together with the doubt of Election Day well and truly behind usremember those anxieties of a contested election? –traders are long term stocks. Extended using a vengeance.

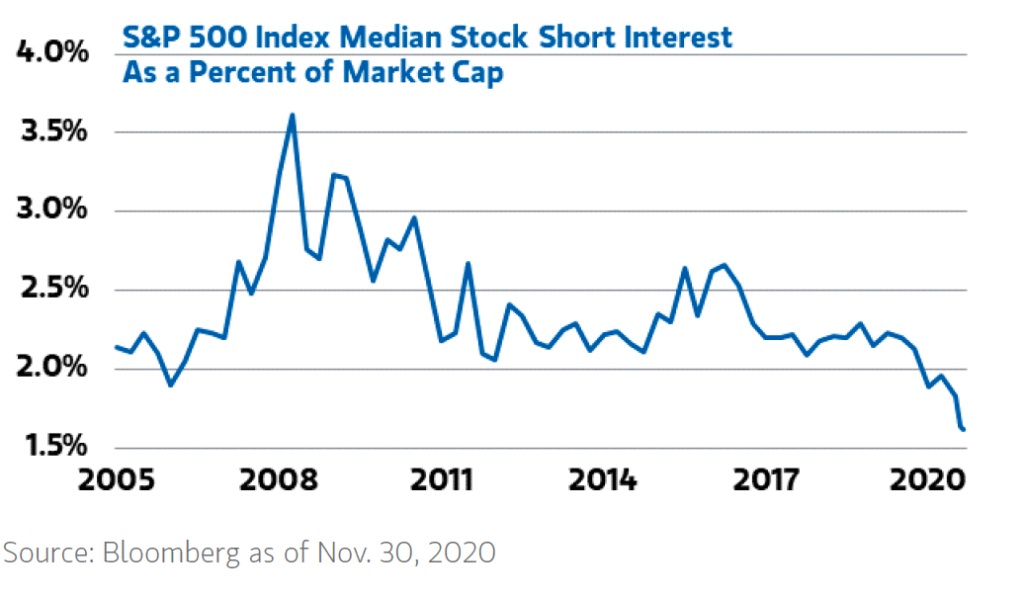

Based on Morgan Stanley, the brief interest at the median S&P inventory is well under 2 percent, the lowest level in almost two years, since the graph below reveals.

This long-everything occurrence is but the most recent indication that investor exuberance for shares is conducting off-the-charts hot. Morgan Stanley Wealth Management chief investment officer Lisa Shalett, for one, sees cause of concern. This everything-is-awesome posture,” she states, “proposes complacency, that constantly becomes its Achilles’ heels. ”

For starters, the more S&P is investing in that a mere 6.5% bashful of Morgan Stanley’s 2021 goal, she points out. “Near-term catalysts are largely exhausted, monetary and fiscal policy are in highest lodging amounts, and opinion and placement indicators have tremendously bullish readings. Thus, we’re indicating caution,” ” she also writes.

Morgan Stanley is barely. Equities analysts view that a strong financial recovery from 2021, along with also a spike in earnings. But shares are so expensive now we’d should find a tide of bottom-line defeats to mass up people comparatively straight denominators, and attract P/Es back to their own historic variety.

***

Correction: In ’s Bull Sheet,” I erroneously recognized the mood of shareholders. As was clear, it turned out to be a risk-on day prior to the opening bell at New York. Apologies for the confusion.

Have a great day, everybody. I’ll visit you tomorrow.

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.