The year 2020 was demanding for many businesses, however it’s turned into a wonderful alternative for brokerages. Buoyed by a record amount of new retail merchants, companies like Robinhood and Fidelity have undergone record amounts of the trading.

This trading explosion, together with the prevalence of newer app-based platforms such as Robinhood, has produced a possible chance for upstarts. These comprise Public, also a New York-based startup whose investing stage attempts to mix social media and investment.

But in practice, this means customers will inform each other what shares they purchase and, sometimes, find out what high profile actors or traders are purchasing. The business has recruited outstanding amounts of pop culture, such as skateboarder Tony Hawk and Alex Pall of this group The Chainsmokers, that will help drum up interest from the stage.

Hawk and Pall will also be one of people who’ve spent in Public’s fresh Series C funding round of $65 million. The round, which had been directed by the venture firm Accel, attracts Public’s overall financing to $90 million since it first started in 2018.

“The stock exchange has been an intimidating area reserved for a fortunate few. As technology continues to interrupt obstacles, Public.com is developing a stage which makes investing available to everybody,” stated Hawk in a statement announcing that the new financing round.

Not so people

However, while Public has star power and also a persuasive thesis, it still ’s uncertain how much grip that the organization is getting on the industry. The business declined to disclose the amount of reports it’s, or how quickly it’s growing. Public also declined to offer any information regarding its own valulation.

In a meeting earlier this season, venture capitalist Ian Sigalow, that spent on behalf of Greycroft, likened Public into Venmo–a community which grew exponentially due to its social networking characteristics. Those features, he states, will even enable Public to prevent spending enormous sums on advertising as it’s going to have the ability to rely on word monthly rather.

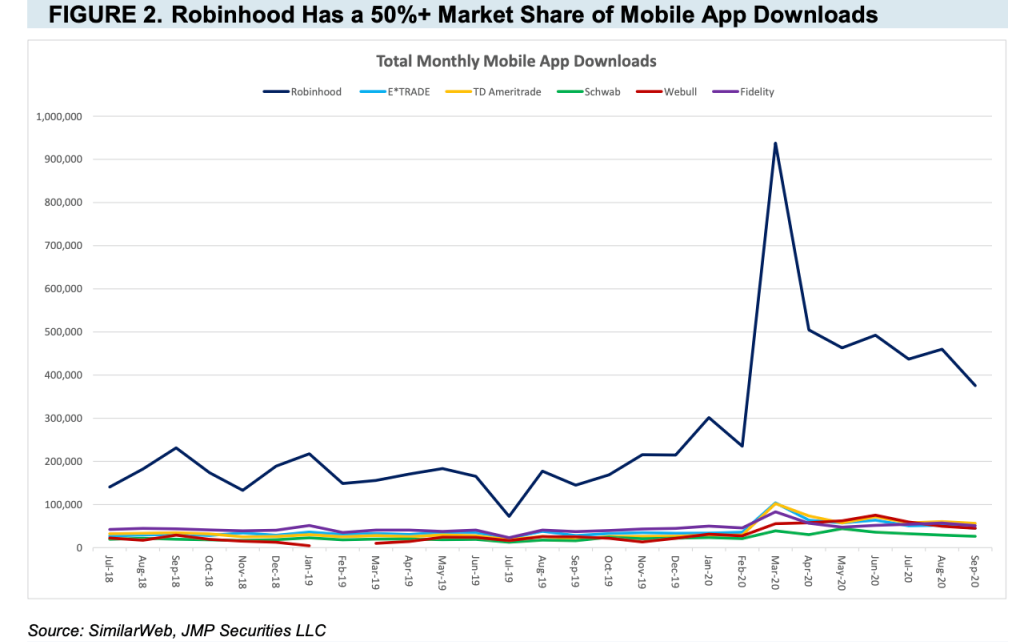

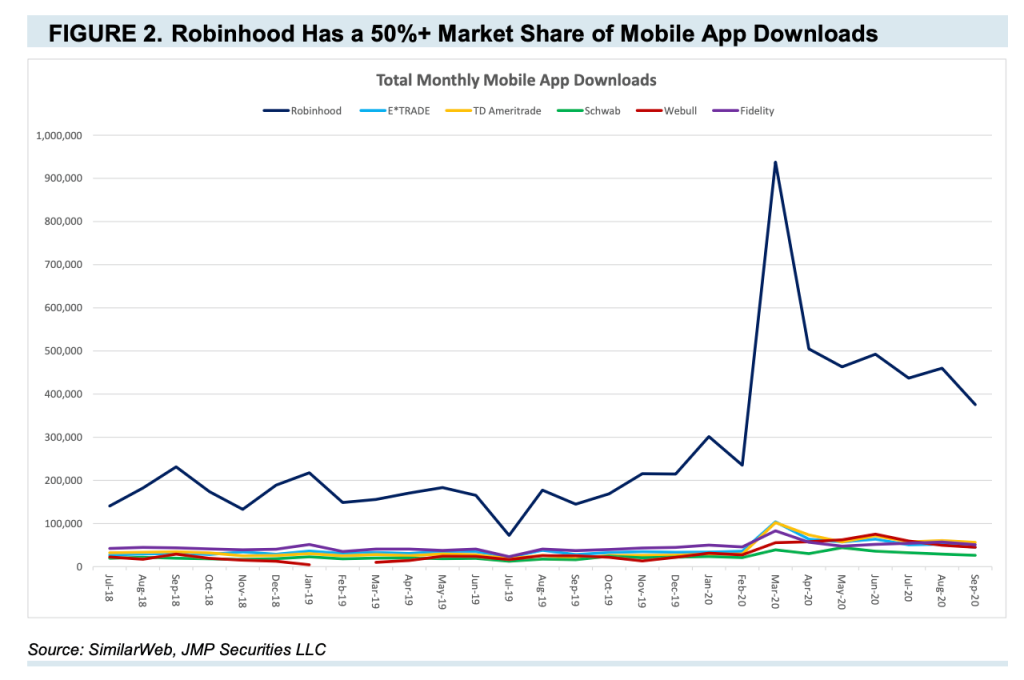

However, Public can face an uphill struggle. A recent report from JMP Securities reveals the amount of program downloads for Robinhood is much greater than quadruple people for different brokerages. Those opponents include conventional brokerages and Webull, yet another trading program with a social networking part.

Even with Robinhood’s evident dominance, the investment from Public indicates traders think there’s space for it to make inroads. Other shareholders in Public’s Series C round comprise Lakestar, Greycroft along with Advancit Capital.