To include or not to include, that’s the question.

As investors expect Tesla’s December 21 addition to this S&P 500, investors that benchmark their performance from the indicator have a difficult choice to make. Since JP Morgan analysts wrote this week: “We’ve recently fielded several calls by long-only investors that are confronted with or soon will have to deal with the choice of whether to purchase Tesla stocks. ”

The lender ’s response?

“We urge investors not burden Tesla stocks in their portfolio at equal proportion to this S&P since Tesla stocks are in our opinion and from virtually every traditional metric not just overvalued, but radically so. ”

Tesla stocks closed in 627 on Thursday. ”

The contrarian JP Morgan consider comes along with the other Wall Street banks have developed more bullish Tesla’therefore prognosis. Last week Goldman Sachs updated the stock from neutral to purchase, ratcheting their 12-month price target from $455 to $780. Since Fortune composed, “Goldman’s analysts mentioned a couple of reasons for the change of heartdisease. They consider EV adoption is accelerating because of battery costs falling faster than they’d anticipated, together with an increase in regulatory proposals to restrict or prohibit the selling of internal combustion motors during the upcoming few decades. Consequently, the analysts ‘currently anticipate EVs to include 18 percent of revenue worldwide in 2030 and 29 percent in 2035 (using 50% adoption in 2035 in the US and in Western Europe).’ ”

Wedbush analyst Dan Ives also updated the stock, adhering a “bull instance ” goal of a $800-$1,000 on TSLA stocks (his 12-month goal, meanwhile, is currently under Goldman’s at $560).

Truly, gambling against Tesla was a stressful proposal in 2020. Since Fortune‘s Aaron Pressman composed lately, “Short vendors, such as Enron-conquerer Jim Chanos, have dropped so much money gambling which Tesla’s inventory would fall (it’s ’s upward nearly eightfold this season ) which Institutional Investor dubbed it that the ‘widow-maker exchange of 2020. ’ With this season, the cumulative reduction of shorters on Tesla surpassed $35 billion. ”

And if some Biden Administration is likely to become a good for Tesla and its ilk, the principal concern about the inventory is still the simple fact that the organization is too reliant upon a declining firm of selling emissions credits, which it simply can’t sell cars to warrant its present market cap. Since JP Morgan reasoned: “We don’t think Tesla will develop to approximate 2x the joint size of Toyota & VW in exactly the same perimeter (or even 1⁄2 the joint size in 4x the perimeter, or some of these other mixes of volume and perimeter which may possibly be reverse engineered” to justify the current evaluation.

That is the reason why the lender has an “underweight” score on the market, with a cost target ofyes you’re reading this directly –$90.

Much more must-read fund coverage out of Fortune:

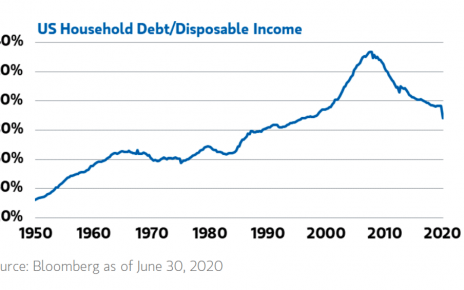

- Why are not people in a second Great Depression?

- The IRS effectively pinpointed the tax break which created PPP loans thus precious

- A 100 million “virtual energy plant” could set a stop to California’s electricity woes

- Robinhood’s following experience : Stealing market share by the wealthy

- Commentary: The 20 most crucial private finance laws to survive with