China, Japan, and South Korea are reconsidering their foreign coal jobs. Here is why.

Fifteen decades ago, coal has been entering a new golden era. China started ridding heaps of fresh coal-fired energy plants each year, and India, together with other developing nations, followed closely in its entirety to meet rising power demand.

However, the latest jobs funded by East Asian states pose a exceptional threat: Their traditional lifespan means that they would run beyond the 2050 deadline where the usage of coal has to be phased out to restrict the global temperatures increase to 1.5 degrees Celsius, according to the Intergovernmental Panel on Climate Change. In case carbon-capture technology is not additional to coal plants to reduce their emissions, then that deadline goes around 2040, then a Climate Analytics research found.

Luckily, the stunt in coal growth is slowing. China and India are cutting on building of coal power plants because 2015 (although too many crops remain in the pipeline), along with other developing nations have begun reconsidering the coal-first growth model in favour of more economical and less-polluting choices. In the last several decades, lots of important new coal jobs are postponed or canceled in nations by Kenya into Vietnam.

Whether they could bring funding is a critical element in how fast developing nations move away from irrigation electricity. Throughout the past ten years, Japanese, Chinese, South Korean, and Chinese banks now have poured cash into coal electricity growth worldwide. Their people financial institutions, that aid national coal-related companies pursue profitable overseas markets, are especially crucial enablers. But that cash is beginning to dry up.

Back in July, Japan announced it could limit its public associations from encouraging coal electricity growth overseas (although not banning it entirely — more on this below). After that month, South Korean lawmakers suggested invoices to prohibit 2 state-run banks along with its biggest usefulness, Korea Electric Power Corp., by servicing coal jobs. In early December, China became the latest nation to indicate a movement away from coal funding.

A fresh study directed by specialists from China’s ecological ministry suggested discouraging the nation’s investment in coal jobs on its own Belt and Road Initiative, which {} includes 138 states .

“When I remember correctly, this really is the very first time some Chinese policymaker openly endorsed the idea of really shifting Chinese investment apart from coal irrespective of its efficacy,” explained Shuang Liua climate fund specialist in the World Resources Institute and also a part of this study’s research group. For China, the largest public financier of this planet’s coal electricity development in the last couple of decades, this change could have enormous implications for the international climate.

But before these East Asian nations definitively ban authorities assistance for most new jobs, these openly endorsed coal jobs may be a substantial source of emissions. China, South Korea, and Japan now allow a bit more compared to 69 gigawatts of coal power under growth beyond their boundaries, as stated by the International Coal Public Finance Tracker. That is roughly one-fifth of the US’s recent coal-generating potential . Coal energy projects under development with assistance from Chinese state banks and businesses alone would contribute to 433 million tons of yearly carbon dioxide emissions by 2030 — the equal of Turkey’s emissions at 2018.

The current signs out of the East Asian financiers indicate an alteration in course could indeed be forthcoming. Domestically, Japan, South Korea, and China have changed toward accepting climate change seriously: Beginning with China, {} nations dedicated this autumn to attain net-zero emissions from the middle of this century — before the largest economic rival, the United States.

But powerful political and financial forces are still forcing their service of coal electricity in the home and abroad, with lethal air pollution and greenhouse gas emissions rather enormous, discounted prices.

The Very Last lenders: The Way China, Japan, and South Korea became thus Essential to developing nations’ coal electricity ambitions

Should you take a look at a record of international coal jobs in the past few decades, just about all the public fund flows out of East Asia.

Previously, Western authorities financed coal jobs to encourage their coal companies’ global ventures. However, a few years ago, that {} to change. Then-President Barack Obama declared in 2013 the US would no more place taxpayer money behind overseas coal jobs. Even the World Bank, many European nations, along with other significant lenders also prohibited or limited coal fund that year because of climate issues.

Their service isalso, in substantial part, since foreign coal jobs have provided enormous business opportunities for their businesses, based on Tim Buckley, a specialist on electricity finance in the Institute for Energy Economics and Financial Investigation (IEEFA).

During their very own domestic coal energy creation, East Asian businesses have become leaders in all parts of the coal industry, from tanks manufacturing to structure. And those companies have expanded overseas through government assistance .

“The reason they’re ready to acquire the huge bulk of these tenders for constructing new coal-fired energy plant is since they’ve ECA fund in their pocket,” said Buckley, speaking to government export credit agencies (ECAs) and banking which are intended to encourage their homegrown businesses.

Considering that 2013, these 3 nations have provided funding for 84 gigawatts of coal electricity growth, together with Indonesia, Vietnam, and South Africa since the leading receivers, as stated by the International Coal Public Finance Tracker. China has dominated, using state-owned monetary funding or state-owned venture investment going toward mining and electricity jobs at 53 gigawatts of power. (The power of a huge coal power plant is approximately 1 gigawatt.)

This does not imply China, Japan, and South Korea are pushing coal plants around developing nations. Their financial aid makes coal jobs more appealing, according to Buckley, however, research has also revealed strong need to improve energy production from fast growing developing nations. A current research printed in Energy Research and Social Science discovered that Chinese-backed coal jobs from India, Indonesia, Vietnam, and Bangladesh were mostly pushed by policies in those states that are favorable to coal growth and, sometimes, hostile to renewable energy.

However, in case the financial lifelines out of East Asia vanished, these jobs will have a more difficult time getting off the floor. Public fund from China, Japan, and South Korea was a”crucial de-risker” for developing nations seeking to build coal plants without even taking on the fiscal burden,” Buckley explained. “In case you do not possess [ECA] fund, you’re not likely to go and construct up a [multibillion-dollar] job that’ll take you five or 10 decades,” he added.

China and Japan have defended their own service for international coal plant building in the last couple of years by asserting their businesses assemble high-efficiency coal jobs and the plants are a route to economic growth for low-income nations.

{Though Japan and China do {} exceptionally effective coal plants, even the very effective (ultra-supercritical) plants cut carbon emissions from just 9 percent in contrast to subcritical plants,” as stated by the Natural Resources Defense Council (NRDC). |} Again, infantry has to be performed between 2040 and 2050 to remain below 1.5°C of heating, that’s the goal of this Paris climate arrangement. Meanwhile, the renewable energy is currently cheaper than coal in several of developing nations, also BloombergNEF jobs by 2025, it is going to not be as costly to develop new solar and wind plants compared to operate coal plants.

One, Japan, South Korea, and China have started to admit this reality during the past couple of months.

Japan has got the clearest dedication of the three thus far. Its new policy, announced in July, is set to take effect this season. It bars that the Japanese authorities from encouraging overseas coal jobs”in principle.”

At a joint announcement published that month, national and overseas environmental NGOs in Japan stated it had been”one step ahead” but also recorded a number of concerns. The coverage leaves space for funding the most effective coal plants, even when the recipient country has a extensive decarbonization strategy set up and no presently available choice. In addition, it permits jobs currently in the pipeline to move while Japanese ecological classes demand a direct withdrawal from jobs in evolution.

In addition to this overarching government coverage, human Japanese private and public banks have additionally declared coal imports. The Senate of the Japan Bank for International Cooperation, the people bank accountable for a lot of the nation’s overseas coal funding, advised that the Japanese press outlet Diamond Online from April the lender would take no additional software for coal electricity projects.

Meanwhile, the lawmakers from South Korea suggested four statements from late July that could stop government-backed businesses and banks by pursuing international coal jobs. He stated a record amount of legislators questioned the nation’s coal fund plans during the yearly audit of state occasions in October, along with also the state-owned utility KEPCO declared it had no plans to pursue growth of new coal-fired energy plants overseas moving forward.

Until December 1, even the largest outstanding issue was if China — that the best coal lender — could also start to align its own overseas power fund policies using its demanding domestic carbon-neutrality pledge produced at September.

A fresh study Inspired from the Chinese Ministry of Ecology and Environment and non-governmental specialists demonstrates some officials are beginning to think critically about the climate dangers of its overseas jobs. The researchers suggest categorizing jobs as yellow, red, or green according to their possible negative effects on”climate change, pollution prevention, and biodiversity protection,” according to this report. The writers put coal electricity projects from the insecure red category on account of their carbon footprint also explained that no reduction measures may be employed to bulge these jobs into the green group.

“I think it’s enormous progress {} a very clear announcement in the people that are attempting to green that the Belt and Road there are obviously engineering which don’t fit in that class,” said Han Chen, an energy specialist in the NRDC who monitors global coal fund.

On the other hand, the writers don’t state that reddish jobs ought to be completely banned from getting real estate investment, but instead they need”strict oversight and regulation” They likewise don’t clarify the way the traffic-light system may be transformed into some binding coverage .

But, the World Resources Institute’s Shuang Liu, that co-authored the analysis, also sees this as a substantial step in this type of policy. “The report was endorsed and endorsed by the {} , and our understanding is the ministry is ready to interpret the accounts into policy guidelines, that is a far more important policy sign to each of the Chinese stakeholders included with foreign investment,” she explained.

With over 56 gigawatts of {} plants encouraged by Chinese people funding under evolution, how and if the proposition is made concrete may have a substantial impact in the future emissions of many developing nations.

What is forcing East Asian fund from abroad coal jobs?

While these policy statements and changes against Japan, South Korea, and China don’t amount to a ban on fresh coal funding, they signify an undeniable tendency toward winding {} participation.

What’s caused these states to begin coming around with this particular issue in just a matter of a few years? Lately, the coal electricity sector — along with its financiers — are all beginning to feel pressure from many sides.

At the surface of this US-China trade warfare and Covid-19, China has significantly radically reduced its own Belt along with Road Initiative investment throughout the board, such as for energy jobs .

International and national complaint directed at coal jobs has played an important role. In COP25, the most recent version of UN climate discussions held in 2019 at Madrid, Spain, UN Secretary-General António Guterres known for new coal plants to be constructed after 2020. Koizumi, Japan’s environmental ministry, informed that the Financial Times the outcry over Japan’s coal service in COP25 — that comprised a demonstration comprising giant illuminated Pikachu outfits — induce the authorities to take additional action on the situation.

Asset managers will also be pushing against the banks and businesses on the situation. Last month, the European capital composed a correspondence criticizing Japanese and Korean teams due to their participation from the Vung Ang two coal power station being assembled in Vietnam.

Together with global pressure, states that were intending important coal electricity growth have begun to alter course, also. As stated by the International Energy Agency’s 2019 report on electricity from Southeast Asia, current alterations to energy programs in the area have raised the share of renewable energy at the cost of coal because of worries regarding pollution and the rising cost competitiveness of all renewables. Vietnam had led the way with solar energy growth, along with other nations in the area are following suit — such as the Philippines, that declared a moratorium on new coal energy growth at October.

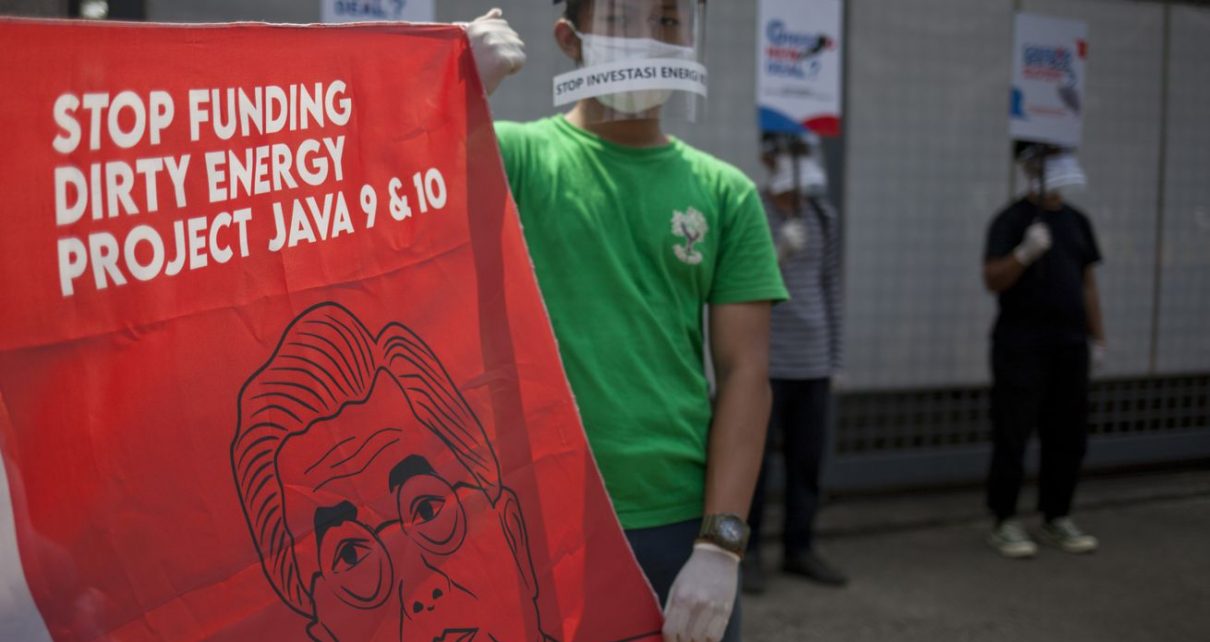

Activists have stopped in their tracks quite a few coal jobs that had procured funding from East Asian banks, such as a 1,050-megawatt job in Lamu, Kenya, along with also the 600-megawatt Thabametsi plant from South Africa, each of which were tabled after long environmental suits and advocacy efforts.

Coal energy remains appealing to some authorities, especially the ones that have national coal reserves, including Pakistan and Indonesia, stated Yiting Wang, a senior strategist with all the Sunrise Project who specializes in the climate consequences of China’s international holdings.

However, as the IEEFA’s Buckley pointed out, government-subsidized funding was a crucial element of what’s made coal electricity so enticing. “The major problem is that a coal job isn’t likely to win when it does not possess a subsidy,” he explained.

But with the exception of a couple of important popular spots, it seems the age of coal power plants could be {} to draw to a closefriend.

“Out of a number of the significant nations which are still chasing coal, such as China, India, and Japan,” I feel as there’s real hope that we’ll most likely be seeing a number of the previous coal plants which are being chased by programmers,” Wang explained.

We will have to wait further information from China, South Korea, and Japan to check whether they will interfere or help quicken the transition.