Interest rates are still hover near, and several believe the stock exchange has been overbought. In conclusion, many traders are trying to earn money by gambling on more exotic assets like artwork, cryptocurrency, and classic sneakers.

These kinds of stakes –called other investments–are hardly fresh. Hedge funds and rich people have dipped in them for decades in a bid to beat the market. But more recently, an increasing amount of internet forums have arisen to pitch these investments into a wider public. Examples comprise Yieldstreet, which enables individuals invest in everything from boats to the results of suits, also Masterworks, that invites investors to buy stocks in excellent art.

Now, there’s a new platform which allows folks peruse 50 of those forums’ offerings around precisely exactly the identical site. The website, that has been working in stealth as this summer, is named Vincent and it is the brainchild of all Slava Rubin, that founded the most favorite crowdfunding website Indiegogo.

Rubin says that he was motivated to make Vincent awarded the rising popularity of other investments, and that, he notesare anticipated to rise from $9 billion to $14 trillion in the following five decades.

“As a macro craze within this interest rate environment, other investments are thicker than ever before. But there is still a significant Quantity of people intimidated by them,” says Rubin, further describing his inspiration to the Website.

Rubin adds that Vincent has been meant to be”that the Zillow of investments,” referring to a popular property website.

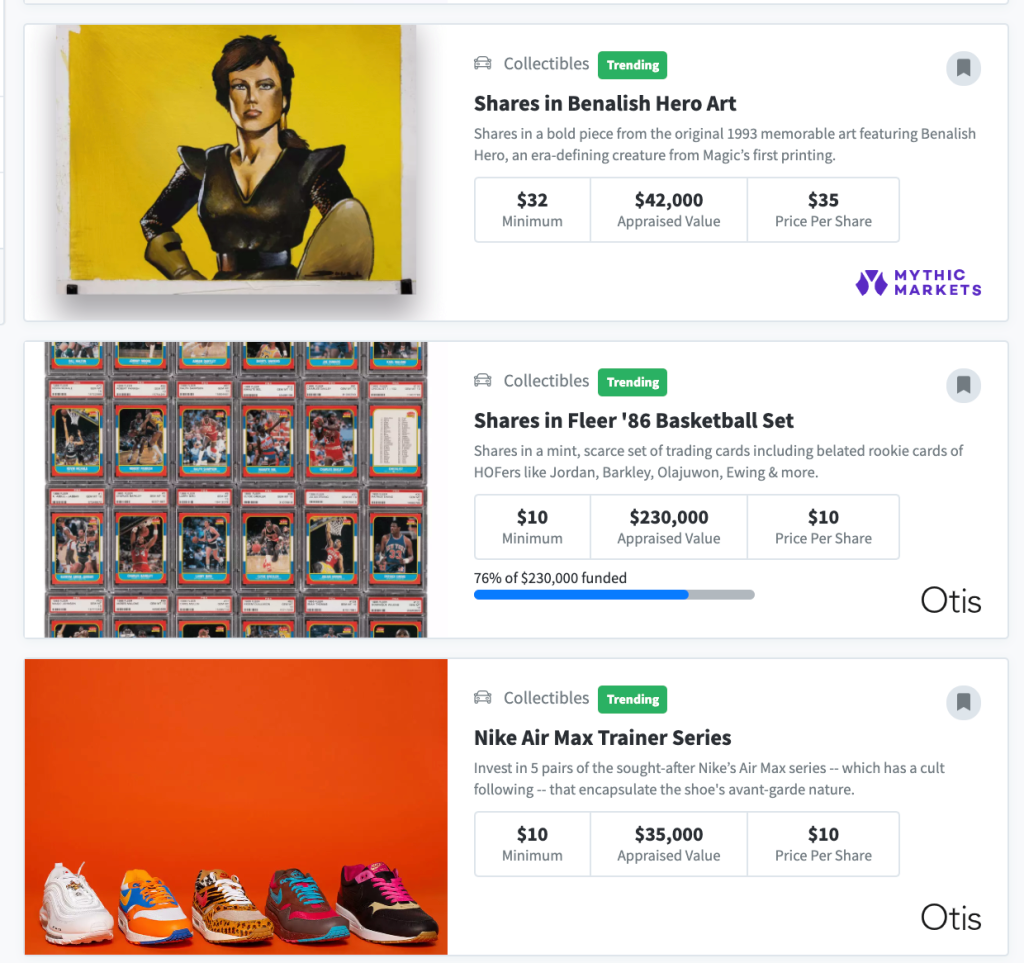

In practice, people who wish to research alternative investments employ a collection of filters, such as how much they really need to spend and the classes to which they’re attracted. (Alternatives include antiques, artwork, and property ). Vincent then shows a selection of choices drawn from the dozens of partner websites.

The website also asks whether the prospective investor is licensed –a distinction that’s dependent on a individual’s internet wealth and that may limit the kinds of investments they’re entitled to create. The screenshot below shows a sample of all these possibilities accessible in the souvenir category:

The opportunity to have a tiny share of an uncommon Nike sneaker or even a costly painting may attract a lot of people, but additionally, it raises the issue of if {} investments are valid. This is particularly the case given beyond controversies between crowdfunded investment opportunities, which in some instances have been shown to be scams.

Rubin states Vincent is relying upon its associate platforms to maintain charlatans away from the website, noting that these programs are modulated by several financial authorities, such as the SEC.

In terms of the way the website gets money, Rubin claims that investors may use it free of charge but Vincent carries a commission out of its partners. Rubin established the website using a $2 billion investment, comprising their own money and of a couple of angel investors.

Much more must-read Fund policy out of Fortune:

- Exactly why the Ability to change the female-founder double normal rests with VCs

- Wall Street culture conflict: If Coinbase fulfilled Cantor Fitzgerald

- The way the Slack/Salesforce bargain piles around history’s other Large Tech acquisitions

- Robinhood’s next experience : Stealing market share by the wealthy

- Denied unemployment gains ? Here are the choices