This summertime, investor Nathan Anderson acquired a hot tip. The topic: Nikola Corp.

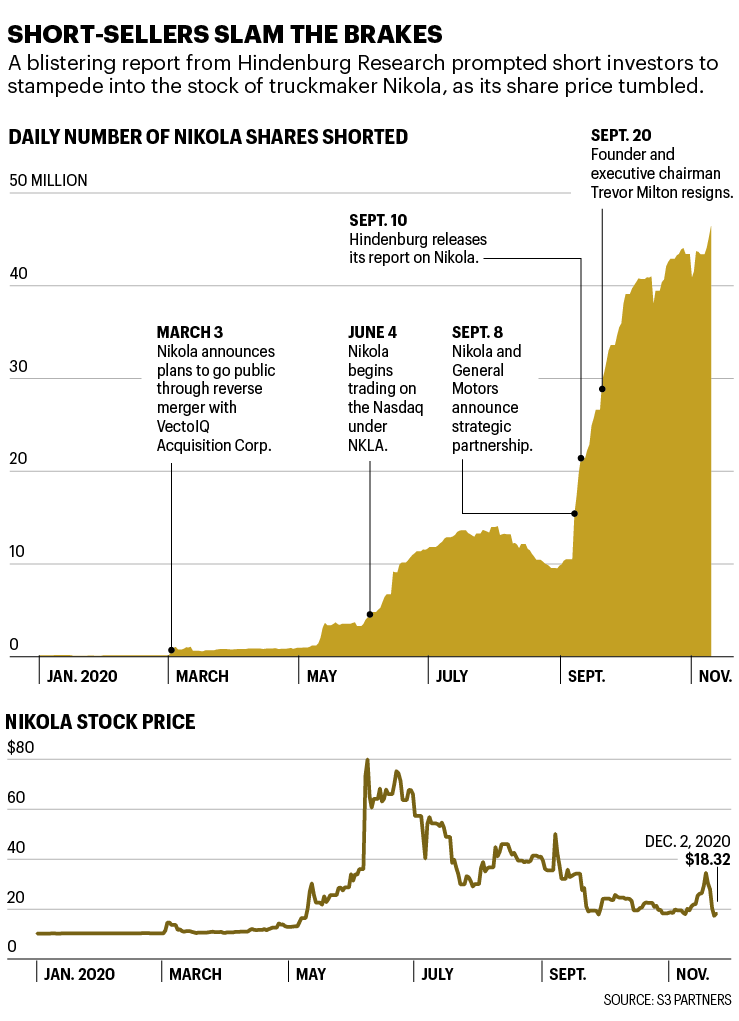

{On June 4, the Phoenix-based electric-vehicle manufacturer had gone {} a reverse osmosis. |} At a year of euphoric requirement for growth stocks, especially EV manufacturers, this one dropped out. Nikola bulls thought that the firm would perform for hydrogen-powered, long standing trucking what Tesla has performed for electrical automobiles. Inside a week, the investors had driven its market cap over $34 billion, sufficient to overtake Ford and Fiat Chrysler although the upstart had to sell one car or truck.

The tipster was not buying the hype. Neither was Anderson, a 36-year-old CFA switched whistleblower flipped short-seller.

The origin set Anderson, the creator of Hindenburg Research–a five-person investment research company with no customers, no permit to handle investors’ cash, without a telephone number or address on its own site –connected two former business associates of Nikola. The informants turned upwards of a cache of text emails, messages, and photos which cast doubts about, among other matters, many public announcements made from Nikola and its creator Trevor Milton regarding the corporation’s progress in creating hydrogen and battery fuel cell technologies.

All these were allegations. However one accusation struck Anderson as nearly too flat-out mad to consider at face value. It had to perform a movie Nikola submitted on YouTube from January 2018 including the Nikola One semiautomatic, its own first prototype rig. The movie indicates the truck cruising throughout the desert beyond Salt Lake City. It opens with a very lengthy shot of this Nikola One moving toward the camera in high rate, barreling along a broad valley. The sun glistens off the doorway as well as the glistening white roof because it erupts across the framework.

It created tens of thousands of viewpoints on the internet and obtained broad pickup in the automotive media. This really is a massive statement!”

The insiders maintained the entire thing was staged. The truck was not traveling under its own energy, they informed Anderson. Rather, it was towed to the peak of a hill. The man in the wheel {} it into neutral and opened it on its travel downhill–gradually at first, then accelerating.

The notion that Nikola had been pulling a fast one would not count as blatant fraud, Anderson understood, since the movie did not explicitly assert the truck had been first self-propelled. But exposing the screenplay could show the sort of razzmatazz that the business was technology to preserve its own hype. Anderson’s issue: How can he establish that the video has been a ruse?

A self-described”obsessive digger,” Anderson employed a method that is common to the open-ended investigations from the Internet’s most cynical corners. He helped him set the exact location of this movie shoot{} to the specific mile mark at which the Nikola truck came to rest along with the beginning point of its travel. He called one of the connections at Utah with an odd request: Visit this very area and recreate the truck roll up, and picture the whole thing. The touch did so, albeit at a 2017 Honda Pilot SUV. It gathered for 2.1 miles and attained a maximum rate of 56 mph entirely in impartial.

Bingo.

That said, Anderson could reveal the way the firm had pulled off the movie –a proof stage of Nikola moving to great lengths to deceive the people. He composed his findings, replete with maps and photos. “You only need to be 100 percent on these matters,” he notes.

Hint No. 1 for prospective shorts

If you are planning to take a significant inventory, then sweat the little stuff.

“Now we show why we think Nikola is a complex fraud constructed on heaps of lies within the duration of its Creator and Executive Chairman Trevor Milton’s livelihood,” the report began. The launching page place the tone: It comprised 24 bullet points which poured cold water to the business’s claims that it had been creating proprietary battery technologies, which it had cracked the code {} hydrogen gas generation. The analysis took repeated swipes in Milton. Plus it laid bare the way the organization gave the Nikola One more push to get upon the desert ground.

For good thing, it included,”This is a hit task for short sale gain driven by greed.” But three days after, Nikola delivered a more comprehensive answer –where it copped the Nikola One wasn’t constructed to”push its own propulsion.”

The harm has been swift. The inventory cratered, and buyer suits started to mount. At a regulatory filing in November, the business disclosed that the Justice Department had issued grand jury subpoenas from Nikola and Milton, which the Securities and Exchange Commission was investigating if Nikola had authorised shareholders. “We have incurred substantial expenditures as a consequence of the legal and regulatory issues regarding this Hindenburg Report,” Nikola revealed. (Nikola dropped several requests to answer inquiries on the issue. Reached via a spokesperson, Milton, that also called the record”false and deceitful” in September, wouldn’t comment further.)

Considering that the report fell, Nikola’s inventory has dropped 30 percent, also Milton has stinks. However one cohort has walked off the greater from the truck mess. Due to mid-November, short-sellers–Anderson one of themhad made $263 million into mark-to-market earnings from Nikola’s dip, based on S3 Associates, a company that monitors short action. And they obviously expect to make more: Over a third of Nikola shares outstanding were shorts.

Bull markets, even the expression goes, discount bad information. And should you put aside the black-swan pandemic-driven crash of ancient 2020, U.S. stock indicators have already been in bull style because the fiscal crisis, nearly 12 decades back.

Anderson’s company a part of a cadre who distinguish themselves by several names–a few showy (“brief activists”); a few self-righteous (“whistleblowing short-sellers”); a few unnaturally trivial (“activist investigators”). These traders investigate goals suspected of unethical behaviour, then introduce them and brief them.

They discuss gimlet-eyed DNA using financiers big and small who have completed exactly the same{} Jim Chanos, that shorted Enron while caution regarding its bookkeeping skulduggery, into the non contrarians who gamble from the subprime bubble, to CNBC-darling hedge fund managers such as Bill Ackman and also Daniel Loeb.

The brand new breed–the tiny large shorts–stand out as, by and large, whistleblowing and shorting is all that they perform. Recently, they have delivered lots of pelts from openly traded Goliaths, driven by thoroughly documented jeremiads whose particulars rocket over social networking and the company media. And with a few exceptions, they get it done to themselves, not to customers: They set bets using their own saliva, so many regulations do not affect them. Anderson assembled a private short place in Nikola throughout summer time as he became convinced that he could choose the business down. Critics fume the shorts’ activities represent a clear conflict of interest. The same as they fire –no battle, no attention.

Carson Block says that he did not see short-selling for a profession if he first published his first brief report from 2010. However, in recent years after the fiscal crisis, as investor appetite for expansion stocks drove gigantic valuations, it increased gigantic red flags for Block. {His company’s success in exposing fraud–and profiting from it{} copycats, a lot of whom were {} hell on investor message boards.|}

Considering that 2010, Muddy Waters has released brief strikes on 38 businesses. It came into fame from shorting Chinese companies recorded in North America, subsequently providing catastrophic haymakers at the shape of free oppo study published on the internet. The accounts torpedoed the company’s stocks, and it went bankrupt a year after. Sino-Forest refused Block’s allegations, however, Canadian authorities finally discovered that its leaders had perpetrated fraudas well as the company depended on an avalanche of investor suits. Before this season, Block went following Luckin Coffee. The business later revealed in an SEC filing that it had inflated its own 2019 earnings by $320 million and also prices by $200 million. Its CEO and COO have been fired, along with the Nasdaq delisted the firm because of the misbehavior.

Though Chinese companies have been Block’s initial concentrate, he understood the defects he discovered in these businesses could be seen anywhere. “The conflicts of interest, the ineptitude, the laziness that allowed those empty boxes to increase cash from the U.S. and exchange in actual valuations–I mean, people are international problems,” he describes.

Among those California-based company’s best-known takedowns came nearer to home. However in August of the calendar year, Muddy Waters entered the scene with all firearms, announcing a brief spot in St. Jude and found that a number of its pacemakers and defibrillators were exposed to hacking. The revelation driven St. Jude shares down 10 percent in one moment.

The Muddy Waters report relied heavily upon evidence published by MedSec, a cybersecurity analysis company. {MedSec had approached Block’s team {} all the juicy info, instead of alerting St. Jude each Food and Drug Administration guidelines. |} St. Jude sued Muddy Waters and also MedSec for defamation. The shorts in; the defamation lawsuit was finally dismissed.

In the hop, activist brief efforts are antagonistic–that the tone is Accounting 101 matches WrestleMania. The shorts endemic fraud at the greatest levels. “Money catch,” is a phrase that appears frequently in the accounts. A Chinese sportswear business isn’t only cooking its books, it is falling”turds from the punch bowl,” blares a Muddy Waters report.

The attack-dog terminology is deliberate. (Ackman, the hedge-fund manager famous for his brief stakes, has honed it into a fine art.) Short-sellers get no issues for prosecuting a fantastic argument. Their study pays off only when the reader chooses actions, ditching her stocks.

Suggestion No. Two

Anticipate a struggle, and do not play nice.

It appears every activist brief has horror stories that they can dine out about: the whale which almost destroyed them, the suits, the PIs along with PRs, the aggressive labs, the death risks. Fraser Perring, creator of Viceroy Research,” states one of his own brief targets sent heavies into his native England at an awkward attempt to kidnap his daughter. (Fortune couldn’t confirm this claim) “At one point there have been bugs in the kitchencameras at the market. This was something from a book,” he states.

“Lots of men have gone and come in brief activism” within the last ten years, Block states. “People thought,’wow, that is truly straightforward. It is a terrific way to earn money.’ And it is not. Owing to being over the lengthy side, it requires much more effort to create each dollar”

Shorting stock is not for the faint of the heart. Assuming a stock will drop an investor opens”brief” position by calculating stocks –state, 1,000 stocks of Nikola. He also sells them for money. He will finally have to purchase 1,000 NKLA stocks to come back to the lending company. That is called”shutting out the brief.” The longer the share price drops involving closing and opening, the more cash the wager makes.

It may easily backfire. “You can simply make 100 percent of your equity over a brief,” Perring describes. If the share price drops from $20 to zero, the gap –$20 percent –would be the own take. But when the cost collapses, your losses twice. In case the cost triplesyour losses. And so Forth. (That is 1 reason many shorts have dropped their tops Tesla, a stock which has been up nearly sixfold year so far as of Nov. 19.)

Viceroy, a three-person store, has the work force to investigate just a few companies each year. Wirecard has been far and away its main dent, Perring states. The share price of this now-insolvent German obligations supplier dropped from $104 at mid-June about 60cents this month after the accounting scandal that landed prior CEO Markus Braun in prison. After whistleblowers, journalists, along with short-sellers such as Perring leveled allegations of malfeasance in Wirecard at 2019,” Germany’s securities regulator, BaFin, researched the tattlers rather than BaFin also briefly pinpointed short-selling of Wirecard stocks:”short strikes,” it stated,”introduced a threat to advertise integrity.” But further evaluation vindicated that the critics, sparking a nationwide event in Germany’s conservative investor civilization.

“Wirecard has been a warfare, a four-and-a-half-year fucking warfare,” Perring groans. At one stage,” he states,”I had been unwanted countless. And that is not bragging.”

“I believe fraud is much more pervasive than any moment I have been at the marketplace.” Until authorities measure up,”we are likely to find a proliferation of actors that are short.”

Nathan Anderson, Hindenburg Research

The 47-year-old claims that his ship arrived in 2020, because of Wirecard along with his muckraking supporting Grenke,” a German leasing firm that Viceroy came later in a report from September. Viceroy’s central complaint is that Grenke used imports to vague how small money it had on its own publications. Viceroy’s offenses are”entirely unfounded,” Grenke mentioned in a declaration; nonetheless, the damage was severe. Grenke stocks are down one-fifth because the report came out, along with its creator stepped apart from the plank. BaFin, meanwhile, started an investigation to Grenke days following Viceroy’s report struck; it had been continuing at the time.

Perring has taken lots of arrows to get his brief strikes, in addition to because of his behavior away from the marketplace. A former social worker, that he had been barred from these job in England eight decades ago after allegations he forged records. (He even sued his former employer and also won a settlement in this situation.) Perring shrugs off his critics. “If you are concerned about your self, then do not enter short-selling,” he states.

After pressed Viceroy’s financing, Perring would just say he’s one external backer, whom he wouldn’t name. “We have never commented about our gain,” he adds,”because we are just like our final accounts anyhow.” That is even more peculiar in 2020, Block climbs; for each Nikola, there”are likely five very frustrating outcomes.”

Suggestion No. 3

Much like Hollywood, short-selling is a hits-driven racket.

FOMO rallies. The retail-investor military. The 60 billion prosper at blank-check IPOs. Cumulative brief positions held on NYSE-listed companies normally hover between 4 percent and 6 percent of shares outstanding; from early November, they’d dropped to less than 1 percent.

The exuberance continues despite the fact that we are enduring the worst downturn and labor-market collapses in {} ; which firms are piling debtthat earnings have dropped. Advisors at banks and agents –the go-to search source for most retail investors–are not just enjoying with the skeptic. FactSet calculates {} 10,322 analyst evaluations affixed into the stocks at the S&P 500, just 6.2percent are a”market” It appears like we have purchased a puppy to get us throughout the ordeal, and Wall Street can not locate any.

Much Nikola, for all its defects, has managed to remain afloat about the rising wave: Soon before the Hindenburg record has been printed, General Motors explained it’d purchase a bet in the business and might consent to cooperate using Nikola on fuel-cell along with pickup-truck growth. Publicly, GM claims that the venture remains a move, however on Nov. 30 that the Detroit automaker climbed back its participation also explained it wouldn’t require an equity stake whatsoever.

Within this permissive age, the shorts view themselves as a essential force once and for all. From the Wild West, they are sheriffs– even sheriffs who push Audis, mind. “I believe fraud is much more pervasive than any moment I have been at the current marketplace, clearly,” states Hindenburg’s Anderson. Until authorities and auditors step their game up, he also adds,”we are likely to continue to observe a proliferation of actors that are short.”

Hint No. 4

Do not shoot the messenger, at the least till later you have read the accounts.

Nikola is not Anderson’s first huge spade, but it still stands out. Normally, his reports enrage very long shareholders, also he hears against them. “We receive more angry mails, or death threats to kill me along with my whole family,” he states. But maybe not that time. In reality, kudos are coming in by a difficult audience: fellow shorts. “The Nikola report,” Perring claims admiringly, is”bulletproof.”

A variant of the story appears from the December 2020/January 2021 issue of all Fortune using the headline,” “Small shorts: Sheriffs at a Wild West marketplace. ”