Great morning. Bitcoin bulls have pushed the crypto money to a close three-year high from the previous 24 hours. Meanwhile, about the stocks front, Monday’s vaccine rally stays on vacant as U.S. stocks are largely flat. Instead, they ’re off their highs, nevertheless, after the combined commerce we’re witnessing in Europe and Asia.

Stocks could be silent this afternoon, but finance managers have not been more bullish. I dig to the findings BofA’s most recent survey of this portfolio experts, identifying where the cash will be flowing as we go into a new calendar year. Suggestion: crypto isn’t called the best actor –not even close.

Allow ’s check on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are combined in day trading with Japan’s Nikkei down 1.1percent since the COVID situation worsens there.

- In its last days, the Trump Administration is pushing forward with programs into delist Chinese firms out of U.S. inventory exchanges. It’s ’s not getting much of an effect on Alibaba or even Baidu stocks; both are level in pre-market trading.

- Per-capita earnings in China is also soaring. It’therefore expected to jump almost nine-fold from 2025, that the IMF jobs .

- Great news for all those who rely transport containers to assess the health of international trade: logistics giant Maersk on Wednesday reported that a stronger-than-expected pickup in company in Q3, also has increased its advice.

- And ’s a little very good news for all those {} to eliminate: Europe’s airlines along with travel websites are visiting with an upswing in reservations in late days, coinciding with the most recent advancement on COVID-19 vaccine trials, indicating some optimism at the year ahead of the jet set. The little Russell 2000 closed slightly higher on Tuesday, however, also the Big 3 all completed in the red as retailers like Walmart along with Home Depot led the far reduced.

- “We are entering a tough winter” This ’s the way the Credit Suisse analyst summed up yesterday’s worse-than-expected retail revenue number. Black clouds are forming because of the key Christmas shopping season methods.

- More merchants report now, such as Target, Lowe’s along with TJX Businesses. You are able to follow our retail policy here.

- Stocks in Boeing are investing in 1.5percent high in pre-market trading before conclusion day. The FAA seems set to provide the 737 Max the green lighting afterwards now to fly .

- As is your buck .

- Crude is apartment using Brent trading about $44/barrel. The crypto money is trading over $18,000.

***

The “most bullish” accept on 2021

Bank of America printed yesterday its newest international fund manager poll, along with also the findings will probably cheer up everything you bulls.

It’s ’s the very impavid BofA record of this year. (Yes, I now ’m likely to get every excuse I would like to slide in the i-word; “impavid” really is a perfectly cromulent synonym for both “bullish,” I will see that Simpsons personality in my mind )

In accordance with finance managers polled by BofA, virtually what appears like a “purchase ” now.

”

This amount of exuberance must really come as little surprise. Generally, following an election cycle cash flows back to the markets. This ’s been the event every four years at the U.S. because the international financial meltdown.

And, however, the findings continue to be worth analyzing. Permit ’s zoom on a few of these points mentioned previously.

First stop: expansion. According to the survey participants, both development expectations are in a more 20-year high.

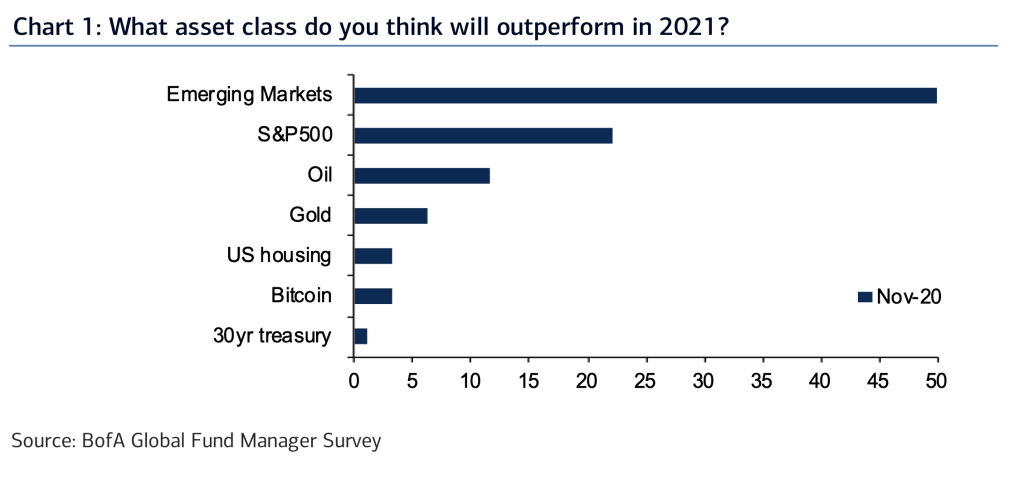

And, dialing up EM–emerging markets–vulnerability is also a rational play since the dollar drops and much more weakness is viewed at the year before . In reality, emerging markets can be regarded as the best out-performer for your season ahead, as the graph below reveals.

This ’s what grabbed my attention: Check oil out, No. 3 to the listing over, before Bitcoin. Perhaps there’s a few philosophical prejudice on the job. But{} , primitive is indeed beaten-down. It is sensible to think need will necessarily rebound briskly, delivering Brent and WTI greater in the year ahead.

Expectations are too very high for a bounce-back in business earnings.

The vaccine information is tripping the largest change in sentiment/strategy. Fund managers are visiting an “unambiguous turning to EM, small cap, value, banks, and financed by reduced allocation to bonds, cash, principles. ”

That brings me into the very fascinating lineup at the report:” The “reopening rotation may continue at Q4, but we state ‘market the vaccine’ in forthcoming weeks/months as we believe we’re near ‘full bull’ ”

Total bull? Is that possible?

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]