Back in September Walmart debuted its own 98 yearly subscription service which provides unlimited same-day shipping and reductions in gas stations. The agency, known as Walmart+, is a direct competitor to Amazon Prime, that cost $119 each year.

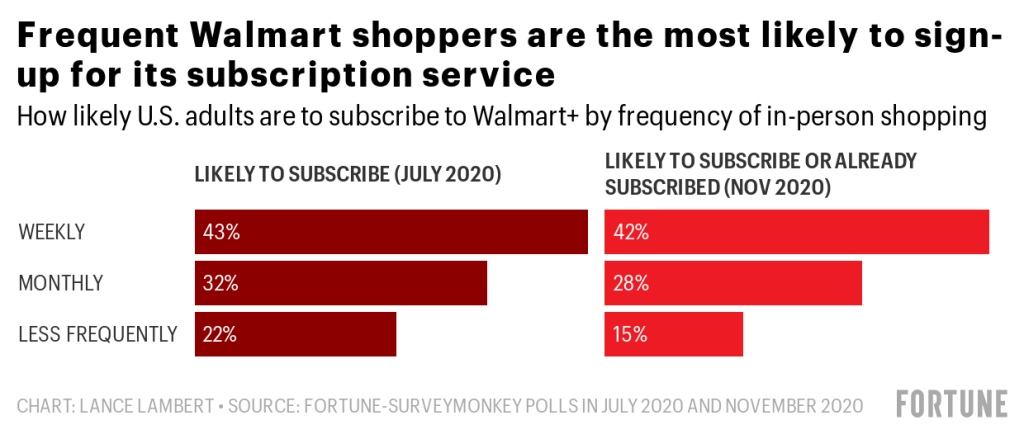

Fortune and SurveyMonkey ran a survey in July before this Walmart+ launching and found 27 percent of Americans were planning to join forces.

However, are such subscribers beginning to materialize? *

In the weeks since it established, 3 percent of U.S. families have signed up to Walmart+. Therefore it’s {} away until it could severely undermine Amazon Prime, that has subscribers in 66 percent of U.S. families.

However, more sign-ups are all on the road. One of U.S. adults, 21% say that they ’re planning to join to Walmart+, although 19 percent of Amazon Prime readers say that they ’re planning to sign up for Walmart’therefore offering. That may price Prime memberships. After-all why would anyone pay for 2 totally free of charge transport solutions?

Even the Fortune– based SurveyMonkey survey finds that the more frequently Americans store in-store in Walmart, the more inclined they are supposed to register to Walmart+. One of U.S. adults who shop at Walmart per week, 42 percent have subscribed to Walmart+ (7 percent ) or are most likely to (35 percent ). If Walmart will continue to convert those regular in-store shoppers to readers, it may develop a user base into the thousands.

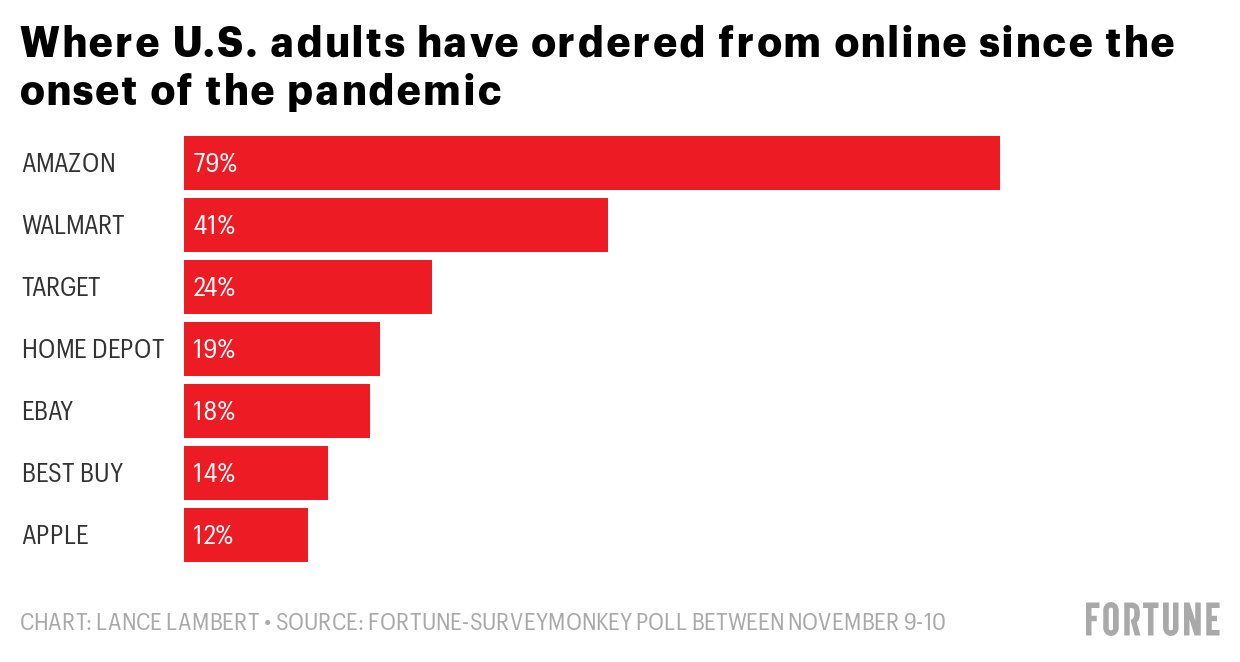

Walmart has poured billions into creating its own worldwide e-commerce company: By the own $3.3 million buy of Jet.com from 2016 to obtaining a stake in Indian e-commerce giant Flipkart to get $16 billion in 2018. And these investments–particularly in the U.S.–are all beginning to pay dividends. Since the beginning of the pandemic, 41 percent of U.S. adults say that they ’Id purchased on line from Walmart. Just Amazon, in 79 percent, has significantly more Americans ordering against it throughout the catastrophe.

From the U.S. alone, online revenue averaging Walmart and Sam’s Club shops $20.1 billion during the initial six weeks of 2020. This ’s up 70 percent in exactly the identical period a year before. International Walmart sales rose 22 percent to $6.2 billion during exactly the identical period. And if it’s too soon to tell if converting in-person shoppers to Walmart+ contributors will undercut the firm ’s in-store earnings, the boom at e-commerce has {} into wealthier Walmart investors. Stocks of Walmart (WMT) traded at $148.18 in the end of trading Thursday, a profit of 24.6% Nominal.

The findings are optional for race, age, gender, education, and much more.

That is an excerpt in Fortune Analytics, a exclusive newsletter which Fortune Premium readers receive as a benefit of the subscription. The publication shares comprehensive analysis about the most discussed issues from the company world at the moment. Our findings come in specific surveys we conduct and proprietary information we gather and examine. Subscribe to find the complete briefing on your inbox.