Here is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe for it on your inbox .

Fantastic morning. This didn’t survive. The vaccine muster is to pause this afternoon. Much Nasdaq futuresWednesday’s large winner, are as a risk-off mood hangs over international markets.

There’s one major exception: Chinese technology stocks are away multi-day lows, rebounding well.

The newest COVID data reveals new documents from Tokyo into Texas.

Permit ’s check on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are combined in day trading using Japan’therefore Nikkei upward 0.7percent . Its stocks are up two% at Hong Kong, following it along with the whole Chinese technology industry chose a pummeling in recent days. Alibaba rival JD.com is upward 7.7percent .

- Who states international exchange is in issue? China along with 14 additional Asia Pacific states are near to signing up a free-trade pact, the planet ’s largest .

Europe

- The European bourses have been a blur of red from the gates with all the Stoxx Europe 600 down 0.8percent .

- We now have a pandemic cost tag for Europe’therefore own banks. As stated by the ECB, the continent’s creditors confront that a $1.4 trillion financial cliff from the forthcoming months since poor loans heap up, along with the eurozone markets struggle to climb from downturn .

- We’ll be mentioning the logic of lockdowns for many years ahead, however there’s ’s an intriguing development occurring in Europe: a range of nations are visiting a fall in the amount of fresh COVID instances because imposing semi shutdown orders. (Ahem, I’d love to see further improvement here in Italy prior to compiling the “Mission Accomplished” flag… É un pó presto qua nel bel paese.)

U.S.

- U.S. stocks stage to a feeble open following Wednesday’s remarkable technician bounce-back.

- Shares in Moderna spiked over 8 percent on Wednesday–and this early in pre-market trading–after the biotech company announced promising information on its own COVID vaccine trial. The mix is comparable to Pfizer’therefore, stoking lots of confidence.

Elsewhere

- Gold is upward, but it’s ’s been a week to overlook its glistening yellow stuff. It’s trading under $1,870/oz .

- The buck is level.

- Crude also has exchanged in crazy swings weekly. Brent stocks are down, trading under $44/barrel this particular afternoon.

- Can Bitcoin best $16,000 now? Crypto bulls are running the cost … A reminder: to the latest on all items crypto, check out Fortune‘s amazing publication, The Ledger.

***

Buzzworthy

Then quit: 3,700

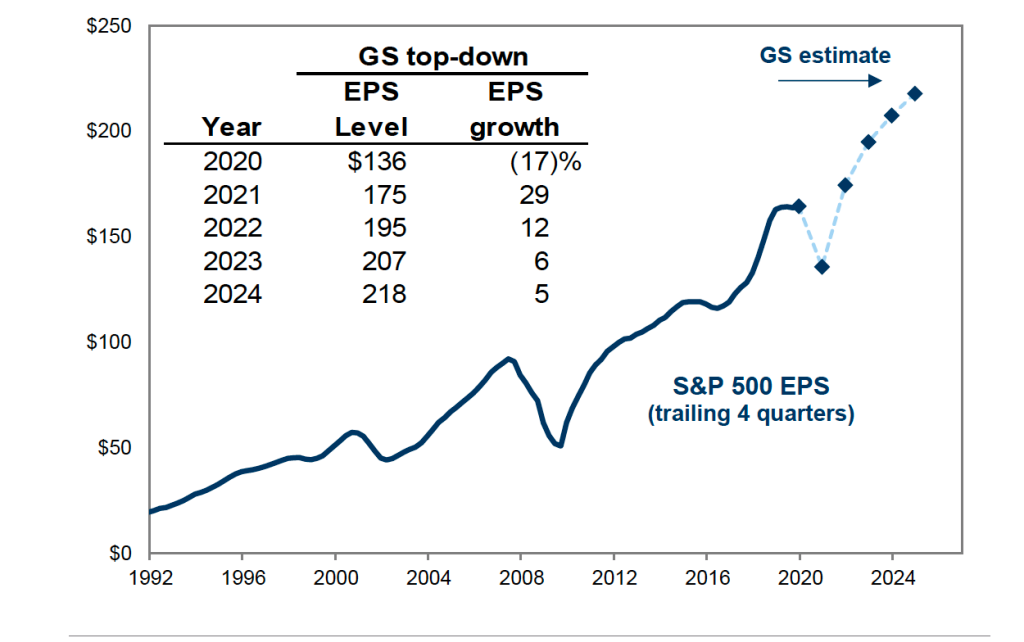

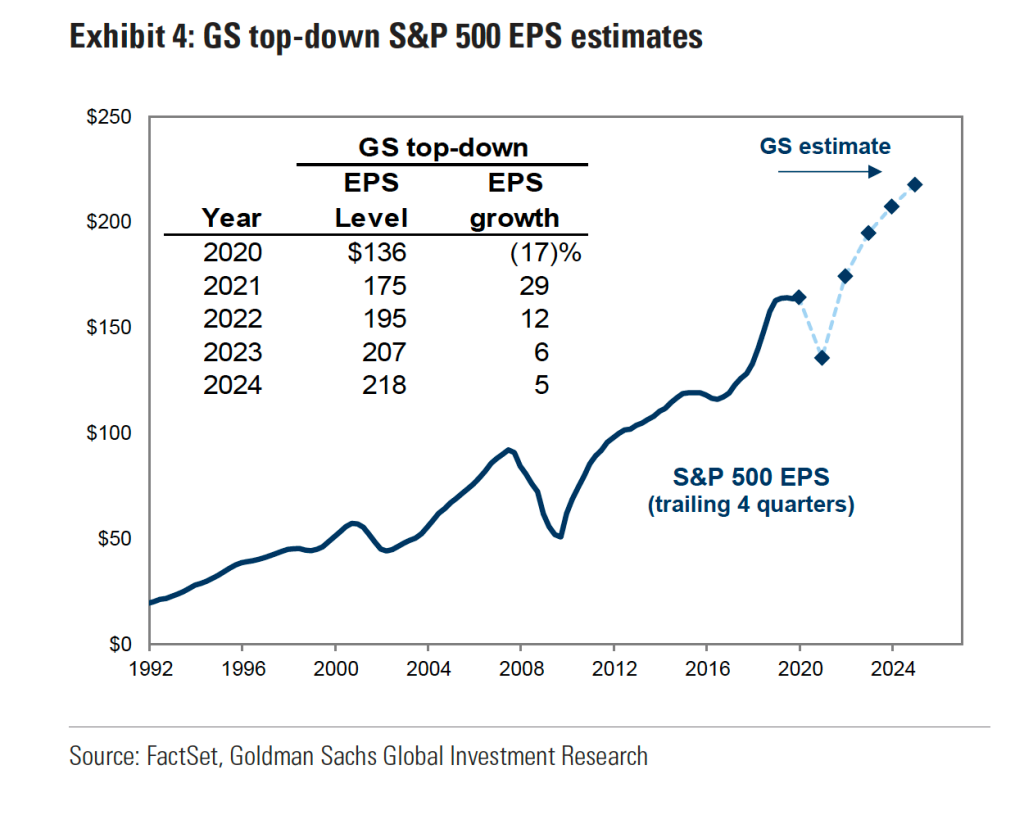

Goldman Sachs awakened its own year-end stocks projection today that we’ve got more prominence onto a vaccine, which we currently know it is going to be a Biden presidency (having a probable divide Congress). Bearing that in mind, Goldman claims that the grade S&P will grow yet another 3.5percent this season to close 3,700. It’ll keep climbing out there in 2021 and 2022.

Goldman Sachs sees a tradeoff at the situation where people have a Democrat in the White House along with also a Republican-led Senate. That would probably mean that a tax increase is really a non-starter as could be a generous stimulation package. Even however, earnings should muster impressively following season for S&P 500 businesses under this kind of power-sharing situation, up 29 percent , Goldman predictions.

Big Bets, Loonie variant

A vaccine must provide a rise to commodities at the year to come. And, greater aluminum and crude prices should reap the dollar as well as the Canadian dollar, Goldman states. This ’s GS’s finest FX stakes for the entire year to come:

***

Have a great day, everybody. I’ll find you {} … But {} there’s additional {} below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.