Our assignment to generate business better would be fueled by viewers just like you. To enjoy unlimited access to the journalism, subscribe now .

How large of a price is a vaccine for all most investors?

Based on Goldman Sachs,”Despite investor concentrate on the potential policy implications of this Biden presidency, the vaccine to COVID-19 is a major determinant of this route of the market and stock exchange in 2021,” strategists directed by David Kostin wrote in a note Wednesday. Meaning the accounts Monday by Pfizer and BioNTech concerning the 90% efficiency of the late-stage coronavirus vaccine may mean massive profits for stocks going ahead.

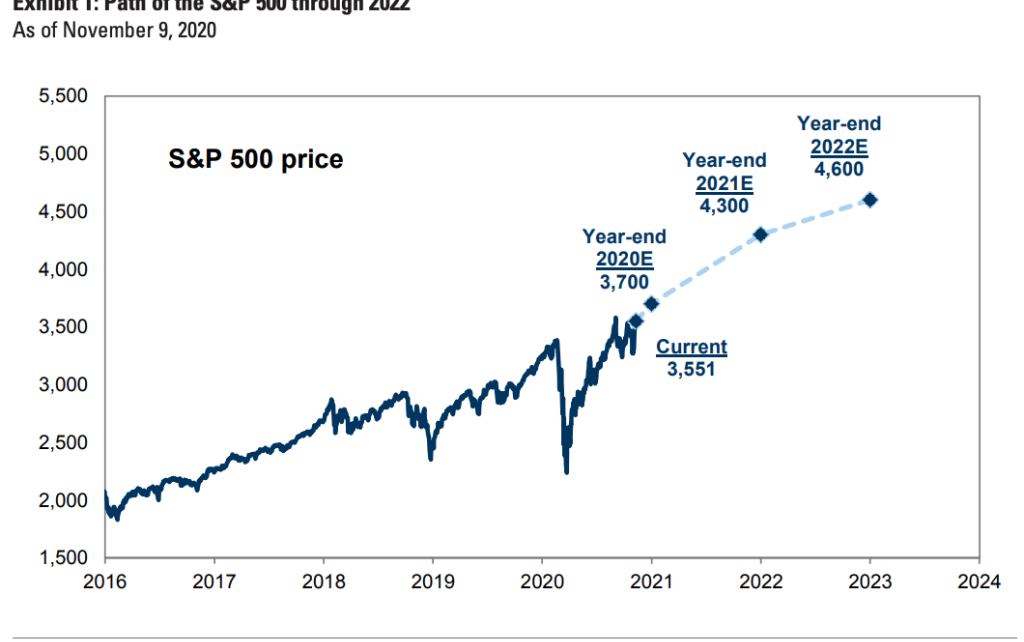

Goldman is currently increasing its year-end 2020 cost goal for its S&P 500 to 3,700. What is more, analysts in the company today expect stocks to grow 21 percent from Tuesday’s near 4,300 at the end of 2021, and soda an additional 7% out of there to reach 4,600 by averaging 2022. (The company expects at least FDA-approved and broadly dispersed vaccine in 2021.)

Really, along with the vaccine information, Wall Street got yet another boost this week by the resolution of this election, together with President-elect Joe Biden procuring the race to the White House during the weekend. Markets are at present pricing at a divided Congress which may prevent important policy changes, anticipating Republicans to keep control of the Senate following two runoff Senate elections in January.

“In a single day, we moved out of no vaccine to maybe many, which required a major chunk of their pandemic worries from this marketplace.

However, not all stocks are still profiting from vaccine expects. Notably the Large Tech stocks which have outshined the wider market up to now in 2020 have been lagging this week, whilst cyclical and stocks have been outperforming.

For many strategists, the industry performance underlines the concept that”investors will need to market for another legtoward more cyclical areas of the marketplace which have lagged behind in 2020, also from large tech and also the principal beneficiaries,” strategists directed by Mark Haefele in UBS Wealth Management composed in a note Tuesday.

But that does not mean investors need to ditch technology entirely: Strategists in Goldman assert that”though the mix of intense valuation dispersion along with a vaccine catalyst must produce a highly effective strategic turning into Worth stocks, by a tactical standpoint development stocks must stay appealing,” including that the”vaccine-driven Worth commerce is very likely to resemble additional Value rallies of the last decade, that have seldom lasted over a couple of months.”

That is why the company is presently advocating value stocks which”benefit in the vaccine and financial normalization” and stocks using”long-term secular growth prospects which have higher development investment ratios,” that the strategists wrote.