Senator Mark Rubio did not have to seek Support from the U.S. to stop Ant Financial’s IPO at Hong Kong and Shanghai–authorities in China do themselves.

On Tuesday, Chinese authorities in Shanghai frozen the Alibaba unit estimated $37 billion IPO, citing”fluctuations in the fiscal tech regulatory environment and other big problems.” Concerns that Ant Financial was overly lightly controlled have been long distance.

What might have tipped the scales only on the eve of the IPO? Well, each my buddy Robert Hackett, Alibaba cofounder Jack Ma spoke from the insolvent banks system at a recent speech,”comparing its associations to stingy pawnshops,” which seemingly did not land with Chinese government. Andalso, Ant Financial poses a possible threat to this government’s management and dominance.

The delay may also induce Ant Financial to reshuffle a few of its company operations and also face a ding to the anticipated $300 billion-plus evaluation. Chinese monetary regulators hailed rules before this week breaking back on the micro-lending marketplace that may hit the earnings of firms such as Ant Financial.

Oh. There is this: The equal into Alibaba’s food shipping company , Meituan Dianping, that is currently worth $238 billion to the Hong Kong stock market, is reportedly considering a leading record in China when the next year. The firm, whose shares have over tripled in the past year alone, is endorsed by Alibaba rival Tencent. Alibaba and Tencent have embraced walled gardens within their own ecosystems since they struggle for dominance in China, together with Meituan Dianping eliminating the former Alipay out of its own payment choices . Do not overlook: Alibaba utilized to be a investor at Meituan Dianping.

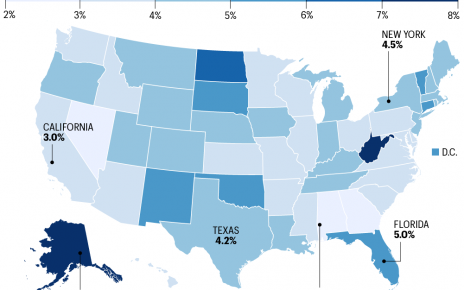

Most importantly, firms such as Uber, Lyft, Postmates, and Instacart obtained a vote from California that will let them keep on classifying motorists since independent contractors rather than as workers . The latter classification could have led to broader advantages to gig-economy employees and pressured the companies to rethink their business models. The firms fought against itDubbed Prop 22, the effort was the most expensive among ballot measures in the country’s history, together with gig-economy firms paying a $200 million to pass the initiative. The triumph has consequences outside California: States including New York and Illinois also have considered legislation equipping gig market employees as workers.

And Mississippi appeared to legalize marijuana for clinical use.