Our assignment that will assist you browse the new ordinary is fueled by readers. To enjoy unlimited access to the journalism, subscribe now .

Quite simply, the stock exchange forecast Donald Trump would conquer Hillary Clinton despite polls to the opposite .

Currently {} identical stock market index –that depends upon S&P 500 operation for the 3 months in August at the end of October–has recently countered its own forecast. Together with all the S&P 500 down marginally (only 0.6percent ) during that period over the previous trading day of October, the stock exchange ’s presidential predictor, since it’s recognized by market analysts, is now formally indicating that Joe Biden will win the election.

Although the dip is small, the damaging S&P 500 operation over these 3 months suggests that the party–in other words,” President Trump– will probably be voted from this White House and substituted using a Democrat.

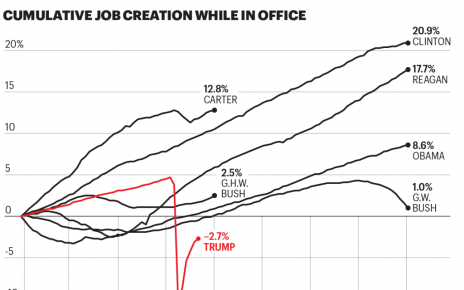

{The layout has held true for nearly a century, since 1928, according to Sam Stovall, the chief investment strategist of all CFRA that has {} the S&P 500. |} Since 1944, adverse performance from the stock indicator above the essential time period has accurately called a changeover at the presidential celebration 88 percent of their period (see graph below); just once has it already been incorrect, at 1956. (Meanwhile, the favorable operation from the S&P 500 at the time frame has signaled reelection of this celebration in the White House 82 percent of this time.)

Even though there’s absolutely not any proven explanation for why the stock exchange has such a higher batting average in regards to the winner of this presidential elections, analysts speculate that it probably has to do with uncertainty as time goes on. Investors often sell stocks as it’s uncertain how events will play out–only see before this season once the coronavirus dropped the planet into chaos and triggered a bear market. Consequently, the thinking goes, that the selloff may show doubt about the way the President from a brand new political party will form coverage in the next few years.

Despite the fact that the S&P 500’s reduction is little within the appropriate forecast interval, it may continue to be appropriate: At the 2000 election when George W. Bush defeated Al Gore (who was then the incumbent party, after Democrat Bill Clinton), the S&P 500 was down only 0.1percent from August through October, based on CFRA. Needless to say, the 2000 election was {} , using a highly contested effect which was finally determined by the Supreme Court–something that lots of politicos are already anticipating could occur with this calendar year ’s election, given the unprecedented nature of the outbreak and also altered voting protocols.

Nevertheless, warns Stovall, “The Predictor suggests, but doesn’t guaranteea Biden success. ”

If the predictor will triumph in 2020, Republicans and investors might need to wait till at election day on Nov. 3 (or even probably longer) to learn. But regardless of what occurs a week, stocks have sealed their forecast.

Much more must-read fund policy out of Fortune:

- Chobani and PayPal are paying employees more–and rethinking capitalism

- once it comes to climate change,” states Mark Carney, this fiscal crisis differs –and {}

- Ray Dalio about why Chinese Legislation is rising –and American payoff is in dire need of a repair

- Microsoft’s cloud may be somewhat foggy for another quarter

- Coinbase starts crypto debit card at U.S. with 1 percent Bitcoin reward