Great morning. Stocks and Stocks have been rebounding shortly after Wednesday’s rout, the oddest sell-off within the previous four weeks. But markets stay on edge before a major set of Enormous Tech earnings calls after the bell now.

Permit ’s check on the activity.

Market upgrade

Asia

- The most Significant Asia indicators are mainly lower with that the Shanghai Composite the very best of this Group, according to 0.1percent profit in day trading.

- News Display: China has dropped far behind in satisfying its part of the deal for its Period 1 commerce deal broke earlier this season, using its U.S. imports dropping to approximately half (53 percent ) of at which they need to be {} the bargain ’therefore parameters.

- Shares in Samsung are 1.5percent in Seoul following the technology giant issued a profit warning about declining chip costs . The Stoxx Europe 600 has been up 0.6percent 90 minutes to the trading session.

- All eyes have been about the ECB now. There is growing speculation that the central bank, facing a tide of lockdowns, will declare that a $500 billion increase for its bond-buying program.

- Tiffany & Co. was among the few gainers in Wednesday. Its rugged courtship using French luxury giant LVMH is back again following Tiffany’s plank consented to shave roughly $425 million away from the selling price.

U.S.

- U.S. stocks stage to a strong open. This ’s following the 3 key exchanges sold off tough on Wednesday, stripping away their profits for the entire month. Tech stocks were one of the biggest winners.

- The Dow’s 943-point shed yesterday delivered marketplace experts back into the history books. This kind of precipitous fall so near Election Day has occurred only twice before–throughout the Great Depression (1932) and in the throes of this international financial disaster at 2008. When history is any indicator, which ’s bad news for the incumbent.

- Should you’re a part of this Presidential Predictor–a oft-cited markets-performance index during presidential elections cycles–it’s currently flashing a very clear winner for your White House weekly.

- There’s ’therefore a lot about the calendar now : GDP amounts, unemployment claims and revenue to Facebook, Apple, Amazon and Alphabet’s Google.

Elsewhere

- Gold is level, but following yesterday’therefore sell-off that it ’s trading under $1,880/oz .

- A reader sent me a notice asking for a few crypto love within this part, so here goes: Bitcoin is currently investing only under $13,200, roughly 3 percent under a high attained yesterday.

- The buck is upward.

- Crude is tanking back now. Brent is currently trading under $39/barrel.

***

“Expectations which COVID-19 will be under command by now have disappeared and now we see stocks dropping by a second 10-20percent out of here. We feel that in the event the S&P 500 breaks under 3,200 prior to the election, then its second move might be down the next 12 percent to 2,890. ” — James McDonald, CEO of Hercules Investments.

…or even only a wholesome sell-off?

“Because I write this, the most S&P 500 is down roughly 8% in the all-time large. That isn’t nothing, but we found a much larger fall in September along with a subsequent retrieval. We saw nearly as large a fall in June along with a subsequent retrieval. And, obviously, we watched a much larger fall in March and also a much larger comeback. Present volatility may pass fast when circumstances change.

FAA(-M)G Thursday

Transferring to be big and the chances are greater than some weakness on some of them are going to be read just as a contagious market signal. All these are priced to get a certain amount of devotion. All have to strike it.

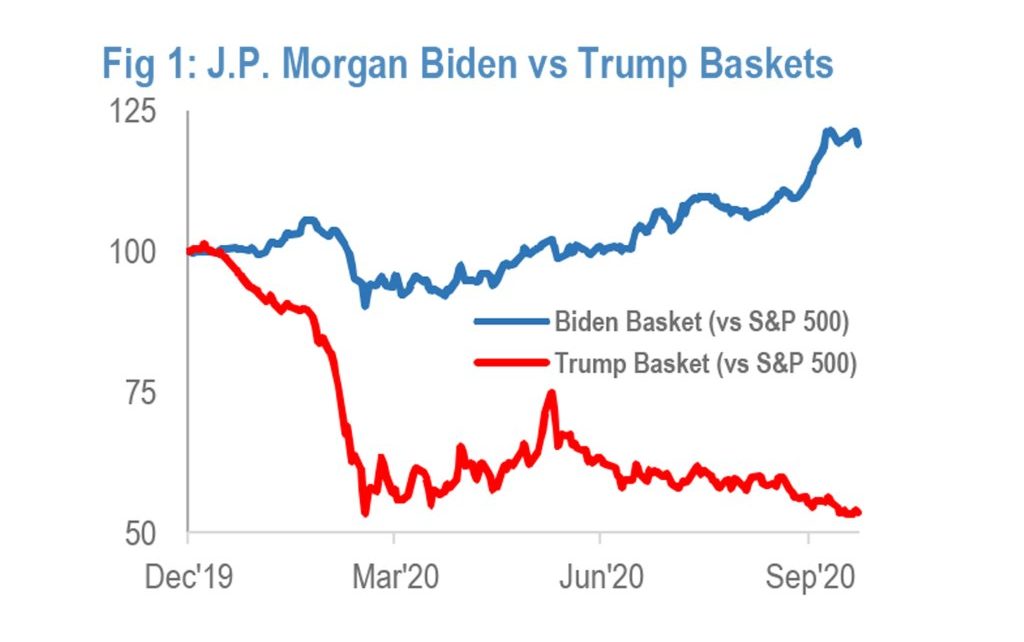

On Trump stocks vs. Biden shares

Stocks move down or up. However, what about left or right? Morgan Stanley analysts comes with an inventive approach to check at stocks entering the election. (We pay this additional in Now ’s reads only below.)

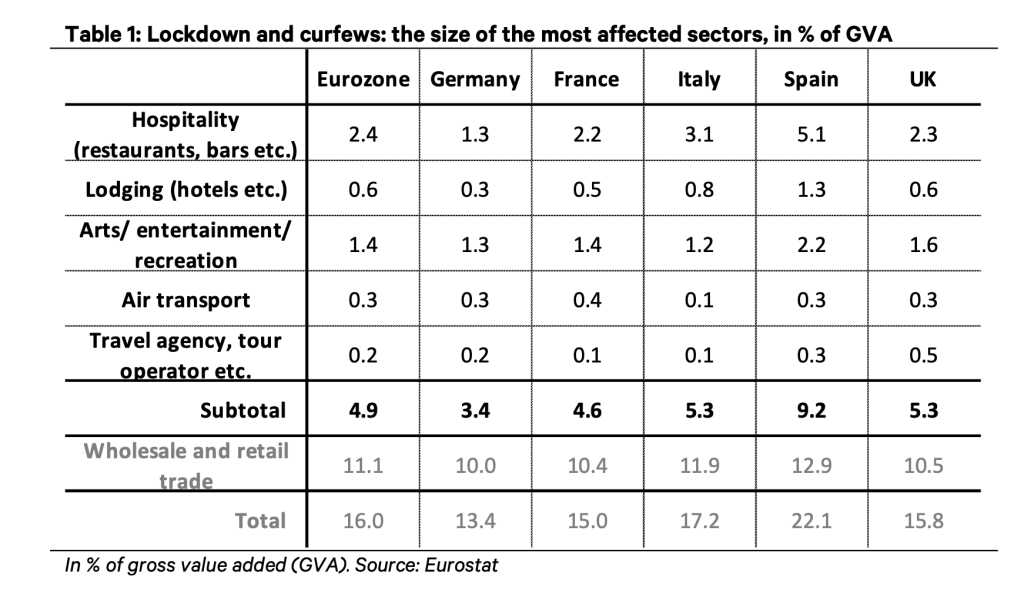

An demanding chilly in Europe

Economists have been once more dividing and rewriting GDP projections since the pandemic worsens. Berenberg Bank published a notice this morning revealing the financial cost which curfews and lockdown-like steps will precise on Q4 GDP. Bars and restaurants are going to be one of the hardest hit.

***

Bernhard Warner

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.