That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Very good morning. It’s shaping up to become just yet another risk-off day since COVID instances spike, chances on a stimulation deal election and sink jitters intensify before tonight’s huge disagreement. Actually Tesla’s knockout quarter is now currently failing to raise technology stock futures.

Allow ’s check out on the activity.

Trade upgrade

Asia

- The most Significant Asia indicators are mostly from the crimson with Hong Kong’therefore Hang Seng the very finest of this Group, clinging to 0.1percent profit in day trading.

- Ant Group, aiming to get a record-setting IPO, intends to place its Shanghai set cost next week (that the Hong Kong leg hasn’t been decided ), so it’s going to begin trading only after Election Day.

- Shares in Cathay Pacific are back to get a second consecutive day following the Hong Kong-based airline declared that the prices of 8,500 rankings and a huge restructuring since the COVID catastrophe ravages its organization.

Europe

- The European bourses dropped at the start. The Stoxx Europe 600 was 0.6percent 2 hours to the trading session.

- A frightful number of Europe’s little and midsize companies –over half–dread that they ’ll go bankrupt within another year if earnings don’t select up shortly. The precarious are at Spain, Italy along with also the U.K. An SME bankruptcy spike will decode Europe’s labour marketplace.

- Talking of gruesome stats… Spain (people: 47 million) will be the very first Western European nation to high 1 million COVID instances. France along with also the U.K. are quickly approaching that amount since Europe’s next wave intensifies. This ’s following the stimulation transaction fizzled on Wednesday afternoon. Even the Nasdaq has closed from the red six from the previous seven sessions.

- The on-again-off-again stimulation talks are incorporating all types of volatility into the markets nowadays. However there’s a different cloud hanging around Washington which ’s unnerving investors: Election Day uncertainty.

- Stocks of Tesla proved upward 3.2percent in pre-market trading following the EV manufacturer posted large top- and bottom beats yesterday. Can a fifth consecutive profitable quarter be sufficient for S&P addition ? An reminder: before today, Tesla’s gains harbor ’t come in purchasing automobiles.

Elsewhere

- Gold will be downward, stuck about $1,920/oz .

- The buck is upward, rising as auctions fall.

- Crude is level, with all Brent trading under $42/barrel.

***

Buzzworthy

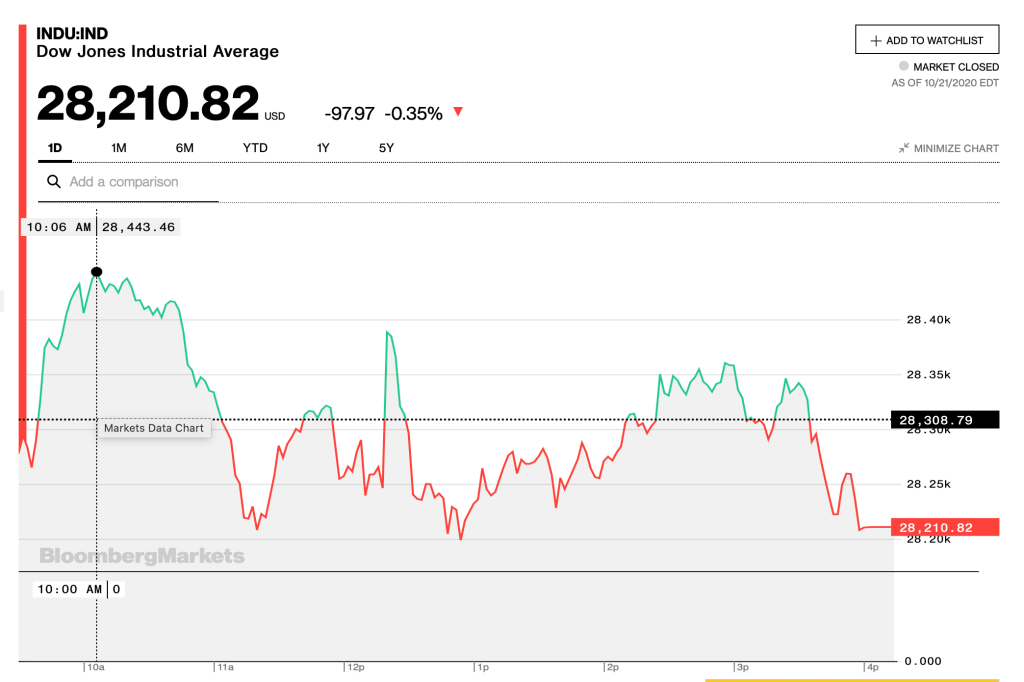

V for Volatility

From peak to trough, the Dow dropped 254 points yesterday. (Tuesday was more explosive.)

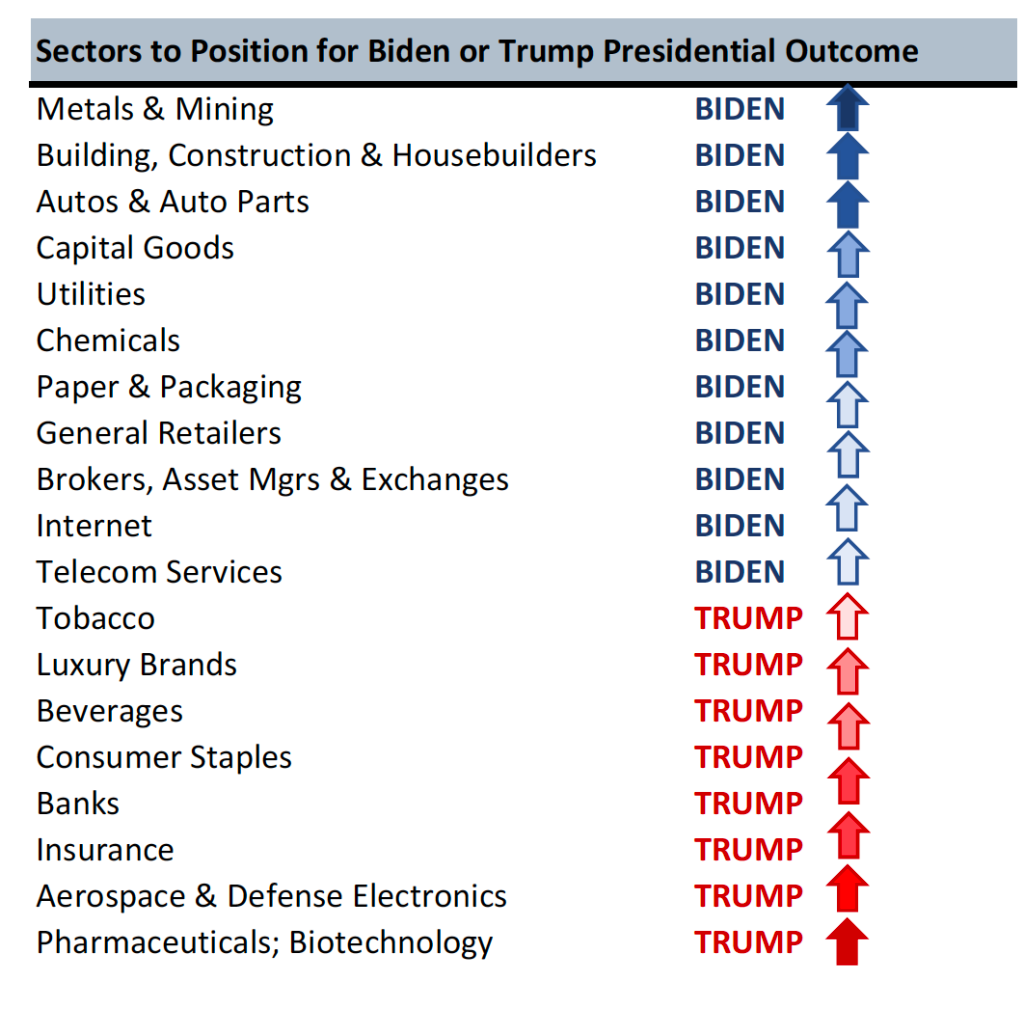

About politics, surveys as well as your portfolio

In accordance with Jefferies, below are the businesses which stand to gain/lose out of a Biden or even Trump success:

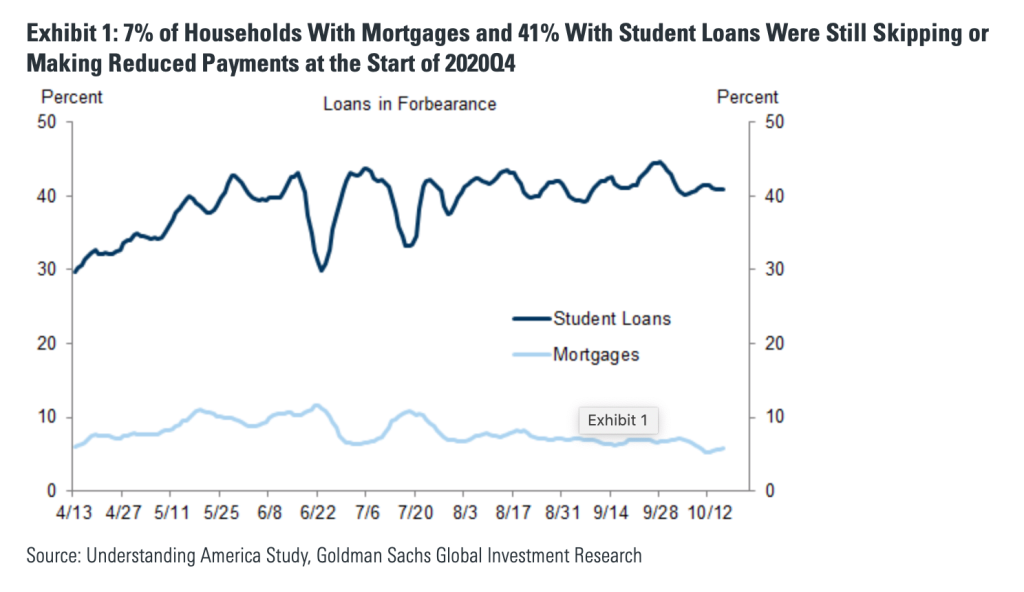

Stimulus, stimulation, stimulation

Two months prior to Christmas, American households are on the edge of an epic financial cliff. Based on Goldman Sachs, 41 percent of families using student loans are either decreasing or skipping payments. A smaller amount have been staggering mortgage obligations.

***

Postscript

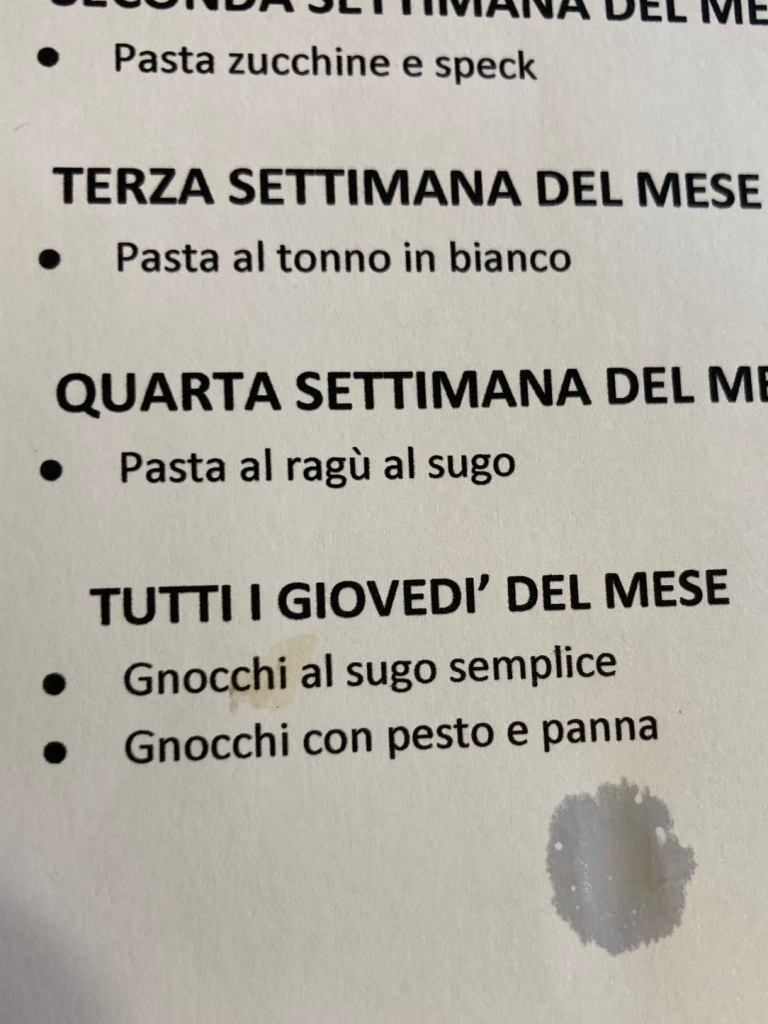

It’s Thursday, so all over the territory there’s gnocchi around the menu.

School lunch menus are all serious issues in Italy. There are particular dishes–believe that the dumpling shaped pasta, gnocchi (pronounced: nyy-OAK-ee)–which can only be served to Thursdays, because of a kitchen decree handed a zillion years back by the potent nonne (grannies) lobby.

At a property of rule-breakers, nobody could dare question this.

Since I love gnocchi day.

Buon pranzo!

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.