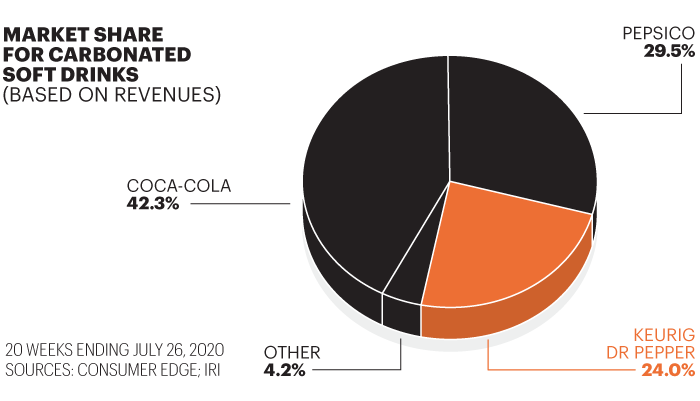

For years, the worlds of hot and cold drinks at the U.S. have stayed different domain names, each controlled by undisputed winners. Not one of the 3 stalwarts are lukewarm about blending warm and cold sections in a major way. However, in a drink marketplace as roiled as each other area of the customer market is this calendar year a surprise winner–famous Keurig Dr Pepper–is now currently carrying advantage of market talk.

Although KDP is significantly much less than half of the number of Coke and Pepsi from U.S. soft beverages, it’s running neck and neck with the two giants at the talk of the excess cans and bottles hungry stay-at-home Americans have been quaffing versus previous year. That boosted its total market share from 22.7percent to 24.0percent. “KDP has done the very best job of any drink firm in navigating the catastrophe,” states Consumer Edge analyst Brett Cooper.

KDP’s increase is particularly remarkable as it is a new venture formed just over a couple of years back through the $18.7 billion merger of java purveyor Keurig Green Mountain and pop up manufacturer Dr Pepper Snapple. The deal proved to be a giant wager by building and encouraging a wide array of classic titles and high-growth novices in groups much more compact compared to Coke’s or even Pepsi’s colas or even Starbucks’ coffee manufacturer, KDP might make a company stronger compared to the sum of its components.

“We endorsed Bob using a total of 17 billion. To begin with, when we purchased Keurig and introduced him as CEO, when we purchased Dr Pepper Snapple,” states Olivier Goudet, CEO of JAB, the Luxembourg holding firm who has also constructed a coffee empire in Europe. (It is endorsed from the Reimanns, among Germany’s most affluent families, and combined with minority spouses holds 44 percent of KDP’s stocks ) “It was a bet on Bob, since he understood picking cold or hot was getting just half of this film. He sees consumer routines shifting before anybody else.”

Over a number of long telephone conversations, Gamgort explained his pattern into Fortune. “The sector viewed drinks much too significantly,” he states. “More than half of Starbucks’ beverages have ice in them. Whenever someone wants a boost from the day, they can pick a coffee, or even a Dr Pepper or our Adrenaline Shoc energy beverage. Nevertheless the business and Wall Street appeared in cold and hot as two entirely different sections. After we combined, nobody got it.” His aim, he explains, is always to make the widest possible lineup. “We will need to become as critical as you possibly can to some Walmart or even Amazon, also we all get there by providing a portfolio which satisfies every customer need,” states Gamgort, 58.

$11,100,000,000

KDP’s earnings annually

At $11.1 billion in earnings this past year, KDP rated because the seventh-largest food and drink business in the us. However, the firm has cornered something which has proved elusive to businesses in the very best of all times, but particularly through a pandemic: a wide, diversified portfolio which has reverted out predictable earnings. For the initial six weeks of 2020, earnings climbed a hardy 3 percent to $5.5 billion, although corrected earnings jumped 11.7percent to $877 million. While KDP adhered into its earnings guidance, pledging to satisfy the 3 percent to 4 percent earnings and 13% to 15 percent earnings-per-share goals set in ancient 2020, the fog of COVID motivated Coke, Starbucks, along with the majority of other food and drink players to announce the industry too mercurial to predict .

Gamgort was gaining about the giants pre-COVID and also needed a sense that the tragedy might work in his favour, but only in the event the firm pivoted quickly and recognized that the future could differ and what customers wanted was shifting, likely for good. “We did not believe the world would go back to normal,” he states. “We devised a pattern which produces disturbance our buddy.”

The first sign that we’re living at a brand new universe came from early March in KDP’s”related panels,” that the 10,000 at-home brewers connected digitally to its data centres. It had been Gamgort who introduced the panels as a piece of the Keurig Green Mountain rescue program. The attached brewers browse the picture of each K-Cup pod to recognize the new and taste utilizing visual recognition technologies, in order that KDP sees immediately any alteration in the everyday cups households are ingesting, as well as the titles and mixes they favor. “We found that this minute-by-minute data demonstrating individuals were departing the towns and sheltering in place and coffee intake has been through the roof,” states Gamgort. That info from the on site java side also revealed what was coming from soft drinks. “We knew several individuals are quitting to get beverages at gas stations or even neighborhood shops or at pubs,” states Gamgort. He instantly expected that from the stay-at-home market , households could be stockpiling soda by buying where they might buy major quantities in one trip, in the megastores like Walmart and Kroger.

“We called they would want major packs of headphones, since they’re easiest to keep from the garage,” states Gamgort. “Cans stay more economical than bottles, along with the children and grownups can pull a can at a moment.” The rub was Gamgort watched no way that his national can providers could make enough of these. The Mexican authorities announced beer that a nonessential item, shuttering factories and departing the regional canmakers with lots of ability. “We pounced on this chance,” remembers Gamgort. “We advised the manufacturers in Mexico,’We will take all of the cans you’re able to give us’ Competitors ran from headphones. We obtained the headphones.”

KDP frees up creation of 12-packs of all cardboard-bound 12-ounce headset and cut on bottles. KDP uses a direct-store-delivery or DSD version, which means {} three-quarters of the country, KDP’s 6,000 trucks provide prices from 160 distribution facilities directly to shops as diverse as a 7-Eleven into some Kroger. Subsequently, a KDP merchandiser brakes a”U-boat” cart taking the manufacturers into the drink aisle and {} the shelves. The merchandisers frequently stop by a significant shop many times per week for 3 or four weeks. They carry up-to-the-minute updates about what is selling and how quickly KDP’s information centres. “If you simply send to the merchant’s warehouse, you do not get that sort of information and do not recognize for one more week what is selling. By then it is too late,” states Gamgort.

34%

Talk of the increase in total carbonated beverage sales KDP has seized

82%

Percent of the Entire coffee pod marketplace that KDP controllers

Other tendencies were emerging also. Requirement for classics like Canada Dry ginger ale and A&W origin beer removed. “We cranked the bestsellers and created a great deal less of these slower moving types,” states Holand Lujan, that heads KDP’s distribution system from the South. Factories cut back Cherry 7 Up and Diet Squirt. However, the swing to large sellers left the merchandisers more effective. The items which used to comprise 55 distinct items were taking as much as 15, in considerably larger amounts, cutting down the time necessary to inventory shelves.

Coffee followed exactly the exact identical pattern. The corporation’s Keurig brewers would be the deal”razor” offered near breakeven to tempt clients to the profitable”blades,” KDP’s K-Cup pods. KDP generates an estimated 10 billion-plus pods per calendar year, an astonishing 82% of this complete industry. After Gamgort saw client pod use surge,”I switched our mills to maximum outputsignal, way ahead of orders. We had been seeing inventories construct when we had not seen any revenue yet.” The associated brewers also revealed that individuals were drinking a lot more superior coffee, possibly because if you are not getting a 3 cup Starbucks, you are good spending 70cents to a K-Cup. Yet more, KDP significantly increased generation of these principles as Green Mountain, also briefly stopped production in market brands. In the summit, at-home K-Cup pod earnings were running 30 percent greater than a year ago, millions for something which develops from the mid–only digits.

The question today for its self-professed challenger is the best way to attain strong growth in just two slow-to-modestly expanding companies. Thus far, KDP has been able to interpret earnings waxing at approximately 3 percent into corrected earnings gains in the 15 percent range. Nevertheless, it’s producing those outsize jumps in earnings chiefly by decreasing expenses and reaping enormous savings in the merger. When price cutting runs its class from the end of 2021, Gamgort will have to garner {} earnings development. “He desires earnings increase of 5 percent to 6% per year, maybe not the few points annually which would be the standard in the company,” states Paul Michaels, a KDP manager and former worldwide president of Mars, in which he had been Gamgort’s mentor and mentor at the 2000s.

In drinks, that is a top bar. It is very likely the KDP will return {} of this large 1 percent -and profit in market share its jackrabbit moves won at the pandemic, a thing Wall Street expects as evidenced from the stock flatline performance within the last calendar year.

But looking forward, Gamgort has many things working in their own favour. To begin with, beginning around 2021 KDP may have retired debt it may use its powerful free cash flow for acquisitions. Gamgort was a master in buying and growing brands on the last; he assembled Mars’ pet food company into rival Ralston Purina’s through purchase of Greenies and other titles and revitalized Pinnacle’s exhausted portfolio using a movement into healthful frozen foods through the buys of Birds Eye veggies, Evol organic meals, also Gardein, manufacturer of foods that are fermented.

We devised a blueprint which produces disturbance our buddy.

Secondly, Gamgort realized that acquiring Keurig brewers in much greater families was what climbing K-Cup pods was about. He aggressively cut the costs of the machines and cups, carrying a temporary hit to earnings to lure more clients, and in the process doubled the amount of U.S. houses with brewers into the present 31 million, representing roughly one family in four. That leaves loads of space to operate: In Europe, over 50 percent of {} have brewers. The fluctuations in consumer tastes at the pandemic are most likely to adhere.

Third, the”tastes” industry (carbonated beverages that are not colas) is currently growing a stage or more quicker than soft drinks as a whole. Adding new tastes to old-line brands may give an additional lift.

The lever is named Allied Brandsthat gets names normally possessed by entrepreneurs or personal players (believe Adrenaline Shoc, a sports beverage invented by drink legend Lance Collins, or Do Not Quit! Protein shakes out of Jake”Body by Jake” Steinfeld). In earlier times the older Dr Pepper Snapple would disperse such manufacturers but did not secure the rights to purchase them when they removed, and could frequently drop out into Coke or some other large bidder. Yet more, Gamgort struck the mould. He will offer to earn a fresh drink an Allied Brand simply when the owner agrees to provide KDP the best to buy it according to a specified formula.

{However, maybe the best thing Gamgort has going for him is {} embracing–instead of dreading–that the uncertainty that lies ahead. |} “Our opponents are rolling and trusting that the status market returns, and it is not returning,” he states. This paradigm-busting audacity has contributed KDP the largest caffeine buzz in drinks.

A variation of the Report appears from the November 2020 problem of all Fortune using the headline,” “Keurig is a system. ”

- From bailout debacle to international dominance: Within the turnaround UBS

- Earning Dark banks thing

- Ford, simply acknowledge it: You are a truckmaker today