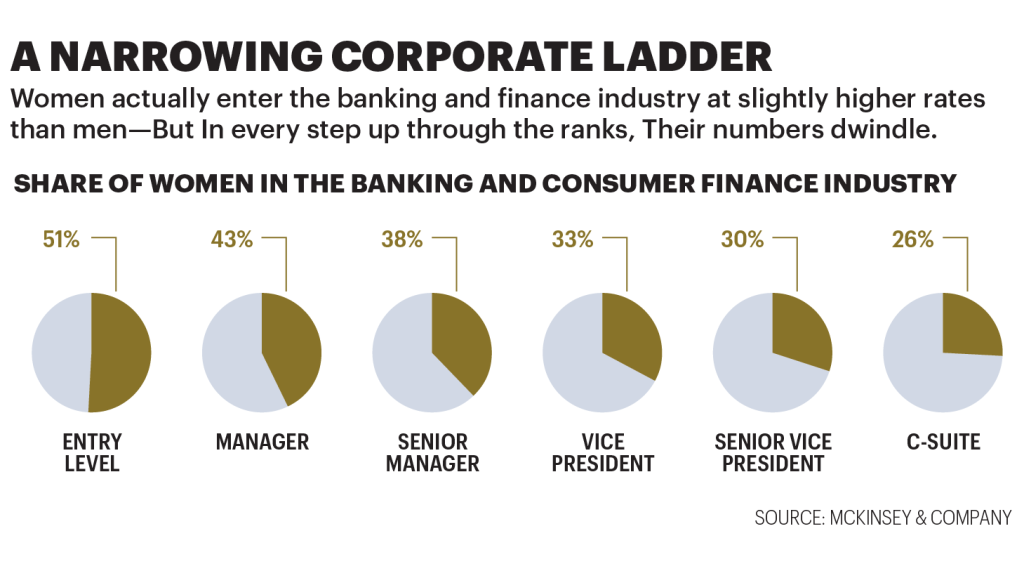

CEOs of of the biggest U.S. banks arose before the House Financial Services Committee at April 2019. After the panelall guys, all of white –were requested under oath when their successors were inclined to be feminine or a man of colour, nobody raised his hands.

Without a word, the CEOs had set a nice point on a difficult fact: Wall Street hadn’t been a female CEO, nor has been one probably in the not too distant future.

The message they delivered has been antithetical to the disposition of corporate America in that moment. The #MeToo motion had motivated a brutal reexamination of workplace workplace dynamics; institutional investors were so demanding the boards of supervisors include more girls; and businesses –banks comprised –were the virtues of diversity.

Who may be the very first to break? So when?

We finally have a definitive answer for all those previous two concerns: Citigroup at mid-September declared that Jane Fraser would triumph Michael Corbat as chief executive in February.

However, Fraser’s appointment does not remove the civilization that had kept girls from their corner office for such a long time.

On the flip side, the latest phase of Fraser’s livelihood follows exactly what Jane Stevenson, mind of CEO succession in executive recruiter Korn Ferry, predicts”the routine”: She worked his way through essential business units in the bank and abandoned every much better than she ever found it. Yet at exactly the identical moment, her refusal to sacrifice her private life in the altar of her profession flouts a number of the older”rules” for getting on the surface. That skill to locate a middle way–to devise a new route through a really old maze–can indeed be a critical part of making her uniquely qualified to your task she will step into the next year. Therefore, for that matter, is her willingness to speak honestly about surfing the labyrinth.

Fraser, 53, was born in St. Andrews, Scotland. (Yes, as a matter of arrival she’s an affinity for golfing.) She proceeded into Australia for high school and also with ambitions for a physician. However she soon realized that she had been awful at mathematics but fond of mathematics and economics, that left banking a pure career match.

She’d lament years after that she had been”the dull British woman” at the workplace. “Everybody else has been a whole lot more exotic, from around Europe. The sensation was inspiration enough to allow her to depart London for Madrid, where she spent two weeks as an analyst in consultancy Asesores Bursátiles and functioned on her Spanisha skill that could prove particularly useful years later on.

After business school at Harvard in the early 1990s, her livelihood diverged farther from the normal banking trajectory. As opposed to return to some location such as Goldman, she chose to combine consulting company McKinsey because she does not sugarcoat: The girls she found in the banking sector at the point”were fairly terrifying,” she stated from the 2016 address.

These were the times of major shoulder pads and masculine suits. The girls and lots of the guys did not look”that joyful,” she remembered. “They were rather profitable. They have been brilliant. Nevertheless, it was hard.”

In summary: She needed a lifetime.

Working in McKinsey was {} , but it provided the identical lively –being a reliable adviser to a customer –with increased predictability.

She got married a couple of decades after and got pregnant the identical year she had been up for spouse. “I have quite a great deal of information,’Do not become pregnant within your venture year.’ And I only thought that was crap,” she informed me in Fortune‘s Best Women Summit at October. The company informed her she had made spouse fourteen days later she gave birth.

After that instant –with a baby, producing spouse –she’d heed another bit of information:”I recall one of my teachers stating for me,’You are likely to get many careers in {} , along with your livelihood will be measured in years. Why this feeling of hurry and attempting to get everything in exactly the identical moment?'” It directed her to make a conclusion she states was crucial: She opted to operate the entirety of her last-minute venture –till she left McKinsey to get Citi at 2004–part time.

“It was not easy–my {} suffered a little on this one, as you really do see those who are more self indulgent than those who’re accelerating faster in their own professions,” she explained. “But that is what allowed me to really feel joyful and also have a balance in my life and private life”

That experience changed her view and altered how she functioned at the workplace.

“Once I return to working back and functioning fulltime,” Fraser explained,”my customers used to inform me,’You are a far more empathetic individual; you’re just this system'”

In 2004, Fraser combined Citi as part of customer plan in the lender’s corporate and investment banking department in London. This is the second she returned into the conventional banking playbook and started halfway through it. On the next 16 decades, she took to a collection of tasks at Citi that educated her about various areas of the company, gave her expertise leading units which had their own gain and loss statements or P&L, also provided her opportunities to create relationships and also a standout standing inside the company. Fraser’s turning in and out of tasks has been”an iterative procedure that came {} ,” she states. “All these sorts of jobs lend authenticity” when planks are weighing series plans.

It really helps, of course, if a few of those functions ask that you make hard choices or manage distressed companies –and should you prove you’ve got what is needed to take care of the requirements.

Following her conduct into corporate and investment banking, then-CFO Gary Crittenden provided Fraser the task of international head of strategy and also M&A at September 2007 since the fiscal crisis was climbing. She even also took the job and proceeded to New York to assist then-CEO Vikram Pandit choose the way to shrink the lender. She orchestrated the purchase of Citi’s Japanese securities industry into Sumitomo Mitsui Financial Group in a $8 billion deal which gave the lender a crucial capital increase in 2009. Throughout her time at the job, she implemented over 25 prices in 18 weeks. The bank offered almost a hundred dollars’ worth of resources and reduce 100,000 jobs in the procedure.

Fraser remembers that function as one of the experiences as a pioneer. “It will force you to sit and be {} and not as wishy-washy,” she informed me in October. “What exactly does being client-driven actually mean so that it’s not only a plaque on the wall? What are a few of the tactical decisions you make? Do them early and get them nicely and pile them up to acquire …nothing much like a catastrophe to possess your steepest learning curve”

Fraser’s career route is “the routine … an iterative procedure that came {} . ”

Jane Stevenson, heart of CEO series, Korn Ferry

Valuable because the encounter was, Fraser nonetheless wished to conduct a small company. Pandit gave her {} at 2009, sending her back to London for a long time to appeal to Citi’s weakest customers because of the bank. It turned out to be a popular job, particularly in comparison to what came {} as CEO of CitiMortgage at St. Louis. She took this task at 2013, once the mortgage company was, even as she confessed from the 2016 address,”that the scourge of the ground” after the subprime catastrophe.

Latin America is the tiniest of Citi’s regional branches by internet earnings but has the maximum rate of yield, which makes it a thing of a crown gem. Its retail arm at Mexico, subsequently Called Banco Nacional de México or even Banamex, is among Mexico’s largest banks, along with its 1,400 branches accounts for more than half of all Citi’s physical places worldwide.

When Fraser occurred, the branch was tarnished. In February 2014, Citi revealed that oil services company Oceanografía had allegedly scammed Banamex from $400 million. Months after, Banamex disbanded a component of the lender that provided protection to executives later finding that workers had participated in prohibited activity by providing unauthorized services to external parties.

At a 2017 meeting using American Banker, Fraser spoke about attempting to modify the bank’s civilization in Latin America so workers could be”more comfy escalating topics, or stating,’I am uncomfortable with what my supervisor [has] done'” A large portion of the attempt was persuasive employees that the lender could act on allegations of wrongdoing. Individuals must consider that”when they raise a problem they are going to be fine, and you’ll do some thing about it”

At exactly the identical time, Citi introduced $1 billion to Mexico, the only Latin American nation in which it {} retail operations. The student investment, declared in 2016, was meant to update the consumer experience with brand fresh ATMs, new electronic instruments, and division makeovers.

Throughout Fraser’s tenure, net earnings and net gain for the Latin America branch climbed 8% and 38 percent, respectively.

Fraser’s following advertising, at October 2019, to president and CEO of international customer banking, had been a indication that the job she had performed in Latin America had driven her into another level. This was confirmation of that which colleagues state was {} : the Fraser has been Corbat’s heir apparent. “Giving her {} business, that will be half our earnings and a lineup working company, and her president turned out… to tee up her to get prepared to become CEO,” Citi seat John Dugan states.

However, Citi formally launched Fraser to the very best job sooner than anticipated. After Fraser was appointed presidentCorbat suggested he’d”decades” left Citi, however no. Two obtained the nod 11 weeks afterwards.

Dugan states Corbat had always intended to depart in 2021 but chose to leave on the first side so Fraser would”have” the lender’s attempts to enhance controls and hazard procedures.

The accelerated deadline gave Citi an edge that was not dropped on the boardit must be to mention a female CEO. “We’re thrilled to beat everybody to the punch. It was likely to take place, and we’re thrilled to have a candidate that had been eminently qualified to the task,” Dugan says.

While Fraser’s ironclad résumé seems, in various ways, such as the large bank CEOs who have come before herpersonal way of her job does not always conform to this corner workplace mould.

She has appeared unafraid of discussing the minutes of self-doubt that all these CEOs appear to hide out in the backs of the custom cabinets. She states that her first reaction to being provided the international leader of strategy and also M&A was she was not great enough for the function. She remembers a friend convinced, stating,”Are you really anxious about falling? Do It. What exactly does it matter whether that’s the situation?”

Fraser’s openness to discuss the side of this project –if lapses at self-assuredness, the requirements of parenthood, the previous failings of lender civilization –puts her apart not only from Wall Street peers, however from different women that have attained”firsts” within their businesses, a number of whom fear {} being open about these matters they will be pigeonholed by the tag, feminine CEO. Fraser sees it as a benefit:”I could be vulnerable in some specific regions; speaking about the individual dimensions of the than a few of my coworkers are more familiar [with],” she explained in May. “I really don’t feel that is whatsoever soft or poorer; I really think that it’s far stronger.”

Before her submitting into Latin America,” Fraser triumphed Cecilia Stewart, currently retired, to get a stint as CEO of Citi’s U.S. customer and industrial lender. Included in this leadership transition, then the group met with bankers throughout the nation. Stewart recalls Fraser can”only naturally sit right down and speak with somebody and join with themwhether it had been life-related.”

“For someone –male or female–to possess that amount of empathy in their own leadership style and {} to go over many different kinds of scenarios is critically important,” Stewart says. The method is particularly well suited to the pandemic. “2021 and 2022 for corporate America might seem very different,” Stewart says,”so with a pioneer like Jane who’s flexible, who’s willing and receptive to direct through that type of shift, whatever {} to be, is equally excellent and also a favorable for Citi.”

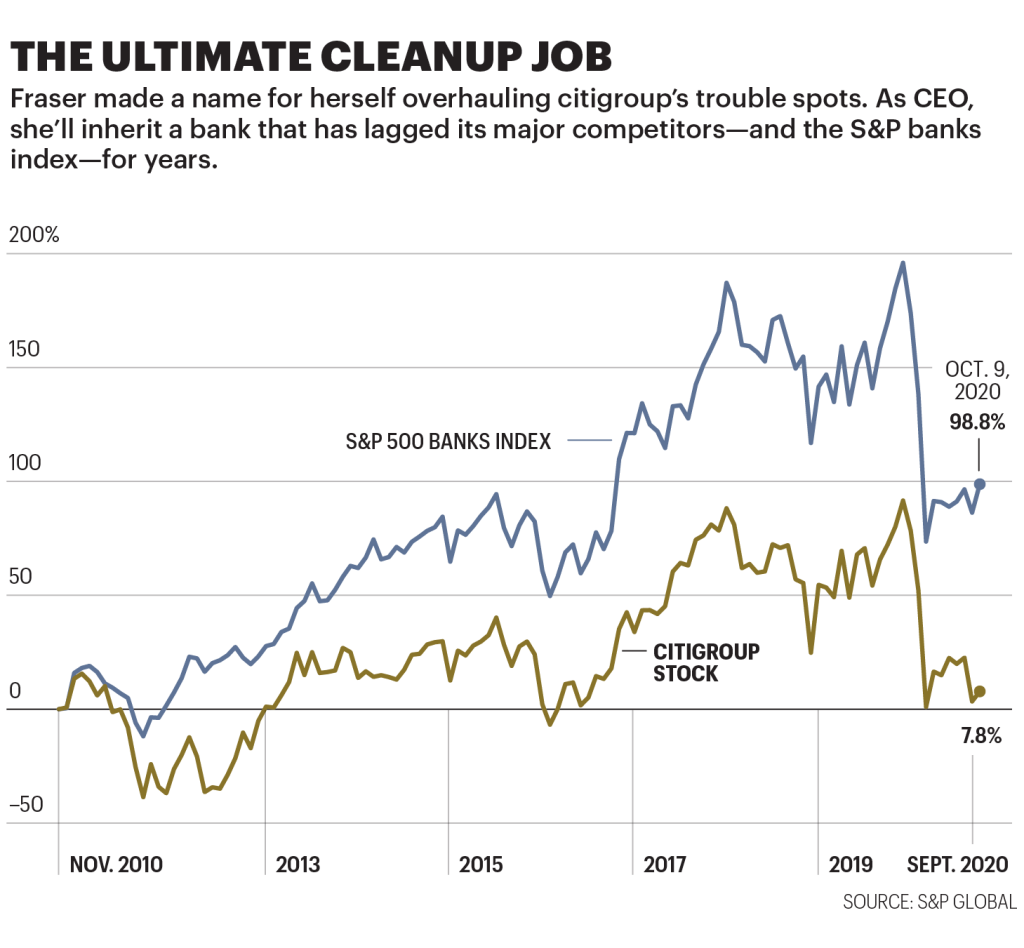

Breaking the glass ceiling, naturally, was only the start. Significant banking’s very first female CEO isn’t having a high-value machine.

Under a month later Citi called Fraser its second CEO, Citi consented to pay $400 million following the Federal Reserve and Office of the Comptroller of the Currency reprimanded the lender to get long-term deficiencies linked to its risk controllers. The actions followed an embarrassing event in August where Citi erroneously mailed $900 million into Revlon creditors, approximately 100 times as far as they were assumed to get. The OCC arrangement provides the operator veto authority over any important Citi purchase and, if needed, the best way to support changes to your bank’s senior management group or board.

It’s”not standard” for its authorities to”return so hard unless they are really happy,” states Arthur Wilmarth, a George Washington University law professor who’s analyzed bank law. In a declaration, Citi stated that it had been disappointed to have dropped short of their authorities’ expectations also contains”substantial remediation projects”

Investors will also be excited for Fraser to tackle Citi’s sustainability, which includes trailed for its Wall Street rivals.

Another obstacle is more from Citi’s controller. “We are in the midst of a pandemic and downturn. Basically, it is a difficult time to become a banker.

The regulatory act has been a sucker punch to Citi, however, Wilmarth claims that, in a sense, it really bolsters Fraser’s place. Under the conditions,”I doubt that she would have gotten the job with no implied blessing of the authorities,” Wilmarth says.

Goldberg states Fraser’s track record implies she is ideal to satisfy with up with the moment. “She’s a great deal of expertise cleaning up things and turning things round.”

Fraser echoes there in dialogue at October. At the face of any emergency,”that I think that it’s going back and forth saying,’What are a few of the root causes and how can you turn into an chance to actually leapfrog and accept the lender to another degree?'” Fraser states. “And how can you galvanize the organization to work toward this? I did this using all the personal lender, did this using mortgages, did this in Mexico. And I am eager to get it here also.”

Come February, she will be the first person to perform the job.

”

Encounter tales from Fortune‘s print variant :

- From bailout debacle to international dominance: Within the turnaround UBS

- Why online voting Will Need to wait

- Earning Dark banks thing

- Ford, simply acknowledge it: You are a truckmaker today

- Following the boom: Canada’s petroleum funds faces an uncertain future