U.S. future are blended before a gusher of Q3 earnings accounts, starting later today. The markets rallied, using the Nasdaq notching its own very best trading day per month. Investors are seeing Amazon (it’s ’s Christmas Day), Apple (it’s ’s fresh iPhone afternoon ) and Johnson & Johnson (awful news about the COVID vaccine entrance ).

Allow ’s view exactly what ’therefore moving the markets.

Trader upgrade

Asia

- The most significant Asia indicators are high in day trading using Hong Kong’therefore Hang Seng slipping againup 2.2percent , and {} 6 percent within the previous two weeks.

- “Timing is on China’s side plus it is not about the United States’ aspect,” states hedge fund king Ray Dalio. He points into China’s {} handling of this coronavirus, its own continuous financial policy along with the excitement across Chinese IPOs as a reason why shareholders see large potential on earth ’s No. 2 market. It ’s IEA stating oil need gained ’t rally to pre-pandemic degrees until 2023 in the first and that we’ll probably hit summit oil at the close of the decade.

Europe

- The European bourses are down using all the Europe Stoxx 600 away 0.4percent a half-hour to the trading session as worries grow past a series of fresh lockdown steps introduced across portions of Europe. {The euro and British pound have been {} . |}

- Pubs and pubs is going to be closed from the hardest hit portions of England beneath Boris Johnson’s newest attempts to corral COVID, moves which are producing additional rifts involving the British PM and his allies.

- U.K. banks shares dropped on Monday following that the BOE delivered out an fact-finding correspondence to creditors asking, How can you fancy unfavorable rates of interest? BOE Governor Andrew Bailey needed to afterwards explain the central bank is only collecting input flat-rate prices , not pulling plans. Tough audience. This ’s following the Nasdaq, Dow along with S&P 500 driven to large profits on Monday, placing the tech-heavy indicator in just two percentage points of its all time large.

- Enormous cap technology stocks directed yesterday’therefore muster together with Amazon stocks up almost 5 percent . The Malaysian giant kicks off its Prime Day buying bonanza with quotes it’ll create near $10 billion within the two-day occasion.

- Shares in Johnson & Johnson are 2.4percent at pre-market trading on information its own COVID-19 vaccine trial was suspended following a mysterious ailment of a player. It reports later now so that the drug giant could have more of a upgrade then.

- The buck is upward.

- Crude is upward, together with Brent trading about $42/barrel.

***

The year of beats

Yesterday in this area we looked forward into this reporting period. Reminder: JPMorgan Chase, Citigroup, BlackRock along with Johnson & Johnson are one of the big names to document now.

The anticipation is that we ’re {} for a quarter of large beats. How large?

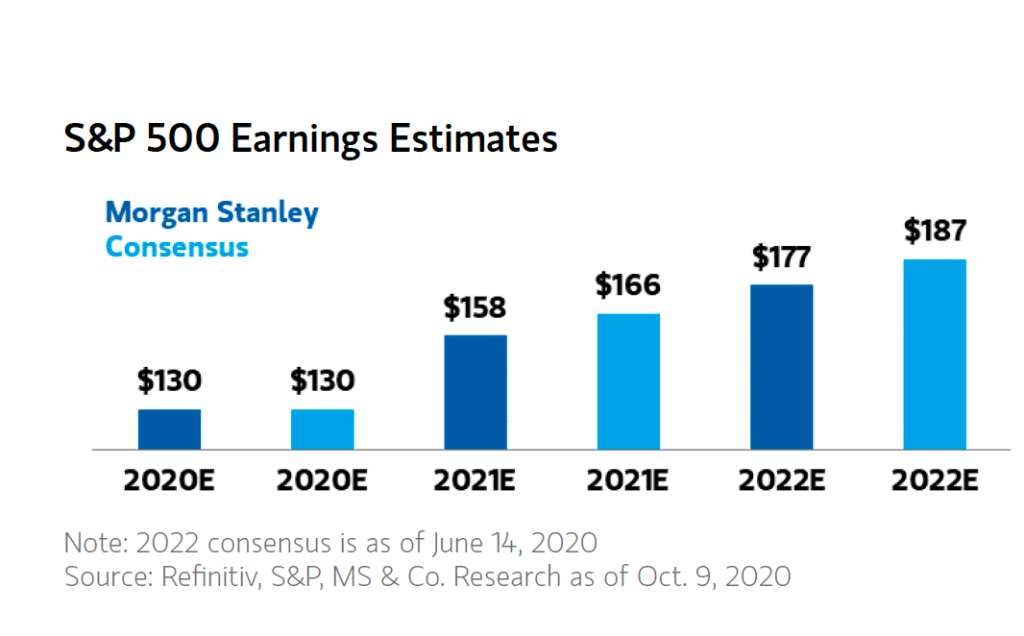

The consensus estimate is that S&P 500 Q3 earnings will come at about $33 per share. That would place full-year EPS at roughly $130, states Morgan Stanley, using much larger buttocks jumps in 2021 and 2022.

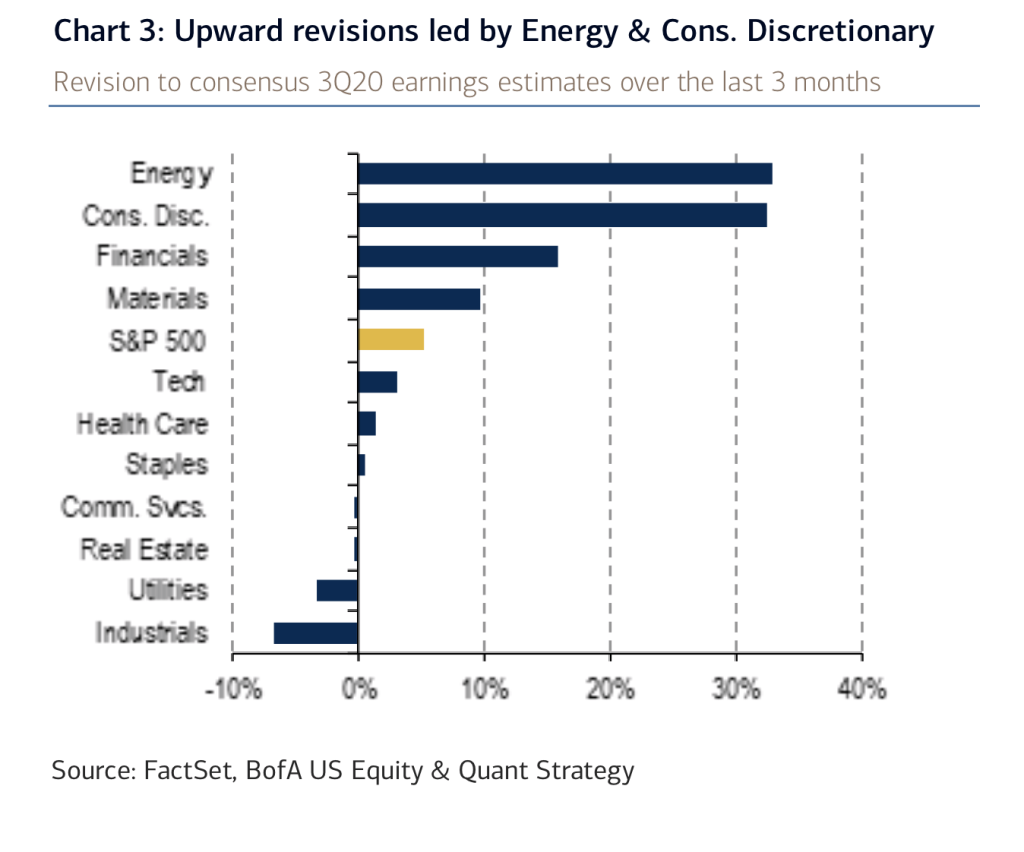

Fundamentally, all of the banks are recalculating EPS quotes after firms beat their expectations annually. In accordance with BofA, its largest upwards alterations come courtesy of a few of their very beaten-up industries this past year: energy, consumer discretionary and financials.

As I mentioned, fund stocks are soaring lately. They exchanged higher yesterday, shutting up 1.1percent. Yes, technology stocks attracted all their attention {} but this rally feels somewhat different. Other businesses are contributing this season around.

This ’s likely since the macro signals show that the financial recovery is on its own way, also we’re planning to see additional granular proof of the during earnings calls within the forthcoming weeks. Since BofA notes, “that a 46% dip in average oil costs from 2Q, powerful consumption and production trends, along with also a weakening USD all point to a healthy recovery in earnings from 3Q. ”

In the minimum, earnings season must provide investors something to concentrate on this ’s a little more orderly and more powerful than stimulation talks along with presidential polling info. And therefore we must be grateful for the diversion.

***

Have a great day, everybody. I’ll visit you tomorrow.

@BernhardWarner

[email protected]

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.